Overview

To bolster the economy, enhance quality of life, and support growing communities, Queensland requires efficient and well-maintained infrastructure that is readily available when and where it's needed. To achieve this, the Queensland Government commits substantial funding for infrastructure in its budget each year. Over the coming years, this will need to cater for the state’s expected growth, support the transition to a renewable energy grid, and prepare for the Brisbane 2032 Olympic and Paralympic Games.

Tabled 14 December 2023.

Report on a page

Queensland requires efficient and well-maintained infrastructure that is readily available when and where it's needed. It bolsters our economy, enhances our quality of life, and grows our communities. All 3 levels of government allocate substantial funding each year to the development of infrastructure. At the state level, the annual budget serves as a source of information on proposed Queensland Government projects for the years ahead. This report provides insights into significant infrastructure projects in Queensland, and an analysis of expenditure by the Queensland Government.

Queensland is experiencing a boom in capital expenditure

The Queensland Government has committed $16.4 billion to major capital projects in its 2023–24 budget, marking an increase of over 30 per cent from $12.6 billion in the 2022–23 budget. It is making substantial infrastructure investments to cater for growth, support the transition to a renewable energy grid, and prepare for the Brisbane 2032 Olympic and Paralympic Games (the Games).

The large volume of capital projects in the pipeline for Queensland, along with other significant capital projects underway across Australia, means the construction sector will face several challenges for years to come. These include a very tight labour market and significant supply chain disruptions following the response to the COVID-19 pandemic and conflict in Ukraine. The Queensland Government must proactively manage these risks, and plan for realistic time frames to ensure it can successfully deliver its extensive infrastructure agenda.

More information is needed on capital projects

Clear and complete reporting on capital projects is critical to building public trust and ensuring accountability. Current reporting requirements in Queensland could be strengthened to require more complete reporting on capital projects. This particularly applies to the disclosure requirements for the annual capital statement (which details capital projects) and public–private partnerships (between private sector companies and the public sector).

Planning for the Games venues is underway

The Queensland Government has announced a $7.1 billion venue infrastructure budget for the Games. Venues announced as part of the bid, including the Gabba, are undergoing a validation process to support investment decision-making. This is in place of a business case, usually required for such investments under the Project Assessment Framework. The government must finalise this process as soon as possible to ensure the Games venues can be delivered on time and on budget.

Cross River Rail project costs and timing have changed

The Cross River Rail project was originally expected to be completed in 2025, at a budgeted cost of $6.888 billion (including private financing of $1.499 billion). The rising costs of supplies and supply chain issues have affected the delivery of the project. The Queensland Government has committed additional funding of $960 million, increasing the total budget to $7.848 billion, with the project now expected to be completed in 2026. The Cross River Rail Delivery Authority is working with other stakeholders to coordinate and streamline activities across the different work packages of the project.

1. Recommendations

|

Queensland Treasury strengthens disclosures in project summaries for public–private partnerships (agreements private sector companies enter into with the public sector to deliver services) |

|

1. We recommend that Queensland Treasury:

|

|

Queensland Treasury updates guidelines for preparing the capital statement (the annual overview of proposed capital expenditure) |

|

2. We recommend that Queensland Treasury:

|

Reference to comments

In accordance with s. 64 of the Auditor-General Act 2009, we provided a copy of this report to relevant entities. In reaching our conclusions, we considered their views and represented them to the extent we deemed relevant and warranted. Any formal responses from the entities are at Appendix A.

2. Insights into Queensland’s major projects

Governments spend a significant portion of their budgets on capital expenditure each year, with the aim of developing lasting community assets that will create jobs and provide economic growth.

This chapter provides insights into major projects the Queensland Government has budgeted for between 2019–20 and 2023–24, as well as insights into the Brisbane Metro, which is the largest capital project currently underway for any local government in Queensland.

This chapter also identifies some issues regarding the reporting of information on capital projects and public–private partnerships.

Capital expenditure: Money spent to buy or build new assets or improve existing assets. This can include land, buildings, infrastructure, equipment, or computer systems. Examples include buying new medical equipment, building a new school, or upgrading roads.

Capital project: A single project, for example, the construction of a new school.

Capital program: Several capital projects brought together under one program, for example, construction of several new roads in a particular area.

In this report, we refer to all capital projects and programs as ‘projects’.

State infrastructure strategy

The Queensland Government’s State Infrastructure Strategy is a 20-year plan that sets out a vision for Queensland’s infrastructure needs over the next 2 decades. It provides a framework to guide infrastructure planning and investment, and has 5 focus areas, as shown in Figure 2A.

State Infrastructure Strategy 2022.

In addition to the State Infrastructure Strategy, 7 regional infrastructure plans across Queensland are currently being developed, with 4 expected to be completed in 2023 and the remainder commencing in 2024. The regional infrastructure plans will complement the strategy and provide plans for Queensland's councils to develop local infrastructure over the next 2 decades. Our Forward work plan 2023–26 includes an audit on planning for Queensland’s long-term infrastructure investment, which will assess how effectively and efficiently the government undertakes planning to inform infrastructure investments.

Since the release of the State Infrastructure Strategy in June 2022, there have been several significant announcements, including:

- September 2022: The $62 billion Queensland Energy and Jobs Plan to deliver new energy generation, storage, and transmission infrastructure; and to move the power grid to renewable sources of energy. It is planned that this will be both public and private sector investment.

- February 2023: The $7.1 billion Brisbane 2032 Olympic and Paralympic Games venues infrastructure program, which will be delivered over the 9 years leading up to the Games.

- June 2023: The $88.7 billion Big Build 4-year capital program to deliver a variety of infrastructure upgrades in transport, health, education, and water management. This includes $19 billion to support the Queensland Energy and Jobs Plan above and $1.9 billion related to the venues infrastructure program in the Brisbane 2032 Olympic and Paralympic Games.

Each of these announcements involves significant infrastructure that is expected to be delivered in the coming decade.

However, risks – including weather events, supply chain disruptions, labour shortages, and a crowded delivery pipeline (that is, too many projects trying to access supplies at the same time) – may jeopardise the Queensland Government’s ability to meet expectations.

This underscores the need for the government to establish clear infrastructure priorities, to ensure the most important projects are delivered on time.

Public sector entities need to strictly manage conflicts of interest when making procurement decisions

Given the significant amount of money involved in delivering infrastructure projects, it is critical that public sector entities strictly comply with the principles of the Queensland Procurement Policy, particularly in terms of managing conflicts of interest.

The policy is designed to ensure projects achieve value for money and meet the highest standards of integrity and accountability in decision-making. In 2022–23, we identified deficiencies and made recommendations for strengthening procurement practices, including managing conflicts of interest, to state government entities. One of these was assessed as a significant deficiency, meaning it is a high risk and needs to be addressed immediately. If entities do not comply with the policy, their procurement decisions may not withstand scrutiny, and they may not be in the best interests of the entities or the public.

