Overview

Queensland's growth relies on strong infrastructure investment, which drives economic development and improves quality of life. To support this, the Queensland Government is increasing spending on major projects. However, challenges such as a tight labour market, industrial disputes, and rising supply costs must be managed to ensure the effective delivery of infrastructure plans over the next decade.

Tabled 20 January 2025.

Report on a page

Queensland needs effective infrastructure investment to support its growth over the coming decades. Well-planned and maintained infrastructure not only drives economic growth, but also enriches our standard of living and strengthens communities. All 3 levels of government are continuing to commit significant funding each year to this. In its annual capital budget, the Queensland Government includes information on proposed state-funded projects for the years ahead.

This report provides insights into the significant infrastructure projects in Queensland, and an analysis of expenditure by the Queensland Government. This report does not cover any significant changes in the strategy or budget following the change of government in October 2024 – those will be included in our Major projects 2025 report.

Queensland continues to increase capital expenditure

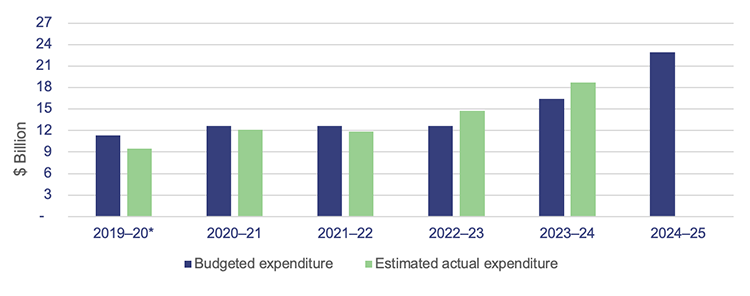

The Queensland Government's total budgeted capital expenditure for 2024–25 is $22.9 billion, a significant increase of approximately 40 per cent from $16.4 billion in the 2023–24 budget. This represents a total increase of approximately 82 per cent from the 2022–23 budget. It reflects the state government’s continuing investment in supporting the state’s growth and areas of priority including energy, education, health, water, and transport.

The Queensland Government continues to spend more on its capital projects than is budgeted. In 2023–24, estimated actual expenditures were 13.8 per cent higher than budgeted expenditures, compared to a 16.4 per cent variance in 2022–23.

Queensland's increased capital investment and projects, along with major projects planned across Australia, presents significant challenges for the construction sector. These include a tight labour market, ongoing industrial disputes, and rising supply chain costs. The Queensland Government should consider assessing and addressing these risks to effectively deliver its infrastructure agenda over the next decade.

Improving coordination and guidelines for timely asset transfers

The Cross River Rail Delivery Authority finished constructing several assets and transferred them to Queensland Rail for use prior to 30 June 2024. However, formal acknowledgement and acceptance of the transferred assets was delayed due to differing views on the transfer date. To better align the operational handovers of the assets and the accounting requirements, agencies should effectively collaborate on the transfer process. This should include discussion with key stakeholders, including ministers and relevant central agencies, on when, and how, the asset transfers should be completed and designated for financial reporting purposes.

Queensland Treasury could consider providing additional guidance to promote early collaboration between agencies, ensuring key milestones are accurately recorded, and that accounting reflects the intended transfer and use of the assets. This will assist those responsible for managing the transfer process to better understand the potential issues that may need to be considered and addressed, including accounting implications.

Labour market constraints have affected the costs and timeline of Cross River Rail

The Cross River Rail project has experienced ongoing constraints in materials, labour, and industrial relations, which has affected its productivity and delivery timelines. As a result of these supply chain and market challenges, major construction works were extended from 2024 to 2025, delaying the formal opening date. The Delivery Authority has not yet announced the revised expected opening date or provided a revised budget due to the ongoing delivery challenges.

1. Recommendations

New recommendations made in 2024

| Relevant agencies should work together better to ensure all legal, accounting, and operational aspects of asset transfers are considered early and agreed prior to the transfer (Chapter 3) |

1. We recommend that agencies involved with future asset transfers implement appropriate governance arrangements to ensure that:

2. We recommend that Queensland Treasury considers whether additional guidance can be provided to better assist agencies in understanding their responsibilities for asset transfers and the issues they may need to consider in discharging their responsibilities. |

Status of recommendations made in Major projects 2023 (Report 7: 2023–24)

In Major projects 2023 (Report 7: 2023–24), we recommended that Queensland Treasury strengthen the disclosure requirements for project summaries of public–private partnerships and update its guidelines for preparing the capital statement (the annual overview of proposed capital expenditure).

Queensland Treasury has taken some corrective action to address these recommendations, but we continue to identify issues in how agencies are disclosing projects in the capital statement.

We have included a full list of last year’s recommendations and their status in Appendix F.

Reference to comments

In accordance with s. 64 of the Auditor-General Act 2009, we provided a copy of this report to relevant entities. In reaching our conclusions, we considered their views and represented them to the extent we deemed relevant and warranted. Any formal responses from the entities are at Appendix A .

