Overview

The Queensland Government’s central agencies play an important role in coordinating the state budget process each year. The budget outlines the government’s priorities and how it will raise and allocate funds to deliver services for Queenslanders – involving everything from healthcare, to education, infrastructure, and social programs.

Our audit does not form any view of whether the government’s community objectives, fiscal objectives, or economic plans are appropriate. Additionally, our audit does not provide assurance that financial estimates will be achieved or on the sustainability of the budget, as this is not within the scope of the report. We also did not audit the budgeting processes at public sector entities.

Tabled 27 September 2024.

Report on a page

Queensland Treasury and the Department of the Premier and Cabinet play an important role in providing economic and financial advice to the government and in managing the state budget.

This report examines how these agencies design and manage the state budget process to support the government’s fiscal principles and objectives. We focused on the 2023–24 budget and 2023–24 budget update, and stand-alone submissions to the Cabinet Budget Review Committee (CBRC) leading up to the 2023–24 budget update. Our audit does not form any view of whether the government’s community objectives, fiscal objectives, or economic plans are appropriate. Additionally, our audit does not provide assurance that financial estimates will be achieved or on the sustainability of the budget, as this is not within the scope of the report. We also did not audit the budgeting processes at public sector entities.

Strengthening budget submissions

The CBRC has a complex and challenging task in approving the budget strategy and making budget decisions that distribute funding to different social programs, service delivery, and infrastructure needs. Queensland Treasury and the Department of the Premier and Cabinet help by reviewing submissions and providing advice to the CBRC. Queensland Treasury uses various models for estimating future revenue, which inform the budget process and its capacity for future expenditures.

The current budget process guides new submissions towards the government’s priorities. However, agencies’ submissions vary, making it difficult to compare or, in some instances, understand their costings, staffing needs, and consultation. Queensland Treasury could improve this by providing enhanced guidelines for agencies preparing submissions and instructions for Queensland Treasury staff reviewing them. This would help make submissions more consistent and of higher quality, enhancing the information used to make budget decisions. Queensland Treasury could also further assist the CBRC by clearly indicating whether it has reviewed and agrees with the agencies’ costings.

The Queensland budget uses an incremental approach, making adjustments to existing budgets by adding new income and spending without reassessing previously approved budgets. Targeted reviews for existing government programs and services, which are not regularly reassessed in the budget process, would help ensure continued alignment with government objectives.

Queensland Treasury developed BudgetPlus to assist agencies in preparing budget submissions. However, stand-alone submissions, which occur outside the regular budget and budget update cycles and make up around one-third of all submissions, do not use this system. As a result, these submissions miss out on BudgetPlus’ functionality for ensuring consistency, security, and monitoring.

Queensland Treasury plans the budget process well and sets clear timelines for submissions. Early engagement by agencies on budget submissions is not always possible. But, where agencies can, they should consult early with Queensland Treasury and the Department of the Premier and Cabinet to reduce pressure on the review process and provide opportunities to enhance the quality of submissions.

Improving budget monitoring capabilities

Queensland Treasury monitors the state budget through regular updates on key economic and budget issues, including market trends, labour conditions, and financial outlooks. While it effectively tracks revenue collections and conducts quarterly reviews of agency budgets, its ability to monitor performance against agency submissions or expected outcomes is limited.

The current budget management system, TriData, has aided in delivering the budget for over 25 years. While functional, feedback from agencies highlighted issues with TriData’s efficiency and ease of use. Queensland Treasury recognises that it needs further capabilities to enhance TriData’s efficiency and functionality. It is implementing the Financial Reporting and Management Enhanced Systems (FRaMES) project to replace TriData with a more modern system in 2027.

1. Audit conclusions

We examined how Queensland Treasury and the Department of the Premier and Cabinet design and manage the state budget process to support the government’s fiscal principles and objectives. Our audit does not form any view of whether the government’s community objectives, fiscal objectives, or economic plans are appropriate. Additionally, our audit does not provide assurance that financial estimates will be achieved or on the sustainability of the budget, as this is not within the scope of the audit. We also did not audit the budgeting processes at other public sector entities.