Previous recommendations on procurement, contract, and project management need to be implemented

Our report 2023 status of Auditor-General’s recommendations (Report 3: 2023–24) noted that 59 procurement, contract, and project management recommendations were made in 4 reports to parliament tabled in 2020–21 and 2021–22. Entities assessed that they had implemented 32 of the 59 recommendations, with 20 of the recommendations still outstanding, and the remaining 7 no longer applicable. Most of the outstanding recommendations were from our report on Contract management for new infrastructure (Report 16: 2021–22). The significant infrastructure investment planned for future years emphasises the importance of entities implementing these recommendations quickly and effectively.

Budgeted capital spending is growing significantly

In the previous 5 financial years, from 2018–19 to 2022–23, annual budgeted capital expenditure averaged $11.8 billion. In 2023–24, Queensland significantly increased its planned capital expenditure to $16.4 billion, largely due to the investment associated with the Queensland Energy and Jobs Plan.

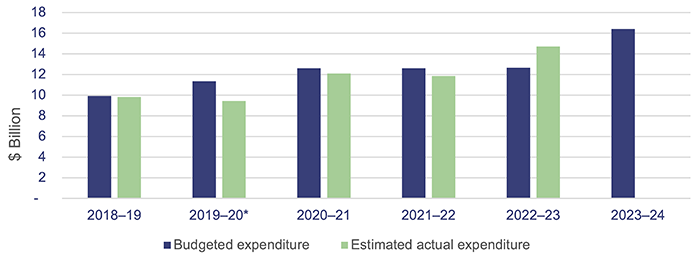

Figure 2B shows budgeted and estimated actual capital expenditure (forecast of actual spend for the financial year) from 2018–19 to 2023–24.

Note: * The estimated actual expenditure for 2019–20 was not disclosed in the capital statement for 2020–21 and was taken from the capital purchases from the non-financial public sector in the Report on State Finances 2019–20.

Compiled by the Queensland Audit Office from capital statements 2018–19 to 2023–24, and the Report on State Finances 2019–20.

Estimated actual expenditure was higher than budgeted in 2022–23 by 14 per cent. This increase was driven primarily by external factors, including inflation on supplies, rising labour costs, weather events, and additional spending required to maintain Queensland’s ageing energy infrastructure. The increase is also driven by some agencies bringing forward capital spending to deliver projects sooner than originally planned. For example, the Department of Transport and Main Roads has accelerated the delivery of several highway and rail upgrades.

The volume of capital projects competing for resources over the coming decade and the external risks facing the construction industry will place intense pressure on government projects to be delivered on time and on budget. This is a key risk that must be managed at a whole-of-government level.

Capital expenditure across Queensland’s regions

Major projects can take years to design and build, and require a long-term investment outlook. These projects create assets that are intended to serve Queensland's various regions for decades. Because of this, capital investment decision-makers must anticipate the state’s future demographics and service needs.

Queensland’s population is projected to grow by 21 to 42 per cent over the next 20 years, reaching between 6 and 8 million people. With a growing population comes increased demand on our existing infrastructure assets across healthcare, education, transportation, and energy.

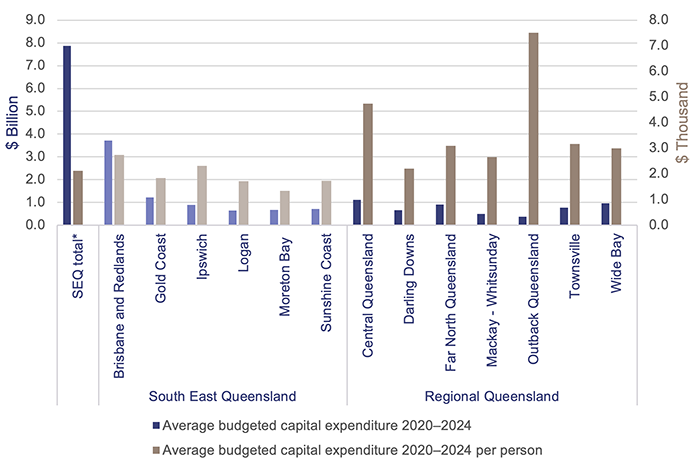

In the 5 financial years from 2019–20 to 2023–24, total budgeted capital expenditure was $39.3 billion in South East Queensland and $26.2 billion across the rest of Queensland. The 2023–24 budgeted capital expenditure for South East Queensland has increased by 22 per cent since the 2019–20 capital budget. For the rest of Queensland, it has increased by 55 per cent.

Figure 2C shows the average budgeted capital expenditure from 2019–20 to 2023–24 for each region, and the same capital expenditure by the number of people in each region as of 30 June 2022 – which is the latest population data available from the Australian Bureau of Statistics. (The regions are shown on a map of Queensland in Appendix E.) Some of these projects are funded by both the Queensland and Australian governments.

Note: * Capital expenditure has been shown for South East Queensland (SEQ) as a whole, as well as the 6 regions within that area. This is because of the interconnected nature of many projects within the area, with individual projects (for example, upgrades to the M1 Pacific Motorway) benefiting people across multiple regions.

Compiled by the Queensland Audit Office from capital statements 2019–20 to 2023–24; and data from the Australia Bureau of Statistics – Regional population estimates.

Projects in Brisbane and Redlands account for 40 per cent of capital expenditure in South East Queensland. This reflects the high population and expected population growth in the region over the next 20 years.

In the 4 financial years from 2019–20 to 2022–23, an average of 38 per cent of state capital spending was focused on regional Queensland. In 2023–24, this shifted significantly to 46 per cent – a nearly even split of infrastructure investment between South East and regional Queensland.

This shift has been driven primarily by the Queensland Energy and Jobs Plan and the Big Build capital program, which will deliver infrastructure to a variety of areas within regional Queensland, including central Queensland and outback Queensland. Planned investments for regional Queensland include water security projects such as the $983 million Fitzroy to Gladstone water pipeline.

Capital expenditure is booming

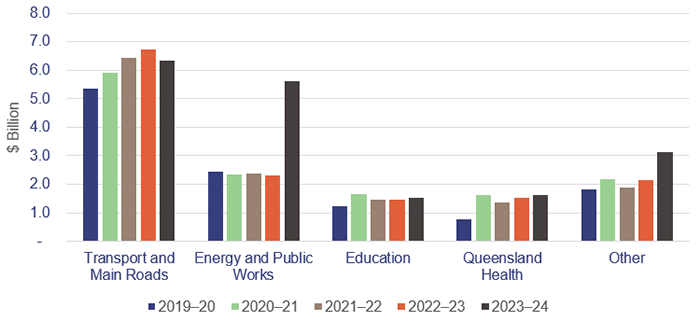

Figure 2D shows the value of capital projects across government portfolios, by budgeted capital expenditure, from 2019–20 to 2023–24. (Appendix C lists the entities included in each portfolio.)

Compiled by the Queensland Audit Office from capital statements 2019–20 to 2023–24.

Budgeted capital expenditure for the Energy and Public Works portfolio has increased 143 per cent since 2022–23, from $2.3 billion to $5.6 billion. This increase is due in large part to the Queensland Energy and Jobs Plan, which includes significant capital investments in generation, storage, and transmission infrastructure.