2. Insights into Queensland’s major projects

State and local governments allocate a significant portion of their budgets to capital expenditure as they plan for the infrastructure needed to support a growing Queensland. Through their investments, they aim to create more jobs, enhance communities, and strengthen regions.

This chapter provides insights into major projects the Queensland Government has budgeted for between 2019–20 and 2024–25, as well as insights into the Brisbane Metro, which is being built by Brisbane City Council.

This chapter identifies some improvement opportunities for reporting information related to capital projects. It also lists some lessons learnt in managing major projects in the past.

Capital expenditure: Money spent to buy or build new assets or improve existing assets. This can include land, buildings, infrastructure, equipment, or computer systems. Examples include buying a range of new computers, building a new school, or upgrading roads.

Capital project: A single project, for example, the construction of a bridge.

Capital program: Several capital projects brought together under one program, for example, construction of several new roads in a particular area.

In this report, we refer to all capital projects and programs as ‘projects’.

Capitalising costs: Adding certain expenses to the value of an asset instead of recording them as immediate costs.

State infrastructure strategy

The Queensland Government’s State Infrastructure Strategy is a 20-year plan that sets out a vision for Queensland’s infrastructure needs over the next 2 decades. It provides a framework to guide infrastructure planning and investment, and has 5 focus areas, as shown in Figure 2A.

State Infrastructure Strategy 2022–2042.

In addition to the State Infrastructure Strategy, the government is developing 7 regional infrastructure plans. Of these, 4 are completed, with work commencing on the others in late 2024. The regional infrastructure plans will complement the strategy and be used by Queensland's councils to develop local infrastructure over the next 2 decades.

The completed regional infrastructure plans identify several drivers for infrastructure investment, including the demand for housing supply, the need to create opportunities for economic growth, and the need to reduce carbon emissions.

Our Forward work plan 2024–27 includes an audit on planning for liveable communities in Queensland. It will examine how state and local governments collaborate and coordinate their long-term plans to provide the services needed to support Queensland’s growing population.

In Major projects 2023 (Report 7: 2023–24) we highlighted significant infrastructure announcements since the release of the strategy. These include the $62 billion Queensland Energy and Jobs Plan, $7.1 billion Brisbane 2032 Olympic and Paralympic Games venues infrastructure program, and $88.7 billion Big Build 4-year capital program. Since then, the Big Build program has grown to $107.3 billion, with $26 billion of the Queensland Energy and Jobs Plan now set to be spent in the next 4 years.

These investments are scheduled for delivery over the next decade. However, ongoing challenges – such as labour shortages, industrial disputes, rising material costs, and unexpected weather events – may result in delays or budget overruns.

To effectively manage these challenges, the government needs to learn from the experiences of past projects. We have captured these key learnings in Appendix G for agencies to consider when planning or delivering capital projects.

Budgeted capital spending continues to grow strongly

Annual budgeted capital expenditure is growing rapidly, increasing by 40 per cent to $22.9 billion in 2024–25, on top of a 30 per cent increase in 2022–23. This represents an overall increase of 82 per cent of capital expenditure from the capital budget 2 years ago.

This growth is primarily driven by increased investment through the Queensland Energy and Jobs Plan, along with rail infrastructure projects such as the Direct Sunshine Coast Rail Line (Stage 1), the Logan and Gold Coast Faster Rail project, and the Gold Coast Light Rail (Stage 3).

Figure 2B shows budgeted and estimated actual capital expenditure (forecast of actual expenditure for the financial year) from 2019–20 to 2024–25.

Note: * The estimated actual expenditure for 2019–20 was not disclosed in the capital statement for 2020–21 and was taken from the capital purchases from the non-financial public sector in the Report on State Finances 2019–20. It includes government departments and corporations that provide public services like health and education and excludes financial entities.

Compiled by the Queensland Audit Office from capital statements from 2019–20 to 2024–25, and the Report on State Finances 2019–20.

In 2023–24, estimated actual expenditures were 13.8 per cent higher than budgeted, primarily due to the Transport and Main Roads portfolio. This increase was driven by additional spending on projects such as the European Train Control System; Cross River Rail; the Queensland Train Manufacturing Program; Bruce Highway (Cooroy to Curra) Section D; and Pacific Motorway, Varsity Lakes (Exit 85) to Tugun (Exit 95) upgrade.