The process for preparing the state budget generally supports the government’s objectives and fiscal principles. Queensland Treasury and the Department of the Premier and Cabinet could implement processes to improve the quality of submissions, evaluate costings, and enhance their capabilities to monitor the outcomes of approved funding.

Queensland Treasury and the Department of the Premier and Cabinet provide advice to the Cabinet Budget Review Committee (CBRC). They both review agencies’ submissions to ensure submissions align with the government's priorities, refine their recommendations, and provide briefs to the CBRC to help it deliberate over budget decisions. Developing standard operating procedures for staff would help improve the review process by standardising how Queensland Treasury reviews costings and records these activities and documents in its information system. The review processes should be improved to ensure the CBRC gets consistent costing information to make well-informed budget decisions.

Queensland Treasury should offer better guidance to agencies to enhance the quality of their submissions. Agencies’ submissions differ in detail and quality, especially about costings, staffing requirements, and stakeholder consultations. This variation can lead to inefficiencies for both the agency and Queensland Treasury, often requiring more information or rework. Inconsistencies can create challenges for the CBRC in comparing or evaluating submissions it needs to prioritise.

Queensland Treasury evaluates new submissions and reviews changes to agencies’ budgets. While these activities cover some budget expenses annually, not all expenses are regularly reassessed. Savings initiatives have also required agencies to evaluate some parts of this ongoing expenditure that are not currently assessed in the budget process. More targeted reviews could help Queensland Treasury ensure that funding from previous submissions continues to align with government priorities.

Despite a high volume of submissions to review, Queensland Treasury’s planning and established processes help it deliver the budget on time. It provides good guidance to agencies on upcoming milestones and instructions for lodging their budgets. By collaborating earlier on budget submissions, Queensland Treasury, the Department of the Premier and Cabinet, and agencies could further enhance the quality of submissions.

Strengthening these parts of the budget framework will ensure it continues to support the government’s priorities.

2. Recommendations

| Strengthening data integrity for revenue models |

We recommend that Queensland Treasury:

|

| Enhancing the submission process |

We recommend that Queensland Treasury:

|

We recommend that Queensland Treasury, the Department of the Premier and Cabinet, and agencies:

|

We recommend that Queensland Treasury and the Department of the Premier and Cabinet:

|

| Improving the review process |

We recommend that Queensland Treasury:

|

|

| Clarifying strategic objectives |

We recommend that Queensland Treasury:

|

Reference to comments

In accordance with s. 64 of the Auditor-General Act 2009, we provided a copy of this report to relevant entities. In reaching our conclusions, we considered their views and represented them to the extent we deemed relevant and warranted. Any formal responses from the entities are at Appendix A.

3. Queensland's state budget

This chapter provides an overview of how Queensland’s state budget is developed, key roles and responsibilities, and how it is guided to achieve the government’s priorities.

The state budget is the foundation for delivering government services. It directly impacts the lives of Queenslanders by directing how resources are distributed, affecting everything from healthcare and education to infrastructure and social programs. The budget also provides accountability to taxpayers by detailing how funds are raised and spent, enabling transparency in the government’s financial management.

How is the budget prepared?