The ‘Other’ category, which includes water distribution and supply infrastructure, public housing, and police assets, has seen an increase of $980 million from the 2022–23 budgeted capital expenditure.

While the Transport and Main Roads portfolio continues to have the largest capital expenditure budget, it has reduced by $0.4 billion since 2022–23. This is largely because of the completion of the major construction works for Cross River Rail, with the tunnels and major underground works finished between 2019 and 2022. The remaining costs – associated with the testing, commissioning, and servicing of the tunnels – are less than the construction costs.

However, the total budget for Cross River Rail increased by $960 million in 2023–24, due to impacts from the response to the COVID-19 pandemic, environmental factors, and supply chain impacts caused by the conflict in Ukraine.

Planned major projects have increased

Each year, the capital statement (Budget Paper 3) lists capital projects across the state in each portfolio, including what they consist of, how much they cost, and how much has been spent to date.

Figure 2E outlines the Queensland Government’s major projects (those costing more than $500 million) as of 30 June 2023, including their expected completion dates, and total estimated costs. The number of projects with an estimated total cost over $500 million has increased 65 per cent from 20 projects in 2022–23, to 33 projects in 2023–24.

|

Projects |

Status |

Completion date |

Estimated total $ |

|---|---|---|---|

|

Energy and Public Works |

|||

|

Borumba Pumped Hydro Energy Storage1 |

Exploratory works commenced. |

2030 |

$14.2 bil. |

|

CopperString 20322 |

Early planning works. |

2029 |

$5 bil. |

|

Wind farm investments in Central Queensland |

Funding applications underway. |

TBD |

$1.1 bil. |

|

Central Queensland renewable projects |

Investment decision making underway. |

TBD |

$500 mil. |

|

Transport and Main Roads |

|||

|

Queensland Train Manufacturing Program |

Contract awarded for designing, building, and maintaining. |

2032 |

$4.9 bil. |

|

Cross River Rail |

Construction in progress. |

2026 |

$7.8 bil. |

|

New Generation Rollingstock |

75 trains delivered. Rectification work on 32 trains in progress. |

2024 |

$4.2 bil. |

|

Logan and Gold Coast Faster Rail8 |

Procurement. |

2030 |

$2.6 bil. |

|

Coomera Connector (Stage 1), Coomera to Nerang3 |

Construction of Stage 1 north is underway. |

2025 |

$2.2 bil. |

|

Gold Coast Light Rail (Stage 3), Broadbeach South to Burleigh Heads |

Construction in progress, PPP Project Summary Report completed. |

2025 |

$1.2 bil. |

|

Rockhampton Ring Road8 |

First construction phase contracts awarded. The $280 million initial package of works is to continue up to the 2025–26 financial year. |

2026 |

$1.1 bil. |

|

Pacific Motorway, Varsity Lakes (Exit 85) to Tugun (Exit 95) upgrade8 |

Package A construction completed. Packages B and C expected to open progressively from 2024. |

2024 |

$1 bil. |

|

Pacific Motorway, Daisy Hill to Logan Motorway funding commitment |

Contract 1 and Contract 2 in progress and due to be complete in late 2024, weather and construction conditions permitting. |

TBD |

$1 bil. |

|

Bruce Highway (Cooroy to Curra) Section D, construction |

Contract 1 and Contract 2 in progress. |

2024 |

$1 bil. |

|

Gateway Motorway, Bracken Ridge to Pine River upgrade funding commitment |

Business case in progress. |

TBD |

$1 bil. |

|

Bruce Highway (Brisbane to Gympie), Gateway Motorway to Dohles Rocks Road |

Business case in progress. |

TBD |

$948 mil. |

|

Pacific Motorway, Eight Mile Plains to Daisy Hill upgrade |

Construction in progress for Packages 3 and 4, opening progressively from 2024. |

2024 |

$750 mil. |

|

European Train Control System Level 24 |

Testing in progress. |

2026 |

$764 mil. |

|

Bruce Highway (Brisbane to Gympie), Caboolture – Bribie Island Road to Steve Irwin Way upgrade |

Construction for Contract 1 is complete. Construction of Contract 2 is in progress, weather and construction conditions permitting. |

2024 |

$663 mil. |

|

Beerburrum to Nambour Rail Upgrade (Stage 1) |

Finalisation of design for Stage 1 in progress, with the timing for delivery and staging of construction works to be finalised following the completion of detailed design. |

2027 |

$551 mil. |

|

Clapham Yard (train) Stabling |

Construction in progress. |

2026 |

$532 mil. |

|

New Gold Coast Stations (Pimpama, Hope Island and Merrimac) |

Design and construction in progress. |

2026 |

$500 mil. |

|

Queensland Health |

|||

|

Capacity expansion program – rest of program5 |

All projects except for New Queensland Cancer Centre are in the design phase (post-business case approval), and on-track to achieve milestones. |

TBD |

$5.9 bil. |

|

Sunshine Coast University Hospital |

Project achieved practical completion in 2016. Financial close in early 2024 to finalise project spending. |

2016 |

$1.8 bil. |

|

New Toowoomba Hospital |

Managing contractor appointed, design is underway. Site establishment and early works anticipated for early 2024. |

2026 |

$1.3 bil. |

|

New Coomera Hospital6 |

Managing contractor appointed, design is underway. Site establishment and early works have also commenced. Tracking towards GCS approval – mid–late 2024. |

2027 |

$1.3 bil. |

|

New Bundaberg Hospital |

Project validation report completed, Managing Contractor appointed, schematic design and planning approvals underway. |

2027 |

$1.2 bil. |

|

Queensland Corrective Services |

|||

|

Lockyer Valley Correctional Centre |

Construction underway. |

2024 |

$861 mil. |

|

Regional Development, Manufacturing and Water |

|||

|

Paradise Dam improvement project |

Early works have commenced. |

TBD |

$1.2 bil. |

|

Fitzroy to Gladstone Pipeline |

Construction underway. |

2026 |

$983 mil. |

|

Education |

|||

|

New schools capital works program |

New school program in various stages of progress, ranging from planning to under construction. |

TBD |

$630 mil. |

|

State Development, Infrastructure, Local Government and Planning |

|||

|

The Gabba redevelopment |

Finalising the project validation report. |

2030 |

$2.7 bil. |

|

Brisbane Arena7 |

Joint business case is currently under development. |

2030 |

$2.5 bil. |

Notes:

1 Pumped hydro storage uses 2 water reservoirs at different elevations to generate and store energy.

2 CopperString is a transmission line running from Townsville to Mount Isa.

3 The Coomera Connector is a proposed 45-kilometre motorway that will connect Logan City with the Gold Coast.

4 The European Train Control System is a train signalling system.

5 The Capacity Expansion Program is building new hospitals and expanding others.

6 Guaranteed Construction Sum (GCS) represents an offer by the managing contractor to deliver the project, and includes a project brief, time frames for completion, and cost information.

7 The Gabba redevelopment and Brisbane Arena are identified in the capital statement and included in the budget, but not listed in the capital outlays by entity. Both projects are being delivered by the Department of State Development, Infrastructure, Local Government and Planning. Funding by the Australian Government for the Brisbane Arena is capped at $2.5 billion.