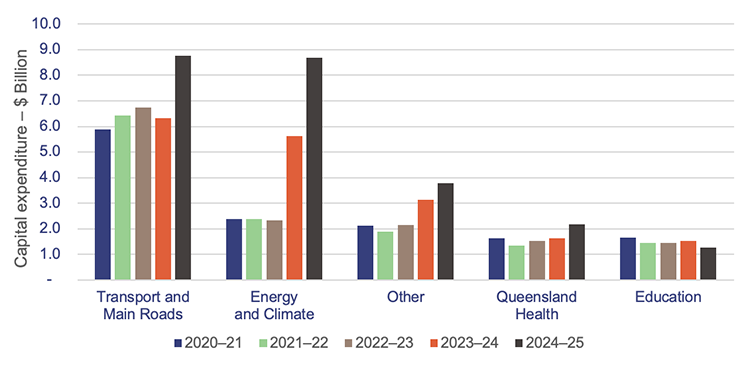

Across the key government portfolios, Transport and Main Roads and Energy and Climate continue to have the largest capital expenditure budgets. Figure 2C shows the value of capital projects across government portfolios, by budgeted capital expenditure, from 2020–21 to 2024–25. (Appendix C lists the entities included in each portfolio.)

Compiled by the Queensland Audit Office from capital statements from 2020–21 to 2024–25.

The increased budgeted capital expenditure for the Transport and Main Roads portfolio is due to higher investments in rail projects. These include the Queensland Train Manufacturing Program, Logan and Gold Coast Faster Rail, Direct Sunshine Coast Rail Line (Stage 1), and New Gold Coast Stations (Pimpama, Hope Island, and Merrimac). Additionally, increased funding for the Coomera Connector (Stage 1), Coomera to Nerang, and progress on Rockhampton Ring Road, and Bruce Highway upgrades including Bruce Highway (Brisbane to Gympie), Dohles Rocks Road to Anzac Avenue upgrade (Stage 1), and Gateway Motorway, Bracken Ridge to Pine River upgrade contributed to the higher budgeted expenditure.

Budgeted capital expenditure for the Energy and Climate portfolio has increased by 55 per cent since 2023–24, from $5.6 billion to $8.7 billion. This increase is driven by continued investments in generation, storage, and transmission infrastructure.

The ‘Other’ category, which includes water distribution and supply infrastructure, public housing, and police assets, has increased by $656 million since the 2023–24 budgeted capital expenditure.

Capital expenditure across Queensland’s regions

Major projects often take years of design and construction before they can deliver community benefits. These projects are designed to create infrastructure that will serve Queenslanders for decades, so the decisions made today need to consider the state’s future population and service needs. Queensland’s population is projected to grow by 15 to 34 per cent over the next 20 years, reaching between 6 and 7.5 million by 2044.

As this occurs, the pressure on our existing infrastructure for energy, transportation, education, and health increases. The government will need to continue to invest in infrastructure to support this growth.

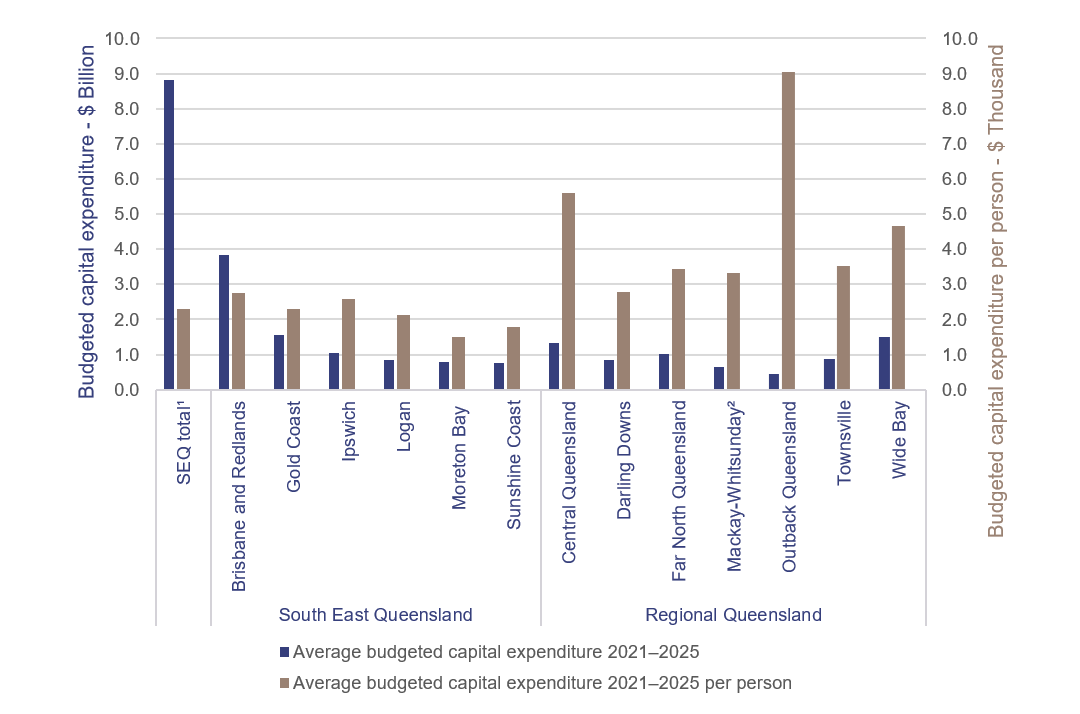

In the 5 financial years between 2020–21 and 2024–25, total budgeted capital expenditure was $44 billion in South East Queensland and $33.2 billion across the rest of Queensland. The 2024–25 budgeted capital expenditure for South East Queensland has increased by 44 per cent since the 2020–21 capital budget. For the rest of Queensland, it has increased by 149 per cent.