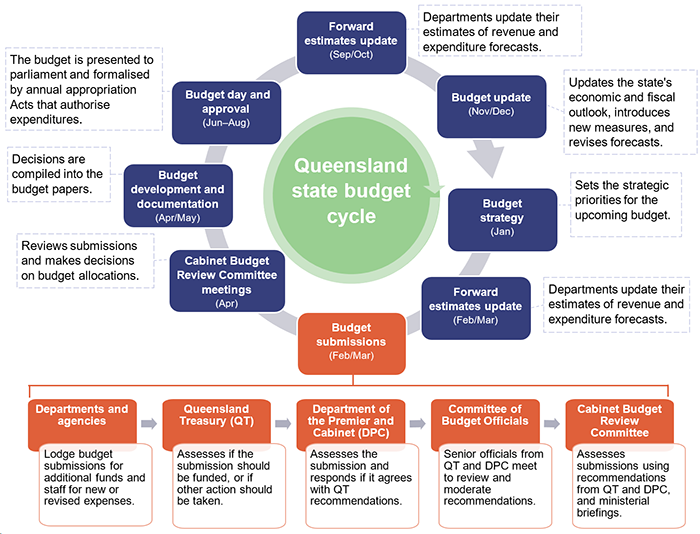

Developing the state budget involves multiple phases and stakeholders. It is a continuous cycle of planning, reviewing, and adjusting to ensure that funds are allocated to meet government priorities. Figure 3A provides an overview of the key phases, showing the budget process’s cyclical nature and the various stakeholders’ interconnected roles.

Queensland Audit Office using information from the Overview of Queensland’s Financial Accountability Framework and information provided by Queensland Treasury.

Budget updates and stand-alone submissions

The Queensland Government publishes an update to the budget around the middle of the financial year. The budget update reflects adjustments to current spending, reflecting changes in economic conditions, revenue forecasts, and emerging expenditure needs. Agencies may make submissions to the government for more funds during the budget update. Both the budget and the budget update include forward estimates, which provide projected revenue and expenditure for the current budget year and the following 3 years.

Agencies can also make stand-alone submissions outside of the budget and budget update. These submissions may require decisions from the Cabinet Budget Review Committee, which cannot wait for the next budget or budget update. These may include submissions on employee agreements, urgent funding needs, or new opportunities.

Roles and responsibilities

Cabinet Budget Review Committee

The Cabinet Budget Review Committee (CBRC) is a key decision-making body within the Queensland Government, comprising senior ministers, including the Premier and the Deputy Premier and Treasurer (currently held by the same minister). It is responsible for setting the overall budget strategy and reviewing agency submissions regarding financial and budgetary matters, such as funding requests, service delivery proposals, and contract negotiations.

The submissions must provide information on the reasons for government action, urgency, alignment with priorities, implementation plans, and costs. High-quality submissions are necessary for the CBRC to make informed decisions.

Queensland Treasury and the Department of the Premier and Cabinet

Queensland Treasury and the Department of the Premier and Cabinet play central roles in the state budget process. Queensland Treasury is responsible for forecasting some revenues, evaluating agency budget submissions, and providing recommendations to the Treasurer and the CBRC.

The Department of the Premier and Cabinet advises the government on policy options, evaluates budget submissions, and administers the Cabinet Handbook (the key guiding document for agency submissions to Cabinet).

Senior officials from Queensland Treasury and the Department of the Premier and Cabinet form the Committee of Budget Officials, which meets to deliberate on the budget and moderate recommendations to the CBRC. Other meetings occur at various levels within these departments throughout the year.

Departments and other agencies

Queensland Government agencies are the various departments and entities within the Queensland Government responsible for implementing policies, running programs, and delivering services. While under the Financial Accountability Act 2009 departments are required to prepare an annual budget, all agencies play an important role in the budget process. In planning their budgets, agencies determine the funds needed for their service delivery. If they require additional funding beyond their previously approved budgets, they must submit a request to the CBRC through Queensland Treasury.

Agencies must ensure their submissions are accurate, comprehensive, aligned with the government’s priorities, and adhere to the requirements of the Cabinet Handbook. They must also monitor their performance and provide updates to Queensland Treasury to uphold the budget process’s integrity and ensure the responsible use of funds.

What guides the state budget?

The state budget is an important instrument for reflecting the government’s social and political priorities and its plans for achieving its objectives. Queensland’s state budget framework is not defined by one single document, legislation, or policy. It involves several of these items to define the responsibilities, the budget’s direction, and how it is implemented and monitored.

Setting objectives, fiscal principles, and economic plans

The CBRC sets the overarching strategic direction of the budget, informed by advice from the Department of the Premier and Cabinet, Queensland Treasury, and other agencies as needed. The Premier and the Treasurer prepare and present community and fiscal objectives in parliament. These community objectives cover areas such as health, education, environment, and employment, and help agencies focus their resource requests on the government's community outcomes.