8 In November 2023, the Australian Government announced funding changes for a number of projects as a result of the Independent Strategic Review of the Infrastructure Investment Program. This included funding increases for Logan and Gold Coast Faster Rail ($1.8 billion), Rockhampton Ring Road ($347.5 million), and Pacific Motorway Varsity Lakes to Tugun upgrade ($70.0 million). Subsequent to this announcement, the Queensland Government announced a confirmed cost estimate increase to $5.75 billion for the Logan and Gold Coast Faster Rail project.

TBD – To be decided.

Compiled by the Queensland Audit Office from capital statements 2019–20 to 2023–24, various state government entities.

Queensland is planning significant investment in energy

One of the main capital programs for the year ahead is the Queensland Energy and Jobs Plan, which outlines the state's pathway to transforming the energy system over the next 10 to 15 years and delivering clean, reliable, and affordable power. The $62 billion plan includes approximately $19 billion in capital investment over the next 4 years, with $1.3 billion across Queensland in the 2023–24 budget. The plan aims to deliver a SuperGrid and a 50 per cent renewable energy target by 2030, 70 per cent by 2032, and 80 per cent by 2035.

SuperGrid: This represents all the elements of an electricity system – including the poles, wires, infrastructure for solar and wind generation, and storage – to provide clean, reliable, and affordable power.

The 2023–24 capital program commits over $1.3 billion as part of the Queensland Energy and Jobs Plan, including several key investments in developing the Queensland SuperGrid, such as:

|

CopperString 2032: over 1,100 kilometres of transmission line from Townsville to Mount Isa, connecting Queensland’s North West Minerals Province (centred around Mount Isa and Cloncurry) to the national electricity grid. In 2023–24, Powerlink (the energy transmitter in Queensland) is investing $594 million on initial construction works for the project. |

|

|

Borumba Pumped Hydro Energy Storage: a 2-gigawatt pumped hydro energy storage project representing a $14.2 billion cornerstone investment of the Queensland Energy and Jobs Plan. In 2023–24, $184 million is budgeted to be spent on detailed design and exploratory works. |

|

|

Wind farms: Several wind farms are being developed, some through joint venture arrangements (where 2 or more entities partner to deliver a project), with $630 million included in the budget for 2023–24. |

Significant rail projects underway in Queensland

Several rail projects are underway in Queensland, including the train manufacturing program and Stage 3 of the Gold Coast Light Rail project.

Queensland Train Manufacturing Program

In June 2023, the Department of Transport and Main Roads signed a $4.6 billion contract with the Downer Group for the construction of 65 passenger trains, including a maintenance facility, stabling, and an initial 15 years of maintenance. This contract is part of the $7.1 billion announced in the 2022–23 Queensland state budget following completion of the project business case.

In June 2023, the estimated total project cost increased to $9.5 billion due to factors such as an increased scope and escalations in the costs of external labour and supplies following the completion of the tender process. Additional scope items for the program include developing train boarding bridges, electronic leveling control systems, and a test track at Torbanlea (north of Maryborough).

The site establishment works are underway at both the manufacturing facility and rail facility sites, with major construction planned for late 2023. At this stage, work is yet to begin on construction of the passenger trains. The first train is planned to be manufactured and begin testing by late 2026, with all trains expected to be in service by 2032.

Logan and Gold Coast Faster Rail project

The Logan and Gold Coast Faster Rail project is still in the planning phase, subject to approvals from the Australian and Queensland governments. As published in the capital statement as of 30 June 2023, both the Australian and Queensland governments will contribute an equal $1.3 billion for the project ($2.6 billion in total). As part of the Australian Government's infrastructure funding announcement in November 2023, federal funding contributions have increased by $1.8 billion. Subsequent to this announcement, the Queensland Government announced a confirmed cost estimate increase to $5.75 billion. The project will deliver more frequent and reliable train services between Brisbane, Logan, and the Gold Coast by doubling the number of tracks between Kuraby and Beenleigh, modernising rail systems, upgrading stations, and removing level crossings.

Gold Coast Light Rail

The Gold Coast Light Rail is being delivered in stages. The dual-track system is currently more than 20 kilometres long and has 19 stations from Helensvale to Broadbeach South, with Stage 3 underway and Stage 4 in its early planning stages.

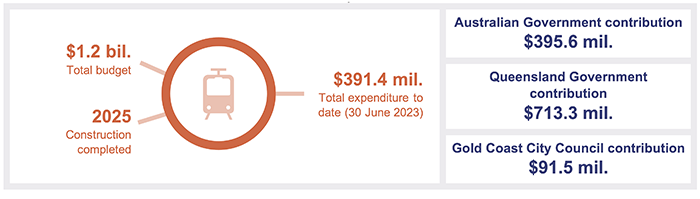

The Gold Coast Light Rail Stage 3 (GCLR3) project provides a 6.7-kilometre extension south of the existing tram network, to link Broadbeach South and Burleigh Heads. The project also includes 8 additional stations, 5 new light rail vehicles, upgrades to the existing Southport depot and stabling facilities, and new light rail/bus connections at Burleigh Heads and Miami. All 3 levels of government are contributing funding towards the project.

Compiled by the Queensland Audit Office.

On 28 March 2022, the Department of Transport and Main Roads entered into a contractual arrangement with GoldlinQ (the light rail consortium) and its chosen design and construction contractor, John Holland. Construction is expected to be completed in 2025.

The project is being delivered through a public–private partnership arrangement, and involves 2 distinct phases:

- the design and construction phase, in which GoldlinQ and its subcontractors take responsibility for the design, construction, and partial financing of the project

- the operations phase, which will commence when Stage 3 construction is completed.

Strengthening transparency on public–private partnership disclosures

The National Public-Private Partnership Policy and Guidelines, the Queensland Project Assessment Framework, and the Queensland Procurement Policy (the guidelines) require the Queensland Government to prepare a project summary when public–private partnership projects are financially closed (funding is finalised) – to promote transparency and accountability.

Under the National Public-Private Partnership Policy, the Queensland Audit Office is required to provide assurance that the project summary report is a fair reflection of the project agreement, before the report is tabled in parliament. We signed our limited assurance report on the project summary for the Gold Coast Light Rail Stage 3 public–private partnership on 9 November 2023. The project summary report was tabled in parliament on 8 December 2023.

Public–private partnerships are cooperative agreements generally entered into by private sector organisations with public sector entities for the delivery of government services.

Project summaries are prepared for any capital project delivered through a public–private partnership, summarising the key information of the project agreement.

Our review of the project summary report for GCLR3 did not identify any material non-compliance with the project summary guidelines. Our review did not provide any assurance over the effectiveness of contract management.

While our audit found that the project summary aligns with the Queensland guidelines and surpasses them in some of the disclosures included (as shown in Figure 2G), Queensland Treasury has an opportunity to enhance the required disclosures. The disclosures mandated in other states could be adopted to better support the Queensland Government’s requirements and expectations about integrity, probity, value for money, and accountability within procurement.