Figure 2D shows the average budgeted capital expenditure from 2020–21 to 2024–25 for each region. It also shows the capital expenditure per person. To calculate this, we used the number of people in each region as of 30 June 2023 (which is the latest date for which the Australian Bureau of Statistics has data). In Appendix E, we show the regions on a map of Queensland.

Notes:

- Capital expenditure has been shown for South East Queensland (SEQ) as a whole, as well as for the 6 regions within that area. This is because of the interconnected nature of many projects within the area. Individual projects (for example, upgrades to the M1 Pacific Motorway) benefit people across multiple regions.

- Figure 2D includes the Pioneer-Burdekin Early Works project, which was cancelled in November 2024.

Compiled by the Queensland Audit Office from capital statements 2020–21 to 2024–25; and data from the Australia Bureau of Statistics – Regional population estimates.

Projects in Brisbane and Redlands account for 36 per cent of capital expenditure in South East Queensland. This reflects the high population and expected population growth in the region over the next 20 years.

Investment in regional Queensland continues to be driven by the Queensland Energy and Jobs Plan and the Big Build capital program. Outback Queensland has the highest capital expenditure per person, despite its small population, due to planned investments like CopperString 2032, which cover infrastructure for renewable energy generation, storage, and transmission. Many of these investments are also expected to benefit multiple other regions across Queensland.

The 2024–25 budget included significant increases in capital expenditure for Wide Bay (102 per cent) and Mackay-Whitsunday (117 per cent). These are for hydro-electricity storage, transmission infrastructure, and wind farms.

The number of capital projects with a budget of $500 million or more continues to grow

Each year, the capital statement (Budget Paper 3) lists capital projects across the state in each portfolio, including what they consist of, how much they cost, and how much has been spent to date.

Figure 2E outlines the Queensland Government’s major projects (those costing more than $500 million) as of 30 June 2024, including their expected completion dates and total estimated costs. This figure presents the budgeted estimated cost to date detailed in the 2024–25 capital statement, published in June 2024. The number of projects with an estimated total cost of over $500 million has increased by 18 per cent – from 33 projects in 2023–24 to 39 projects in 2024–25.

Status: Represents the progress made towards each project as at 30 June 2024. Projects can go through multiple phases (such as early works, tendering and procurement, design, construction, commissioning, and completion). The status is provided by the delivery agencies for each project.

Announced estimated completion date: The year when the project is expected to be completed and/or operational. In some cases, this represents the completion date for a particular phase of the project, rather than the underlying capital project in its entirety. The completion date is provided by the delivery agencies for each project.

Budgeted estimated cost to date: Represents how much a project (or stage of a project) is expected to cost from commencement to completion. In some cases, this may instead represent the allocated budget to date, with further consideration from business cases to reach a final cost estimate.

| Projects | Status | Announced estimated completion date | Budgeted estimated cost to date |

|---|---|---|---|

| Transport and Main Roads | |||

| Cross River Rail1 | Construction in progress. | 2026 | $7.8 bil. |

| Logan and Gold Coast Faster Rail | Procurement process underway. | 2031 | $5.8 bil. |

| Direct Sunshine Coast Rail Line (Stage 1), funding commitment | Pre-delivery activities have started. Preparing for procurement for Stage 1. | 2032 | $5.5 bil. |

| Queensland Train Manufacturing Program | Design and manufacture of trains in progress. Construction of manufacturing and rail facility sites in progress. | 2032 | $4.9 bil. |

| Coomera Connector (Stage 1), Coomera to Nerang2 | Construction of Stage 1 North (Shipper Drive to Helensvale Road) is underway. Stage 1 Central (Helensvale Road to Smith Street Motorway) enabling works are underway. Stage 1 South (Smith Street Motorway to Nerang-Broadbeach Road) early works are underway. | Staged opening from late 2025 | $3 bil. |

| Rockhampton Ring Road | Construction in progress. | 2030 | $1.7 bil. |

| Pacific Motorway, Varsity Lakes (Exit 85) to Tugun (Exit 95) upgrade | Package A construction completed. Packages B and C expected to open progressively from 2024. | 2024 | $1.5 bil. |

| European Train Control System Signalling Program: Phase 13 | Testing in progress. | 2026 | $1.3 bil. |

| Gold Coast Light Rail (Stage 3), Broadbeach South to Burleigh Heads4 | Construction in progress. | 2026 | $1.2 bil. |

| Bruce Highway (Cooroy to Curra) Section D, construction | Opened in October 2024. | 2024 | $1.2 bil. |