The fiscal objectives are outlined in the government’s charter of fiscal responsibility. It includes fiscal principles on managing revenue, expenses, and borrowings – and establishes budget targets while describing how the government intends to manage debt and maintain a sustainable financial position.

The government can also establish economic plans like the Queensland Energy and Jobs Plan or set savings targets like the Savings and Debt Plan.

Our audit does not form any view of whether the community objectives, fiscal objectives, or economic plans are appropriate. Additionally, our audit does not provide assurance that financial estimates will be achieved or on the sustainability of the budget, as this is not within scope of the report. We also did not audit the budgeting processes at public sector entities.

Developing the budget strategy

Each year, Queensland Treasury prepares a budget strategy. The Treasurer presents this strategy to the CBRC for approval. Once approved, Queensland Treasury communicates the strategy to the accountable officers of Queensland Government agencies, along with their relevant ministers.

The strategy provides an economic update and outlines the fiscal outlook, budget pressures, priorities, savings targets, and timetable. It offers an opportunity to reset the focus of the government’s community and fiscal objectives. Agencies use the budget strategy to inform their budget submissions and their understanding of emerging fiscal pressures and challenges.

4. Preparing and monitoring the state budget

This chapter is about how Queensland Treasury and the Department of the Premier and Cabinet manage the budget process to support the government’s fiscal principles and objectives.

Our audit covered the 2023–24 budget and 2023–24 budget update. We also covered stand-alone submissions to the Cabinet Budget Review Committee (CBRC) leading up to the 2023–24 budget update. These submissions were made between July 2022 and October 2023. These elements come together to form the state annual budget.

We examined Queensland Treasury’s review of these submissions and not the merits of the proposal or decisions taken. We also did not audit the budgeting processes at other public sector entities.

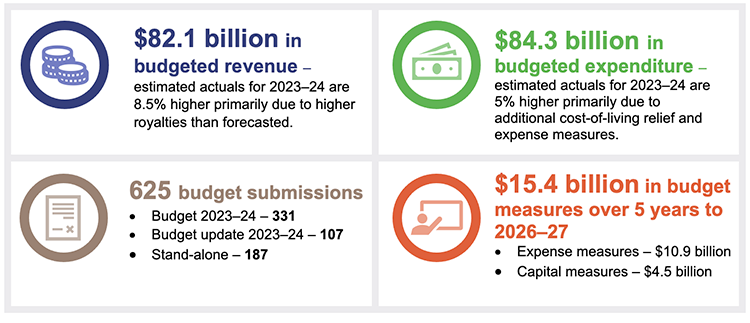

Figure 4A provides a snapshot of the budget for this period. It shows key metrics, such as estimated revenue and expenditure, and the number of submissions to the CBRC.

Queensland Audit Office using information published in the 2023–24 and 2024–25 Queensland state budget papers and information provided by Queensland Treasury and the Department of the Premier and Cabinet.

Budget measures are policy decisions with financial impacts made by the government since its last budget. These can include expense measures relating to service delivery or grants and subsidies for the community. They can also include capital measures for new assets or infrastructure or revenue measures for significant changes to revenue policy like changes in tax rates. These measures only include new policy decisions and do not include the total amount of additional funding provided to agencies to deliver services and infrastructure.

Does Queensland Treasury’s budget process support revenue and expenditure forecasts?

We assessed Queensland Treasury’s process for estimating some of the largest revenue sources in the budget and how it evaluates submissions for budget expenditure. We do not provide assurance that financial estimates are accurate or will be achieved, as this is not within the scope of the audit.

Queensland Treasury collaborates with the Department of the Premier and Cabinet to review budget submissions. While the revenue forecasting used reasonable methodologies, the quality of agencies’ submissions and process for reviewing this expenditure could be improved.

Estimating the budget revenue

Queensland Treasury uses various models for estimating revenue from goods and services tax, coal royalties, and payroll tax. These models use specific assumptions and calculations for each revenue type. Queensland Treasury uses these revenue projections to inform the budget process by forecasting the resources available for future spending.