Figure 2G lists the disclosure requirements of public–private partnership projects for Queensland, New South Wales, and Victoria.

|

Disclosure requirements |

GCLR3 |

QLD |

NSW |

VIC |

|---|---|---|---|---|

|

Project overview |

✔ | ✔ | ✔ | ✔ |

|

Procurement option analysis |

✔ | ✔ | ✔ | ✔ |

|

Project advisors |

✔ |

X |

X |

✔ |

|

Tendering information and evaluation |

✔ | ✔ | ✔ | ✔ |

|

Contractual relationships |

✔ | ✔ | ✔ | ✔ |

|

Contract milestones |

✔ | ✔ | ✔ | ✔ |

|

Risk allocations |

✔ |

X |

✔ | ✔ |

|

Contract termination rights |

✔ |

X |

✔ | ✔ |

|

Contract modification procedures |

X |

X |

✔ | ✔ |

|

Contract value |

✔ | ✔ | ✔ | ✔ |

|

Value-for-money analysis |

X |

X |

✔ | ✔ |

|

Service payments |

X |

X |

X |

✔ |

|

Contributions by parties, including private financing |

X |

X |

✔ | ✔ |

|

Variations of costs or milestones |

N/A – No variations have occurred |

✔ | ✔ | ✔ |

|

Performance measures |

✔ | ✔ | ✔ | ✔ |

|

Specified time frame for publishing project summary report |

No time frame has been set |

Not specified |

Within 90 days of the contract becoming effective |

Within 60 days of financial close |

Note: Qld – Queensland; NSW – New South Wales; VIC – Victoria.

Compiled by the Queensland Audit Office.

As shown above in Figure 2G, the Queensland guidelines do not specify time frames for tabling the project summary. This can lead to delays, sometimes meaning the information is not timely when it becomes available. For example, we finished our limited assurance audit procedures over the Tunnel, Stations and Development public–private partnership project summary for the Cross River Rail Delivery Authority on 3 June 2020, but this was only tabled in parliament on 5 December 2023.

More explicit guidance is needed to ensure these reports are made public in a timely manner.

|

Queensland Treasury strengthens disclosures in project summaries for public–private partnerships (agreements private sector companies enter into with the public sector to deliver services) |

|

The government needs to provide more information on capital projects

Each year, the capital statement (Budget Paper 3) provides information to Queenslanders on major capital projects across the state, including what each project consists of, how much it costs, and how much has been spent so far. It is an essential source of information on projects relating to, for example, energy, transportation, and education.

Guidelines for capital statements in Queensland

Preparing capital statements is common practice in all Australian states and territories. In Queensland, the requirements for what is included in the capital statement is detailed in Queensland Treasury’s guidelines, Capital Statement – Guideline for Agencies, as well as the Capital Program Portal – BP3 Module user guide. We have summarised the key requirements of these guidelines in the Queensland column of Figure 2H.

Individual agencies are responsible for providing information on their capital projects to Queensland Treasury as part of the process to prepare the capital statement each year.

Naming of projects and programs

The guidelines require agencies to name projects and programs in a self-explanatory manner, provide an appropriate level of context to the reader, and strive for consistency with other publications. We have, however, found some instances of programs and projects changing names each year, despite no change in scope or nature of the program or project.

This lack of consistency makes it more difficult for readers to identify and monitor projects across years.

Presenting projects and programs

Capital expenditures are presented either as individual capital projects, or collectively under a single capital program in the capital statement. Agencies are responsible for determining how to present this, but we noted there is no guidance to ensure their determination is appropriate and consistent.

In the following example, we have noted inconsistencies with how capital programs have been disclosed in the capital statement.

|

The $9.8 billion Queensland Health Capacity Expansion Program includes 3 new hospitals, totalling $3.8 billion. These 3 new hospitals have been identified individually within the capital statement, with the remaining $6 billion capital budget disclosed collectively as a single line item. This single line item contains many projects, 6 of which are expected to each cost over $465 million. Separate disclosure for these projects is expected in the capital statement when the planning and procurement activities are further progressed. Other capital programs, such as the $378 million Satellite Hospitals Program, have also been disclosed entirely as a single line item. |

The absence of clear guidelines for agencies when deciding the level of detail in disclosing capital programs can lead to inconsistencies, and limits transparency over their capital expenditures.

Guidelines in other jurisdictions

We reviewed the information contained in the capital statements across other jurisdictions and have highlighted the main requirements in Figure 2H.

|

Disclosure requirements |

QLD |

NSW |

VIC |

|---|---|---|---|

|

Project description for key capital projects and programs |

✔ | ✔ | ✔ |

|

Total estimated project cost |

✔ | ✔ | ✔ |

|

Total actual project cost to date |

✔ | ✔ | ✔ |

|

Budgeted project cost for coming year |

✔ | ✔ | ✔ |

|

Statistical area of project (showing regional location) |

✔ | X | X |

|

Categorisation between existing, new, and completed projects |

X | X |

✔ |

|

Estimated project completion date |

X |

✔ |

✔ |

|

Supplemental interactive dashboard for significant projects |

✔ |

X |

✔ |

Note: Qld – Queensland; NSW – New South Wales; VIC – Victoria.

Compiled by the Queensland Audit Office.

As illustrated in Figure 2H, while Queensland’s capital statement does include information on the statistical area of the projects, it does not include the estimated project completion date as other states do, nor does it show which are new, and which are from the previous year.

New South Wales and Victoria disclose information on projects completed in the prior financial year in their capital statements, including the completion date and total actual expenditure. Because the purpose of the Queensland capital statement is to focus on future capital expenditure, Queensland Treasury has not included information on recently completed projects. It could, however, provide this information in conjunction with the capital statement to provide more transparency on completed projects.

|

Queensland Treasury updates guidelines for preparing the capital statement (the annual overview of proposed capital expenditure) |

|

2. We recommend that Queensland Treasury:

|

Brisbane Metro is the largest council-led project in Queensland

Major projects are not only delivered by federal and state governments. Local governments (councils) are integral in the delivery of services to their community, and this can include planning and delivering significant infrastructure.

As of this year, Brisbane Metro remains the largest council-led project in Queensland.

Brisbane Metro

Delivery of Brisbane Metro began in late 2021. It will transform 21 kilometres of existing busway into a high-frequency rapid transit system, connecting Eight Mile Plains and Roma Street, and the Royal Brisbane and Women’s Hospital and the University of Queensland.

It will feature 18 stations, 11 of which will be interchange stations linking the metro to bus routes, with 2 linking to Cross River Rail stations. The project will also deliver a new fleet of 60 all-electric high‑capacity metros (battery-electric vehicles).

The estimated cost of delivering Brisbane Metro is $1.6 billion, funded jointly by the council and the Australian Government. Expenditure to 30 June 2023 has been $790 million, of which $374 million was spent in 2022–23.

Figure 2I provides a snapshot of Brisbane Metro, including total funding, the contribution of the Australian Government and Brisbane City Council to the budget, and expenditure as of 30 June 2023.