| Beerburrum to Nambour Rail Upgrade (Stage 1) | Finalisation of design and procurement in progress, construction due to start 2025. | 2027 | $1 bil. |

| Pacific Motorway, Daisy Hill to Logan Motorway, funding commitment | Subject to a business case addendum and further approvals. | TBD | $1 bil. |

| Gateway Motorway, Bracken Ridge to Pine River upgrade | Procurement for design and construction has commenced. | TBD | $1 bil. |

| Inland Freight Route (Charters Towers to Mungindi), funding commitment | Early works package underway. Program details for the remaining funding for delivery are being developed consistent with the overarching Inland Freight Route investment strategy. | 2033 | $1 bil. |

| Bruce Highway (Brisbane to Gympie), Gateway Motorway to Dohles Rocks Road upgrade (Stage 1) | Procurement for design and construction has commenced. | TBD | $948 mil. |

| Pacific Motorway, Eight Mile Plains to Daisy Hill upgrade | Construction in progress for Packages 3 and 4. | 2025 | $750 mil. |

| Bruce Highway (Brisbane to Gympie), Anzac Avenue to Uhlmann Road upgrade, funding commitment | Detailed design and early works activities to commence. | TBD | $733 mil. |

| Clapham Yard Stabling (Moorooka), construct stabling yard5 | Construction in progress. | 2026 | $532 mil. |

| New Gold Coast Stations (Pimpama, Hope Island, and Merrimac) | Construction in progress. | 2026 | $500 mil. |

| Energy and Climate8 | |||

| Borumba Pumped Hydro Energy Storage6 | Early works commenced. | 2030 | $14.2 bil. |

| CopperString 20327 | Early works under Delivery Launch Package. | 2029 | $5 bil. |

| Lotus Creek Wind Farm | Construction phase. | 2026 | $1.3 bil. |

| Central Renewable Energy Zone9 Battery | Construction phase. | 2027 | $747 mil. |

| SuperGrid Stage 1: Borumba to Woolooga10 | Early works. Project development is in progress after revised project scope report received due to changes from 500kV to 275kV. | 2031 | $682 mil. |

| Brigalow Hydrogen-ready Gas Peaking Plant11 | Early planning works. Site mobilisation is expected to commence in early 2025. | 2026 | $642 mil. |

| SuperGrid Stage 1: Halys to Borumba10 | Early works. Project development is in progress after revised project scope report received due to changes from 500kV to 275kV. | 2030 | $593 mil. |

| Southern Renewable Energy Zone9 Battery | Construction phase. | 2025 | $514 mil. |

| Queensland Health | |||

| Capacity expansion program – rest of program12 | The following projects have moved into Stage 2 with construction begun at Logan Hospital Expansion Stage 2, Princess Alexandra Hospital Expansion, QEII Jubilee Hospital Expansion, Cairns Hospital Expansion, and Ipswich Hospital Expansion. Remaining projects are in Stage 1 (design and early works). Hervey Bay Hospital Expansion has also commenced construction. | 2028 | $7.4 bil. |

| Capacity expansion program – New Toowoomba Hospital | Managing contractor underway with early works procurement and piling works progressing. | 2027 | $1.3 bil. |

| Capacity expansion program – New Coomera Hospital | Managing contractor underway with early works and progressing well on site. Design has progressed beyond 80 per cent. | 2027 | $1.3 bil. |

| Capacity expansion program – New Bundaberg Hospital | Managing contractor awarded Stage 1 with design underway. Site mobilisation activities commenced following environmental approvals. Main construction commencement awaits approval of an offset management plan and agreement of value-for-money GCS13 sum to progress to Stage 2. | 2027 | $1.2 bil. |

| Queensland Corrective Services | |||

| Lockyer Valley Correctional Centre | Major construction is complete, commissioning has commenced. | 2025 | $880 mil. |

| Regional Development, Manufacturing and Water | |||

| Fitzroy to Gladstone Pipeline | Construction underway. | 2026 | $983 mil. |

| Youth Justice | |||

| Woodford Youth Detention Centre – 80-bed construction project | Construction underway. | TBD | $627 mil. |

| Games Venue and Legacy Delivery Authority | |||

| Upgrades to Queensland State Athletics Centre (QSAC)14 | Planning is paused. | 203015 |

$2.7 bil. |

| Upgrades to Gabba Stadium14 | Planning is paused. | 202615 | |

| Upgrades to Suncorp Stadium14 | Planning is paused. | 202615 | |

| Brisbane Arena14 | Joint business case underway. | 2031 | $2.5 bil. |

| Minor Venues Program | Project validation report progressively being finalised. Procurement activities have begun for some projects within the program. | Staged from 202816 | $1.9 bil. |

Notes:

- The Delivery Authority is working with its delivery partners to assess the impacts of ongoing industrial actions, market conditions, and contractor performance issues. A revised completion date and budget have not yet been announced due to these challenges.