The budget papers document Queensland Treasury’s assumptions used to estimate revenue in the budget. These assumptions help explain the potential implications of different scenarios, such as changing coal prices and export volumes. Although no calculation errors were identified, the security of revenue models could be improved with data integrity controls to prevent accidental errors and unauthorised access, which could affect later stages of budget planning and decision-making. This improvement would support the integrity of the data, calculations, and reliability of the revenue projections.

Recommendation 1 We recommend that Queensland Treasury strengthens the security of its revenue projection models by implementing enhanced data integrity controls to reduce the potential for inappropriate access or errors. |

Evaluating the budget expenditure

Queensland Treasury has established processes to moderate its recommendations to the CBRC through internal review and consultation with the Department of the Premier and Cabinet. The budget process ensures that agencies’ new submissions align with the government’s priorities and fiscal targets. Where submissions do not align, Queensland Treasury and the Department of the Premier and Cabinet provide that advice to the CBRC.

Assisting the government by clearly indicating whether costs are agreed

Queensland Treasury provides advice to the CBRC to assist its budget decisions. The Cabinet Handbook requires agencies to consult closely with Queensland Treasury and agree on costing information in the submissions. However, Queensland Treasury has not defined how it agrees on costing information or issued guidelines to agencies that provide best practice examples.

Agencies’ submissions and Queensland Treasury’s recommendations sometimes do not indicate whether costings have been agreed upon. Queensland Treasury may be unable to review and agree with all costings due to time constraints, insufficient information, or disagreement with the agency. However, the extent to which Queensland Treasury has reviewed and agreed on costings should be made clear to the CBRC. Other jurisdictions, like New South Wales, include this information in their submission templates to specify if the costings are agreed, making this clearer to their government.

Recommendation 5 We recommend that Queensland Treasury provides clarity to the Cabinet Budget Review Committee on whether costings have been reviewed and agreed upon in submissions. |

Improving agency submission quality and comparability

Queensland Treasury allows agencies to have flexibility in the content of submissions, leading to varying levels of detail. Despite meeting the Cabinet Handbook’s minimum requirements, the budget, budget update, and stand-alone submissions we reviewed varied in the information provided, making it difficult to compare or evaluate costings, staffing needs, and consultations. Figure 4B illustrates disparities in budget submission information.

A comparative analysis of budget submissions for capital expenditure | ||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Agencies plan for new assets and infrastructure by assessing their needs, expected outcomes, and estimated costs. Different stages of a project will involve varying levels of detail regarding the project’s scope and costs. Submissions can be presented to the CBRC at different stages of the project for input or approval. This case study compares the differences in 3 agencies’ submissions requesting funding for capital expenditure. While these examples show the extremes, the varying level of detail makes it difficult to evaluate, compare, and prioritise funding for these capital projects.

Agency A’s submission was comprehensive, providing a detailed cost breakdown of 3 options, including specific costs per square metre. The submission also outlined the stakeholder consultation process, enabling more effective costing reviews by Queensland Treasury and providing clarity to the CBRC. Agency B also provided a detailed cost breakdown for 2 options, but no detailed evidence of consultation. Agency C's submission lacked these details, illustrating the differences in the quality of submissions. |

Queensland Audit Office using information provided by Queensland Treasury.

Clearer guidelines would streamline the development and review process of submissions for both agencies and Queensland Treasury, enhancing the information provided to the CBRC. It could also reduce the need for additional information, rework, and potential delays.

Recommendation 2 We recommend that Queensland Treasury strengthens its assistance to agencies by providing detailed guidance materials on the financial information to support their budget submissions, including costing methodologies, staffing needs, and consultation. |

Strengthening the submission review process

Queensland Treasury’s annual surveys show that agencies value its advice and support.

Queensland Treasury refines its recommendations through an internal review process, complemented by consultations with the Department of the Premier and Cabinet. However, it has not provided its staff with standard operating procedures to clarify how it agrees costing information, reviews submissions, or records its reviews consistently in its information management system.