Compiled by the Queensland Audit Office.

Budget and current progress

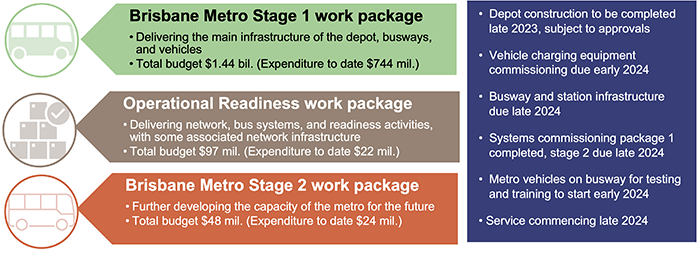

Figure 2J provides information on activities under each of 3 work packages of the Brisbane Metro project, as well as the total budgeted and actual expenditure as of 30 June 2023.

Expenditure to date across the work packages increased from $416 million in 2021–22 to $790 million in 2022–23. There has been a budget increase for the Stage 1 work package of approximately $100 million to accommodate the impacts from the response to the COVID-19 pandemic, global supply chain disruption, the conflict in Ukraine, and the protracted La Nina weather event.

Brisbane City Council estimates the remaining cost to complete all 3 work packages will be $795 million – an increase of $90 million. This is expected to be spent in the 2023–24 and 2024–25 financial years.

Again, this is in line with the progress of the project as outlined in Figure 2J, which shows when milestones are due to be reached. These include completion of the busway and station infrastructure, commissioning of the system, and commencement of busway testing and training.

Compiled by the Queensland Audit Office from Brisbane City Council project budget.

Construction works began in late 2021. The construction of the Brisbane Metro depot is planned to be substantially complete in December 2023. The metro and its charging system are the first of their kind in Australia, and because of this, testing and commissioning activities are currently underway, with more major milestones approaching in early 2024. The completion of the busway and station infrastructure is due in late 2024.

Following a successful pilot metro (battery-electric vehicle) test in 2022, Brisbane City Council placed an order for the initial 59-vehicle fleet. Of these, 6 are due to be delivered in early 2024. The production and delivery plan for the remaining 53 vehicles is still under development, with a planned fleet acceptance time frame of 2024–25.

In 2022, works on operational readiness began with network engagement (consultation with planning advisory firms and the Brisbane community). The council has since finalised its submission for state approval of the bus network. Concurrently, the commissioning of Brisbane Metro Management Systems Package 1 was completed in 2023, and the fully integrated readiness timeline was established. This timeline will bring together all aspects of the Operational Readiness work package in preparation to commence customer services.

Brisbane Metro – Woolloongabba Station

In March 2022, as part of the South East Queensland (SEQ) City Deal (a funding agreement to deliver infrastructure investment), the Australian Government, Queensland Government, and Brisbane City Council announced $450 million for a new Woolloongabba Brisbane Metro Station. The new busway station at Woolloongabba will improve connectivity between the Woolloongabba Cross River Rail station, Brisbane Metro services, and bus services on the South East Busway, supporting urban renewal across the precinct.

In late 2023, the project plan was agreed between the 3 levels of government. Detailed planning and design are underway and will continue over the next 2 years. A high-level scope of this project includes:

- a new station and busway connections

- bus layover facilities

- upgrades to local roads and intersections

- pedestrian, cycle, and urban improvements within the precinct.

3. Progress of the Cross River Rail project

The Cross River Rail (CRR) project is being delivered by the Cross River Rail Delivery Authority (the Delivery Authority). The project will deliver a 10.2-kilometre rail line that includes 5.9 kilometres of twin tunnels running under the Brisbane River and central business district. It includes 4 new underground stations, and one new and 7 rebuilt above-ground stations.

CRR remains the current infrastructure project with the largest capital expenditure in Queensland in 2022–23 and continues to progress through its construction phase.

We reported in Major projects 2022 (Report 7: 2022–23) that the delivery of the CRR project had been affected by supply chain issues including increased costs of materials and labour. The Delivery Authority continues to monitor and assess the impact of these factors on the project cost and the timing of delivery.

As a result, in March 2023, the Queensland Government announced the total cost of the CRR project was revised to $7.848 billion – $960 million over its original budget of $6.888 billion. The additional approved funding is made up of:

- $530 million for the Tunnel, Stations and Development work package

- $110 million for the Rail, Integration and Systems work package

- $208 million for activities relating to testing and commissioning, integration, operational readiness, and project management

- $112 million reimbursing the Delivery Authority for previous land acquisitions.

Project milestones have also been affected, with major construction works extended from 2024 to 2025 and the formal opening date delayed from 2025 to 2026.

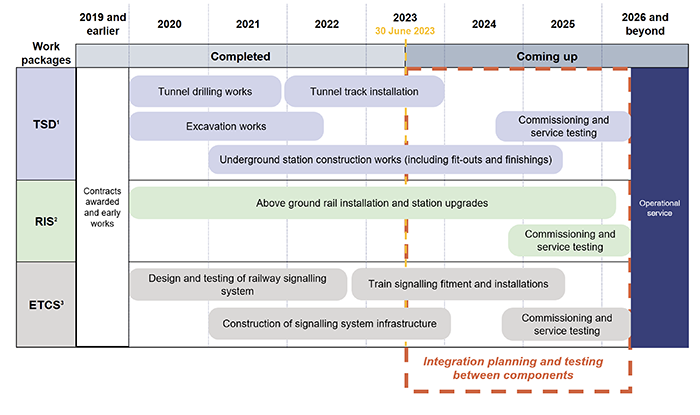

Figure 3A outlines the progress of the CRR project as at 30 June 2023, and the revised project timelines.

Note: 1TSD – Tunnel, Stations and Development; 2RIS – Rail, Integration and Systems; 3ETCS – European Train Control System. Refer to Figure D1 of Appendix D for the project details.

Compiled by the Queensland Audit Office from Cross River Rail Delivery Authority management reports.

In 2022–23, the Delivery Authority made major construction progress on each of the major work packages (see Figure D1 in Appendix D). Below ground, it completed rail installation and cabling works in the tunnels and installed permanent lining (the support system of a tunnel) at Woolloongabba and Albert Street stations.

Above ground, it handed over the Mayne Yard North train stabling facility for use by Queensland Rail and completed upgrades to Yeronga station. It continued to make progress with testing and fitting signalling systems onto trains during the year.

Continued monitoring of project’s cost and schedule

As of 30 June 2023, $5.8 billion had been spent on the CRR project, which is $276 million less than the originally budgeted expenditure to date. This underspend has primarily been caused by construction delays arising from significant supply chain disruptions due to responses to the COVID-19 pandemic and the conflict in Ukraine. Figure 3B details the expenditure to date for the CRR project.

With the construction period extended by one year, the budgeted costs will be allocated over an extended period. As the project progresses and the Delivery Authority incurs additional costs to catch up with construction, actual expenditure is expected to closely reflect the revised budgeted costs.

To meet the revised completion date of 2026, the Delivery Authority has implemented an integrated delivery program, which means the testing of tunnels, stations, train lines, and signalling systems will be conducted progressively as construction continues.