- The Coomera Connector is a proposed 45-kilometre motorway that will connect Logan City with the Gold Coast. In March 2024, the previous Minister for Transport and Main Roads and Minister for Digital Services released a media statement detailing a budget increase of $864 million was needed to complete Stage 1. In May 2024, the Australian Government released a media statement confirming it would fund half of this budget increase, $431.7 million, for Stage 1. Stage 1 of the Coomera Connector is expected to progressively open to traffic in sections from late 2025.

- The European Train Control System is a train signalling system.

- The Gold Coast Light Rail (Stage 3), Broadbeach South to Burleigh Heads project budget increased from $1.22 billion to $1.55 billion on 30 September 2024.

- A stabling yard is used to store, clean, and maintain trains.

- Pumped hydro energy storage uses 2 water reservoirs at different elevations to generate and store energy. In December 2024, the Treasurer, Minister for Energy and Minister for Home Ownership announced a $4 billion budget increase for the project, raising the total to over $18 billion. They also noted that the final completion date will be delayed.

- This is a transmission line from Townsville to Mount Isa. The final budget has yet to be determined.

- The capital statement includes $1 billion of equity for Pioneer-Burdekin early works, which is not shown in the table above.

- Renewable energy zones are areas where renewable energy sources, such as wind and solar, can be developed efficiently.

- The SuperGrid Stage 1 project will link the future Borumba Pumped Hydro Project to 2 points in the Queensland grid: Woolooga in the north, and Halys in the south-west. The high voltage transmission connection to Halys will be 106 kilometres long and the link to Woolooga will be 90 kilometres long. The project is expected to be finished when the Borumba Dam Pumped Hydro project starts operating.

- The Brigalow Peaking Power Plant is a 400-megawatt natural gas power station expected to be operational mid-2027.

- As part of the June 2024–25 state budget process, $1 billion of additional funding was provided to the Capacity expansion program to support revised cost estimates and allow projects to engage the major contractor for delivery.

- Guaranteed Construction Sum (GCS) represents an offer by the managing contractor to deliver the project, and includes a project brief, time frames for completion, and cost information.

- The Queensland State Athletics Centre and refurbishment of the Gabba Stadium, Suncorp Stadium redevelopment, and Brisbane Arena are identified in the capital statement and included in the budget but not listed in the capital outlays by entity. All projects are being delivered by the Games Venue and Legacy Delivery Authority once an investment decision has been made. Funding for Brisbane Arena by the Australian Government is capped at $2.5 billion.

- Completion dates for these projects are subject to scope and staging of works around event schedules at operational sites.

- While most of the Minor Venues Program projects are planned to be completed from 2028, minor upgrades to existing competition and training venues may be undertaken closer to the Brisbane Games. The Minor Venues Program includes venues such as the Chandler Indoor Sports Centre, Sunshine Coast Indoor Sports Centre, and Sunshine Coast Stadium.

TBD – To be decided.

Compiled by the Queensland Audit Office from the 2024–25 capital statement for various state government entities.

Significant rail projects are underway in Queensland

Several rail projects are underway in Queensland, including the Direct Sunshine Coast rail line, Logan and Gold Coast Faster Rail faster rail, Queensland Train Manufacturing Program, and the Gold Coast Light Rail project.

Direct Sunshine Coast Rail Line (Stage 1), funding commitment

The plan for the Direct Sunshine Coast Rail Line, announced in February 2024, is for a 37.8-kilometre dual-track rail line running from the North Coast Line at Beerwah to Maroochydore, via Caloundra and Birtinya.

The first stage includes 19 kilometres of dual track built from Beerwah to Caloundra and is expected to cost between $5.5 billion and $7 billion. Stage 1 is funded equally by the Australian and Queensland governments, who have each committed $2.75 billion.

The business case was completed in December 2023 and the project is currently in the design development and pre-procurement phase. Construction is expected to begin in 2026.

Logan and Gold Coast Faster Rail

The Logan and Gold Coast Faster Rail project is expected to deliver more frequent and reliable train services between Brisbane, Logan, and the Gold Coast by:

- doubling the number of tracks between Kuraby and Beenleigh

- modernising rail systems

- upgrading stations

- removing level crossings.

As published in the 30 June 2024 capital statement, the Australian and Queensland governments will contribute $2.875 billion each for the project.

In September 2024, delivery contracts were awarded for:

- the Loganlea Station Relocation Project

- the Logan and Gold Coast Open Level Crossing Removals Package.

The contract award for the remaining Logan and Gold Coast Faster Rail Package was expected to be announced in late 2024 or early 2025, subject to government approvals. Construction is expected to start in 2025.

Queensland Train Manufacturing Program

In June 2023, the Department of Transport and Main Roads signed a $4.6 billion Design Build Maintain (DBM) contract with the Downer Group for the construction of 65 passenger trains, including a maintenance facility, stabling, and an initial 15 years of maintenance. This contract was part of the $7.1 billion announced in the 2022–23 Queensland state budget once the project’s business case was completed.