Evaluating submissions is a complex task. Without clear guidelines and procedures, the review process and recommendations to the CBRC could become susceptible to inconsistencies, which may impact how resources are allocated to agencies. The CBRC relies on clear documentation and recommendations in the budget submissions it reviews.

Queensland Treasury sometimes attaches conditions, such as requiring a business case, to its approval where costings are based on preliminary estimates. However, this approach commits the budget to submissions before sufficient scrutiny of the costs occurs. It also creates some inefficiencies, with agencies needing to prepare a second submission, and Queensland Treasury reviewing it twice as the submission was not fully ready when it was initially submitted.

Recommendation 6 We recommend that Queensland Treasury enhances the budget submission review process by implementing standard operating procedures that include:

|

Assessing ongoing expenditures

In Queensland, the state budget mostly follows an incremental approach. The focus is on new income and spending, where new plans are added to existing ones without reassessing the whole budget.

Under the Financial Accountability Act 2009, the accountable officers of departments and statutory bodies have the primary responsibility to ensure ongoing expenditures continue to achieve reasonable value for money. Queensland Treasury also plays a role by implementing the government’s budget strategies, evaluating new submissions, and reviewing changes to agencies’ budgets. These activities cover certain parts of the budget expenses annually, but not all expenses are regularly reassessed.

Past budget strategies, such as the $3 billion Savings and Debt Plan, have challenged agencies to identify potential savings within this expenditure. The recent 2024–25 budget announced the new Smarter Spending, Better Jobs Plan targeting $3 billion in savings over 4 years to 2027–28. It aims to target savings in non-wage expenses, like travel, advertising, accommodation, consultants, and labour hire.

Queensland’s budget framework could incorporate more targeted reviews of ongoing expenditures to ensure it is effective and efficient. These reviews could be conducted regularly to cover various agencies over a defined period. Independent program evaluations could also assist with regularly checking how effectively and efficiently government programs are working.

A combined approach with targeted reviews would ensure that resources are continually realigned to support current government priorities effectively.

Recommendation 7 We recommend Queensland Treasury implements government-endorsed savings reviews, conducts and coordinates other targeted reviews, and uses independent program evaluations to identify opportunities for more efficient and effective service delivery. |

Assessing the timeliness of budget delivery

Queensland Treasury effectively manages the budget process to ensure timely delivery. It has established clear processes and plans for each phase of budget development, with a realistic timeline that aligns with other jurisdictions. Queensland Treasury’s website for agencies, the Financial Management Centre, provides comprehensive resources, including training guides and information on key dates for budget submissions.

The Cabinet Handbook requires agencies to consult early with Queensland Treasury on all proposals with financial implications. From time to time, agencies will have short notice to develop submissions where early engagement is not always possible. Where it is possible, agencies need to engage with Queensland Treasury and the Department of the Premier and Cabinet as early as possible. This will reduce pressure on the agency, Queensland Treasury, and the Department of the Premier and Cabinet to resolve matters quickly and maintain the quality of their submissions.

In the 2023–24 budget cycle, Treasury Analysts had 3 weeks to review over 300 submissions and develop recommendations. This tight time frame can place pressure on analysts to review submissions and obtain additional information from agencies before developing their recommendations. Queensland Treasury indicated that many agencies consult with it early for advice before formally submitting their documents.

Feedback from some Queensland Treasury staff indicated concerns about workload, with mixed opinions on whether 3 weeks is sufficient if early consultation has not occurred. Queensland Treasury and the Department of the Premier and Cabinet collaborate with a range of stakeholders to set budget timelines and could consider strategies to promote more timely submissions from agencies that regularly submit late.

Another aspect of the budget process is the receipt of outcome letters from the CBRC. These letters notify agencies whether their funding proposals have been approved or not. Timely receipt of these letters ensures that Queensland Treasury and the involved agencies have adequate time to review and incorporate any necessary changes into the budget documents. The limited 2-to-3-week window to review these letters and amend the budget based on the approvals may increase the risk of errors. While we did not find errors in the budget, agencies raised concerns about the inadequate time for this part of the process. The timing of these letters depends on the timeliness of the decision-making process.