The integrated schedule is intended to allow all parties to work together to minimise the time between completion of different components of the work packages. The Delivery Authority will need to continue to manage the cost, and align delivery schedules with all stakeholders, to achieve the revised milestones.

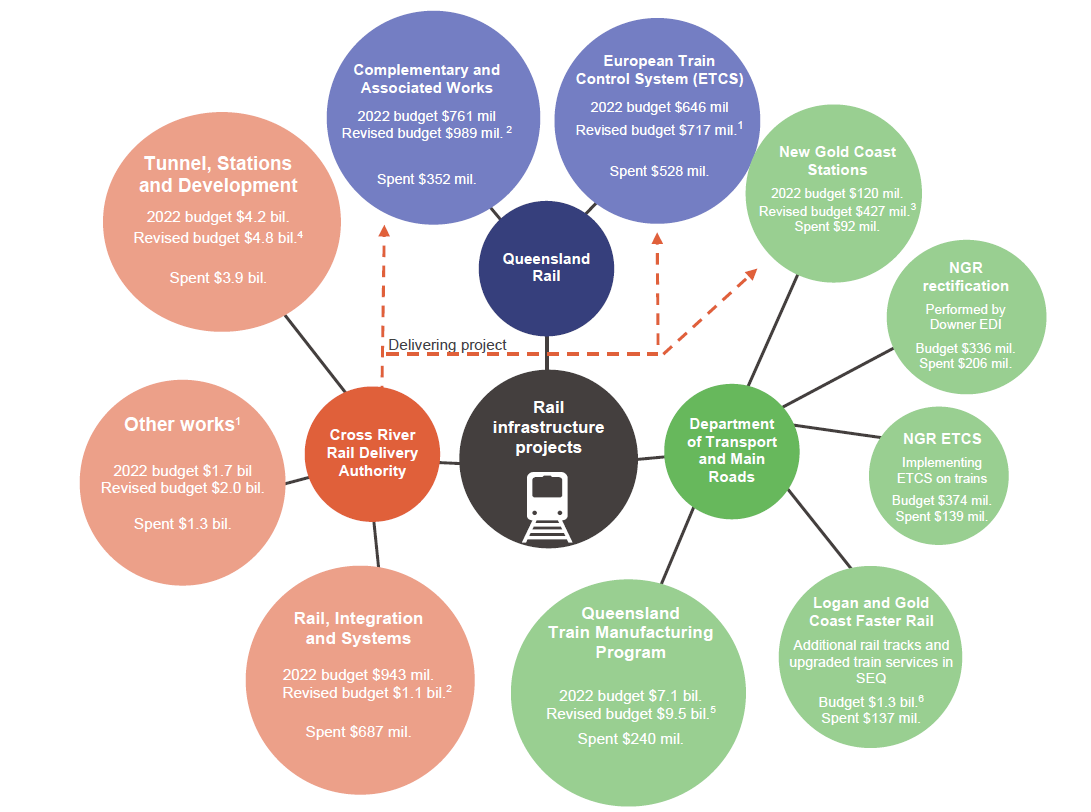

Additional funding for Cross River Rail-associated projects

The Delivery Authority is also delivering several other related projects for the Department of Transport and Main Roads and Queensland Rail. These include upgrading train stabling yards, bridges, and stations (Complementary and Associated Works); implementing the rail signalling system (European Train Control System project); and constructing the Pimpama, Hope Island and Merrimac stations on the Gold Coast (New Gold Coast Stations project).

Due to the continued effects of market forces on the supply chain, actual expenditure in 2022–23 on these projects is $18 million less than originally budgeted.

As part of the broader SEQ Rail Connect (which is a strategy to deliver an integrated transport network in the South East Queensland region), other rail infrastructure projects are being planned to complement and support the CRR project. These include building a train manufacturing facility, building new tracks and rail systems in South East Queensland, and deploying new signalling systems on more trains.

Figure 3B outlines the projects and their funding sources, including the budget increases.

Notes:

1. The total budget for the ETCS work package is $764 million, with Queensland Rail funding $717 million and the Delivery Authority funding $47 million from the Other works budget.

2. The total budget for the Rail, Integration and Systems work package is $2.1 billion, with Queensland Rail funding $989 million and the Delivery Authority funding $1.1 billion. The state has committed additional funding of $197 million and $110 million to Queensland Rail and the Delivery Authority respectively. A further increase of $30 million in Queensland Rail funding relates to signalling works and Dutton Park accessibility (Southern Area) modifications.

3. The total budget for New Gold Coast Stations has increased from $187 million to $500 million, with the Department of Transport and Main Roads funding $427 million (previously $120 million), and Queensland Rail funding $73 million (previously $67 million).

4. The state committed additional funding of $530 million for the Tunnel, Stations and Development work package.

5. The original budget for the Queensland Train Manufacturing Program was $7.1 billion, as announced in October 2021, but it was increased to $9.5 billion in June 2023 following the completion of a tender process.

6. As published in the capital statement as of 30 June 2023, the total budget for the Logan and Gold Coast Faster Rail is $2.6 billion, which is funded equally by the federal and state governments. In November 2023, the Australian Government announced funding changes for a number of projects as a result of the Independent Strategic Review of the Infrastructure Investment Program. This included a funding increase for the Logan and Gold Coast Faster Rail project of $1.8 billion. Subsequent to this announcement, the Queensland Government announced a confirmed cost estimate increase to $5.75 billion.

NGR – New Generation Rollingstock.

All budgets for major projects include a contingency to allow for any construction risks to be addressed as they arise. For the CRR project, this is included in the Other works revised budget of $2 billion. As of 30 June 2023, the contingency for the CRR project remained within budget.

Compiled by the Queensland Audit Office.

4. Brisbane 2032 Olympic and Paralympic Games infrastructure

The Brisbane 2032 Olympic and Paralympic Games (the Games) promises to be a significant event for Brisbane, Queensland, and Australia as a whole. With the Games less than 9 years away, effective governance, budgeting, and venue planning are crucial for success.

Since 21 July 2021, when the International Olympic Committee announced Brisbane as the host city for the Games, there have been several major developments, as outlined in Figure 4A. The announced budget to enhance or build new venues infrastructure for the Games is $7.1 billion and includes a $3.4 billion intergovernmental funding agreement between the Australian and Queensland governments. This funding agreement is for the construction of the Brisbane Arena and the 16 new or upgraded venues included in the Minor Venues Program.

International Olympics Committee (IOC) announces Brisbane as host city for 2032 Olympic and Paralympic Games

Brisbane Organising Committee for the 2032 Olympic and Paralympic Games (BOCOG) is established as a statutory body in Queensland

Olympic and Paralympic Games Legacy Committee is formed to advise on vision for after the Games. The committee is not a separate entity

$7.1 billion budget announced for the Games venue infrastructure

Construction of the Gabba redevelopment commences

Construction of the Brisbane Arena commences

Brisbane Arena and the Gabba construction finishes

Completion of all venues within the Minor Venues Program

Olympic and Paralympic Games

Compiled by the Queensland Audit Office.