In June 2023, the estimated total project cost increased to $9.5 billion due to factors such as an increased scope and escalations in the costs of external labour and supplies after the tender process.

The additional scope of the Queensland Train Manufacturing Program, outside of the DBM contract, will be undertaken by the state and includes stabling roads and test track, and a further 20 years of operation and maintenance beyond what is included in the contract with Downer.

In late 2023, major construction works began at both the manufacturing facility and rail facility sites. The manufacturing facility is expected to be completed by late 2025, and the Ormeau rail facility is expected to be constructed by late 2026. Work on manufacturing trains is expected to start in late 2025, with the first train planned to be manufactured and ready for testing by late 2026, and all trains expected to be in service by 2032.

Gold Coast Light Rail (Stage 3)

The Gold Coast Light Rail is being delivered in stages. The dual-track system is currently more than 20 kilometres long and has 19 stations from Helensvale to Broadbeach South, with Stage 3 underway and Stage 4 in its early planning stages.

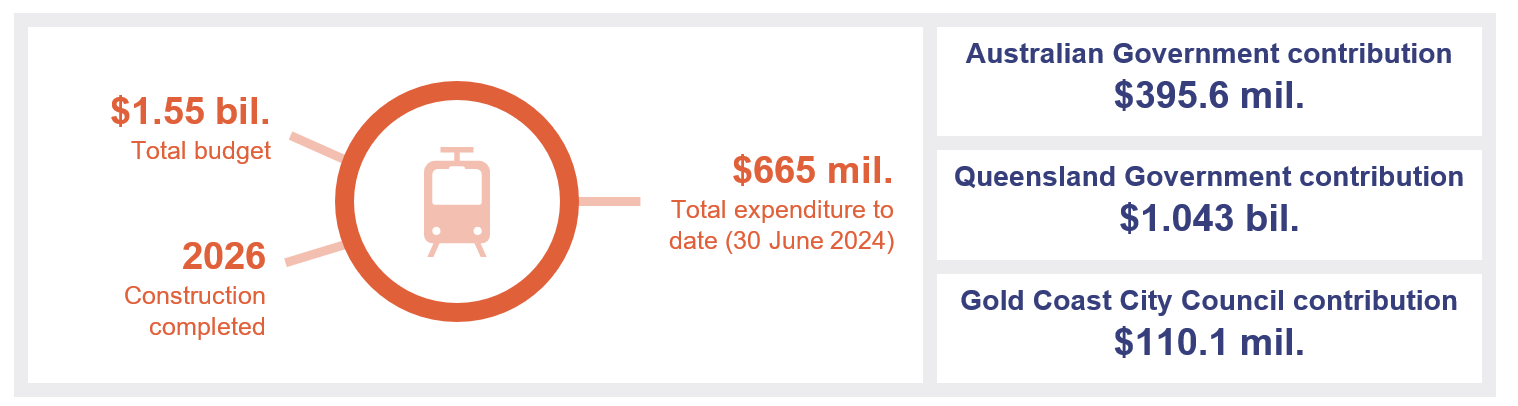

The Gold Coast Light Rail Stage 3 project provides a 6.7-kilometre extension south of the existing tram network, to link Broadbeach South and Burleigh Heads. The project also includes 8 additional stations, 5 new light rail vehicles, upgrades to the existing Southport depot and stabling facilities, and new light rail/bus connections at Burleigh Heads and Miami. All 3 levels of government are contributing funding towards the project.

On 28 March 2022, the Department of Transport and Main Roads entered into a contractual arrangement with GoldlinQ (the light rail consortium) and its chosen design and construction contractor, John Holland.

On 30 September 2024, the Department of Transport and Main Roads increased the budget for the Gold Coast Light Rail Stage 3 project by approximately $330 million, from $1.219 billion to $1.549 billion. Completion of the project has also been delayed to mid-2026.

Compiled by the Queensland Audit Office.

Gold Coast Light Rail (Stage 4) planning

The Gold Coast Light Rail Stage 4 project will be a 13-kilometre extension south of the Light Rail Stage 3, linking Burleigh Heads to Coolangatta via the Gold Coast Airport. The project also includes 14 additional stations, 8 new light rail vehicles, a new stabling facility and satellite depot, as well as ongoing maintenance of 2 northbound and southbound traffic lanes on the Gold Coast Highway.

Stage 4 is currently in the early planning stages, with $30 million of funding allocated and jointly funded by the Queensland Government and Gold Coast City Council to date for work on the detailed business case. This is expected to be completed by late 2025.

A preliminary business case for Stage 4 has indicated a cost estimate of $4.5 billion. The total range of the estimate is between $3.1 billion and $7.7 billion, depending on finalisation of the detailed business case.

Infrastructure Australia progressed the project to Stage 2 Potential Investment Options on the Infrastructure Priority List following review of the preliminary business case.

