Each year, the Queensland Audit Office (QAO) holds an in-person and live-streamed event for all our clients’ chief financial officers, finance managers, and other staff involved in financial statement preparation. We share and discuss emerging issues and opportunities from our audit work across entities, upcoming changes to financial reporting requirements and other technical matters, and updates on our audit program.

We recently held our 2024 update, and below, highlight the main takeaways on what we covered. We appreciate the Queensland Treasury presenter’s valuable involvement in our event, who provided a status update on climate risk and sustainability reporting, and what to look for in this year’s financial reporting requirements (FRRs). We would also like to thank Sally Trestrail and Steve Allan from Tourism and Events Queensland, for their presentation of their recent system implementation.

Technical and accounting standards update

Similar to last year, there are no new material accounting standard and policy changes required to be implemented this financial year. Nor do we expect major changes will be made to the FRRs.

The main change we highlighted was for disclosures relating to ‘significant accounting policies’ being changed to ‘material accounting policy information’.

The changes require preparers to avoid standardised ‘boilerplate’ disclosures that duplicate or summarise international financial reporting standards without tailored information. Focused financial reporting aims to provide insight into how an entity has exercised judgement in selecting and applying accounting policies.

In practice, many entities have already adopted focused financial reporting, or effective financial reporting practices promoted by QAO and Queensland Treasury. No significant changes are expected to the illustrative financial statements in the FRRs – Sunshine Department and Future Bay Regional Health Foundation.

Entities, when using illustrative financial statements, should continue to tailor those illustrations to their situations. See QAO’s prior blog article on this topic: www.qao.qld.gov.au/blog/focused-financial-reporting.

Fair value measurement (replacement cost) changes

We also covered the changes to AASB 13 Fair Value Measurement. These changes are applicable to all financial reporting periods beginning on or after 1 January 2024 (that is, 31 December 2024 or 30 June 2025 reporting dates).

Broadly, the changes relate to determining current cost (also referred to as replacement cost) under AASB 13. The main modifications are focused on the following areas:

- assessing highest and best use

- developing unobservable inputs (for the current cost)

- applying the cost approach.

Entities should understand the impact on them during this year’s reporting process, to help smooth the transition next year.

We plan to publish a more detailed blog about this soon.

As Queensland Treasury’s Non-Current Asset Policies for the Queensland Public Sector (NCAPs) are written at a high level, we are not expecting major changes to them.

Climate-related risk disclosures

In January 2024, the Commonwealth Treasury issued proposed legislation on how it will mandate application of climate-related financial disclosures to entities reporting under the Corporations Act 2001 (Corporations Act). These proposals are expected to affect many Queensland government owned corporations (GOCs) that are registered under the Corporations Act.

Queensland Treasury will determine how the standards apply to the public sector entities under its jurisdiction that are outside of the Corporations Act (such as departments and statutory bodies). Like last year, Queensland Treasury is directing departments and statutory bodies not to prepare their own climate-related or sustainability reports.

At our event, we discussed with attendees how QAO is getting ready to audit the climate-related financial disclosures for the initial companies affected by the Commonwealth legislation.

Insights from our recent reports to parliament

At our events, we take the opportunity to cover the enduring, common, or emerging themes from our reports to parliament.

Internal control findings

Internal controls are the people, systems, and processes that ensure an entity can achieve its objectives, prepare reliable financial reports, and comply with applicable laws and regulations.

This year we focused on the findings of our report to parliament Implementing machinery of government changes (Report 17: 2022–23). We highlighted issues to consider and system changes over the multi-year implementation of machinery of government changes.

Other matters we discussed included:

- information system weaknesses

- the various maturity models we have (now 6)

- improving asset management

- special payments

- fraud tools.

Entities’ progress with implementing our recommendations

On 28 November 2023, we tabled our report to parliament 2023 status of Auditor-General’s recommendations (Report 3: 2023–24). This report captures entities’ self-assessed progress in implementing our performance and assurance audit recommendations. Valuably, it shares insights on common challenges and opportunities facing the public sector and where entities can improve their systems and practices.

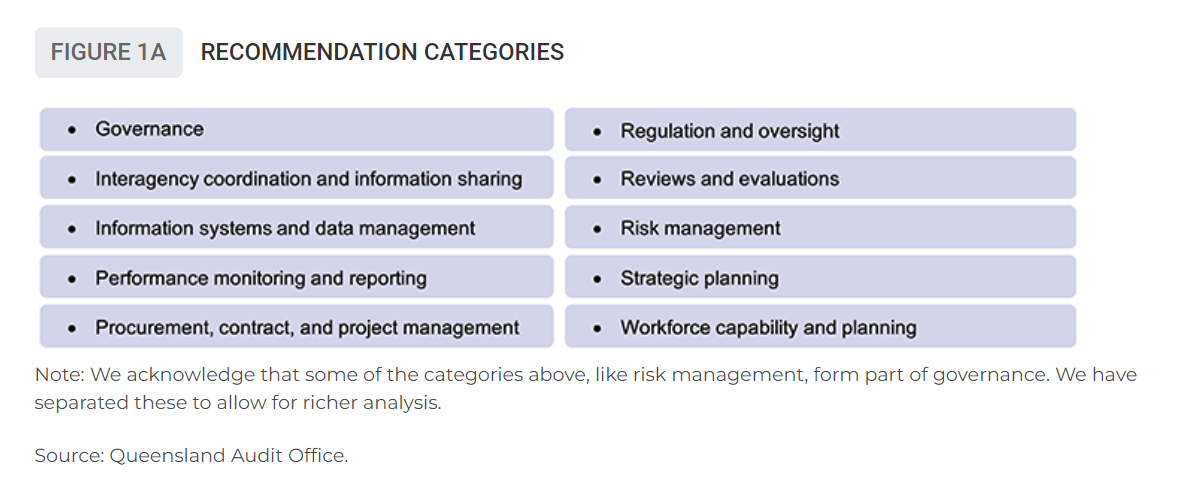

The areas we made the most recommendations about across our reports are summarised below. This indicates these are the areas entities are finding most challenging. We encourage all entities to review our reports for findings and recommendations that may be relevant to their business-as-usual work and new projects.

Our report includes a supporting interactive dashboard that allows users to explore entities’ self-assessments of their progress in implementing our recommendations. Based on their role or areas of interest, users can filter by year, report, entity, parliamentary committee, and recommendation implementation status. www.qao.qld.gov.au/status-auditor-generals-recommendations-dashboard.

We also covered our forward work plan and the remaining 2023–24 reports to parliament.

Further resources

- Presentation from QAO’s Technical audit update 2024 – 21 February 2024

- 2022–23 Financial Reporting Requirements for Queensland Government Agencies, Queensland Treasury

- Non-Current Asset Policies for the Queensland Public Sector (NCAPs), Queensland Treasury

- 2023 Queensland Sustainability Report, Queensland Treasury.

QAO resources

- Better practice: Annual internal control assessment

- Better practice: Checklist for managing machinery of government changes

- Better practice: Implementing machinery of government changes maturity model

- Better practice: Delivering successful technology projects

- How you can manage the risk of your legacy systems

- Is your Information Security Management System helping you mitigate cyber risk?

- Access controls for information technology systems

- Why is it important to report material losses to QAO?

- 2023 status of Auditor-General’s recommendations (Report 3: 2023–24) and interactive data dashboard

- Various QAO reports to parliament and supporting interactive dashboards.