Queensland Treasury, the Department of the Premier and Cabinet, and agencies engaging early in the process would reduce pressure on timelines and facilitate a productive feedback loop. This would allow agencies to present the merits of their submissions and explain their costings sufficiently.

BudgetPlus, an online application designed to assist agencies in preparing funding proposals, provides some monitoring capabilities and streamlines the collation of budget submissions. Queensland Treasury uses BudgetPlus for the budget and budget update (mid-year fiscal and economic review). However, stand-alone submissions, which make up approximately one-third of all submissions, do not use BudgetPlus. There is an opportunity for Queensland Treasury to leverage BudgetPlus’ inbuilt functionality for consistency, security, and monitoring.

Recommendation 3 We recommend Queensland Treasury, the Department of the Premier and Cabinet, and agencies engage early in the submission development phase to facilitate a thorough review and timely feedback, with agencies adhering to lodgement timelines. Recommendation 4 We recommend that Queensland Treasury and the Department of the Premier and Cabinet evaluate if stand‑alone submissions that are made outside of the main budget can use the BudgetPlus system for preparing funding proposals. |

Is Queensland Treasury effectively monitoring the budget?

Queensland Treasury has established several processes to monitor the state budget, including regular updates on key economic and fiscal issues. While it enables monitoring of agency budgets, its ability to track the performance outcomes of agency submissions could be enhanced further.

Queensland Treasury monitors economic and financial matters and shares regular updates on international and domestic market trends, labour market conditions, and financial forecasts. It provides these updates to key stakeholders, such as the Treasurer and the CBRC, to ensure they have an understanding of factors affecting Queensland’s fiscal environment. The information from these reports informs decisions about potential budget adjustments.

Additionally, Queensland Treasury monitors revenue collections, such as goods and services tax, payroll tax, and land tax, to ensure sufficient funding for planned expenses. It also conducts quarterly reviews of agency budgets to assess their financial performance against budgeted allocations.

Budget system functionality

For over 25 years, Queensland Treasury has used a financial reporting and budgeting system called TriData. This system enables Queensland Treasury to prepare the state budget, forecast expenditures, and monitor high-level agency budgets and cashflows. It is also used to produce the annual consolidated financial statements of the state government.

TriData is a whole-of-government financial reporting and budget management system that handles financial information entry, validation, and approval across all in-scope government agencies. It facilitates the consolidation and reporting of agency data at the whole-of-government level.

Agencies periodically report back to the CBRC on their submissions, but the format of these reports can vary, and Queensland Treasury lacks effective visibility to monitor them. TriData does not collect information to individually track the submissions’ expenditure or the outcomes expected by agencies. Feedback from some agencies highlighted duplicate effort, usability problems, and system issues with TriData, leading to some inefficiencies.

Queensland Treasury is aware of TriData’s limitations. In September 2022, it initiated the Financial Reporting and Management Enhanced Systems (FRaMES) project to enhance security, automation, and support for agile funding decisions. The project also aims to enable the government to deliver new forms of reporting and better track and evaluate outcomes from expenditure to more accurately inform future decisions. The project is expected to be completed in 2027.

Clarifying objectives to improve outcomes and agencies’ performance

One of Queensland Treasury’s strategic objectives is to achieve fiscal sustainability. It works towards this through strategies such as implementing the government’s fiscal principles, developing the budget strategy, maintaining revenues, and monitoring agency budgets. However, greater clarity is required on how these strategies will improve outcomes and agency performance, as Queensland Treasury has not linked them to activities in its operational plan.

Without clearly defined activities and metrics, it is challenging to assess whether Queensland Treasury is effectively achieving its goal of improving outcomes and agency performance. Clearly documented activities and performance metrics would enable better tracking against targets, leading to improved outcomes and stronger agency performance.

Recommendation 8 We recommend that Queensland Treasury clarifies its strategic objectives, especially its current objective to improve outcomes and agency performance. |