In this chapter, we provide an overview of the governance arrangements in place to deliver the venues for the Games, as well as insights into the planned budget and timeline for their construction.

We intend to deliver a series of audits examining the planning, delivery, and benefits of the Games. The audits will focus on governance, project management, allocation of funds, and the longer-term legacy of the Games for Brisbane and Queensland. As part of our Forward work plan 2023–26, we have included an audit for tabling in 2023–24 on preparing for the Brisbane Games. It will be our first report on the initial preparation and planning for delivering the Games.

Governance strategy to deliver the Games infrastructure

Planning and coordinating the delivery of infrastructure for use during the Games involves all levels of government and is informed by the Brisbane 2032 venues and villages program. This program includes 37 competition venues, of which 6 are new venues, 8 are upgraded venues, and 23 are existing or temporary venues.

The Department of State Development, Infrastructure, Local Government and Planning (the department) is responsible for planning and delivering these venues, as well as the villages, for the Games. Figure 4B provides an overview of the significant venues and villages projects for the Games.

Compiled by the Queensland Audit Office.

The department will also work closely with the Brisbane 2032 Coordination Office (within the Department of the Premier and Cabinet), the Brisbane Organising Committee for the 2032 Olympic and Paralympic Games (BOCOG), and other government entities and Games partners to ensure the Games infrastructure is delivered on time, on budget, and to a high standard of quality.

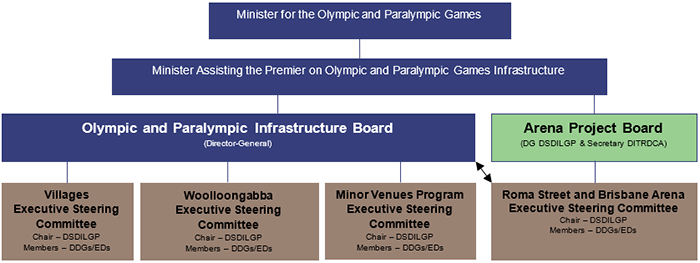

The department has also created an interim governance framework for the Games infrastructure, which is shown in Figure 4C. This will be in use through the planning and project validation phase for the venues, and is expected to undergo changes when the delivery phase commences. We have summarised some components of this governance framework for simplicity.

Note: DG – director-general; DDG – deputy director-general; ED – executive director; DSDILGP – Department of State Development, Infrastructure, Local Government and Planning; DITRDCA – Australian Government Department of Infrastructure, Transport, Regional Development, Communications and the Arts.

Compiled by the Queensland Audit Office from information provided by the Department of State Development, Infrastructure, Local Government and Planning.

The interim governance framework has set up the Olympic and Paralympic Infrastructure Board and the Arena Project Board to oversee the delivery of the Brisbane 2032 venues and villages program. We plan to perform a detailed assessment of the governance structures in place as part of our series of planned audits examining the planning, delivery, and benefits of the Games in line with our Forward work plan 2023–26.

The Arena Project Board was specifically set up to be led collaboratively between the department and the Australian Government Department of Infrastructure, Transport, Regional Development, Communications and the Arts. It will drive government investment decisions in accordance with the intergovernmental agreement signed in February 2023.

Each steering committee oversees a major capital project essential for the Games, and will be chaired by the department.

A budget for the Games venues has been announced

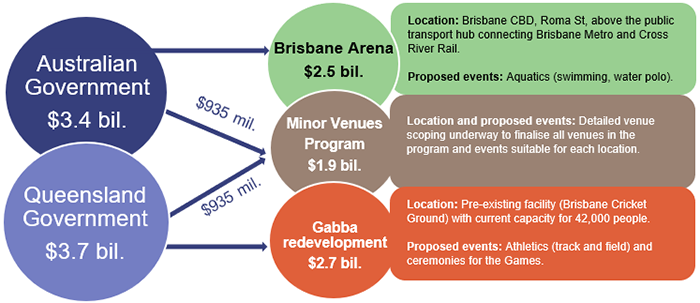

In July 2023, the Australian and Queensland governments announced they would spend a combined $7.1 billion on venue infrastructure before the 2032 Olympic and Paralympic Games. Figure 4D breaks down the Australian and Queensland government venue infrastructure program budget.

Compiled by the Queensland Audit Office.

The Queensland Government faces a large and complex task in ensuring that the budget reflects a realistic view of the current and forecasted future market conditions, and that it caters for appropriate contingencies.

It also needs to make sure it can manage competing demands for resources (funding and otherwise), given the range of other capital projects currently underway.

Australian Government funding

The venues infrastructure program is jointly funded by the Australian and Queensland governments under the intergovernmental agreement. Based on agreed milestones, the Australian Government will provide up to $2.5 billion for developing the Brisbane Arena, and up to $935 million for developing minor venues.

The allocation of funding for specific venue projects will be subject to government investment decisions, following the completion of detailed venue scoping. In total, the Australian Government will contribute a capped $3.4 billion to the venue infrastructure program.

Detailed scoping for the games venues is currently underway

The Games are broadly divided into 3 zones: the Brisbane Zone, the Gold Coast Zone, and the Sunshine Coast Zone. The major venues for the Games will be located in the Brisbane Zone, with the Brisbane Arena and Gabba redevelopments as centrepiece capital projects.

The Minor Venues Program comprises 16 smaller capital projects across Queensland that will play host to a variety of different sports. The program aims to ensure that a wide range of Olympic and Paralympic sports can be accommodated during the Olympics, and that local communities can benefit from the legacy of the Games.

Ordinarily, when planning major infrastructure projects, the Queensland Government uses Queensland Treasury’s Project Assessment Framework to help develop business cases. Using this framework helps to ensure infrastructure investment decisions are well informed, appropriately costed, and support the Queensland Government’s strategic priorities.

For the Games venues, the Queensland Government is currently undertaking a detailed scoping activity to validate the locations and venues already announced as part of the Future Host Commission Questionnaire. Through this process, the Queensland Government will prepare several project validation reports that aim to provide assurance that the venues can be delivered against the approved budget and are appropriately planned prior to construction.

Project validation reports seek to provide assurance to decision-makers regarding the anticipated scope, costs, risks, and delivery planning associated with the proposed investment for the given project.

On 24 November 2023, the Queensland Government announced the project validation report for the Gabba rebuild was complete. The initial estimate of $1 billion for the Gabba redevelopment announced in 2021 was revised upward to $2.7 billion (announced in February 2023), following an assessment of 4 redevelopment options for the venue. The option selected from this process was for a full redevelopment of the venue, and includes the construction of a pedestrian bridge to Cross River Rail and Brisbane Metro stations.

For the other major venue, Brisbane Arena, a joint business case is currently under development between the Queensland and Australian governments. Both the Queensland and Australian governments agreed through the intergovernmental agreement to prepare a joint business case, since both parties will be participating in the procurement scope and assessment decisions.

We intend to assess the project validation reports and business cases prepared for venues (including for the Gabba and Brisbane Arena) against the Project Assessment Framework as part of a future audit.