Queensland continues its significant investment in energy

Queensland continues to invest in energy through the $62 billion Queensland Energy and Jobs Plan,with planned capital expenditure of $26 billion over the 4 years to 2027–28 – an increase from $19 billion over the 4 years to 2026–27.

The plan aims to deliver a Queensland ‘SuperGrid’ and a 50 per cent renewable energy target by 2030, 70 per cent by 2032, and 80 per cent by 2035. These renewable targets were legislated under the Energy (Renewable Transformation and Jobs) Act 2024, which was passed on 18 April 2024. The Act also established the governance and advisory functions of the plan.

Queensland Energy and Jobs Plan: The state's pathway to transforming the energy system over the next 10 to 15 years to deliver clean, reliable, and affordable power.

SuperGrid: This represents all the elements of an electricity system – including the poles, wires, infrastructure for solar and wind generation, and storage – to provide clean, reliable, and affordable power.

The 2024–25 capital program commits over $4.1 billion (up from $1.3 billion – a 215 per cent increase from 2023–24) as part of the Queensland Energy and Jobs Plan, including several key investments in developing the Queensland SuperGrid, such as:

CopperString 2032: Delivered by Powerlink (the energy transmitter in Queensland), this project is expected to deliver over 1,100 kilometres of transmission line from Townsville to Mount Isa, connecting Queensland’s North West Minerals Province (centred around Mount Isa and Cloncurry) to the national electricity grid. In 2024–25, Powerlink is investing $712 million to continue delivery of the project. This is part of the $1.3 billion funding approved in October 2023 by the state government to advance construction of the project. The total cost of the project was originally estimated to be $5 billion. In September 2024, the previous Minister for Resources and Critical Minerals released a media statement detailing that the cost of the CopperString project was $6.2 billion. The final budget is yet to be determined. In 2024, construction began on the workers’ accommodation facilities in Hughenden and Richmond (capable of housing 620 workers), as well as on ordering equipment and designing the asset. Powerlink expects the CopperString project to be completed by 2029. | |

Borumba Pumped Hydro Energy Storage: A 2-gigawatt pumped hydro energy storage project located at Lake Borumba, west of the Sunshine Coast, is being delivered by Queensland Hydro. In June 2023, the Queensland Government announced $6 billion in funding to progress this, with the total project cost estimated to be $14.2 billion. The government has budgeted $935.9 million to be spent in 2024–25 on this project. Early works are underway onsite while Queensland Hydro seeks regulatory approvals, with the environmental impact statement approvals expected by late 2025. | |

| Wind farms: Several wind farms are being delivered by Queensland energy entities such as CS Energy and Stanwell. These wind farms are located across Queensland at Lotus Creek (north-west of Cairns), Boulder Creek (south-west of Rockhampton), Wambo (north-west of Dalby), and Tarong. For 2024–25, over $1.4 billion of expenditure is included in the budget to continue development of these wind farms. | |

Network batteries: Multiple Queensland energy entities are developing network batteries for large-scale energy storage. These will be located at Stanwell Power Station, Swanbank, Greenbank, and other locations (not yet specified) across Queensland. For 2024–25, over $1 billion of expenditure is included in the budget for development of the batteries.

|

Planning for the Games venues and villages is continuing

Queensland will host the Brisbane 2032 Olympic and Paralympic Games (the Games), which promises to be a significant event for both Queensland and Australia.

As part of our Forward work plan 2024–27, we included an audit for tabling in December 2024 on preparing for the Brisbane Games. It will be the first of a series of reports on the Games. This report examines the effectiveness of the governance and planning for the Games, including progress on the venues and villages.

Brisbane Metro is nearing completion

Delivery of the $1.6 billion Brisbane Metro began in late 2021. It will transform 21 kilometres of existing busway into a high-frequency rapid transit system, connecting Eight Mile Plains and Roma Street, and the Royal Brisbane and Women’s Hospital and the University of Queensland.

It will feature 18 stations, 11 of which will be interchange stations linking the metro to bus routes, with 2 linking to Cross River Rail stations. The project will also deliver a new fleet of 59 all-electric high‑capacity metros (battery-electric vehicles).

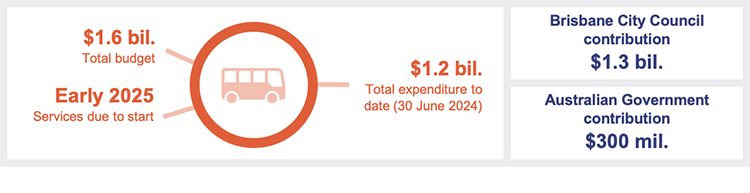

Figure 2G provides a snapshot of the Brisbane Metro, including total funding, the contribution of the Australian Government and Brisbane City Council to the budget, and expenditure as of 2024.

Compiled by the Queensland Audit Office.

Budget and current progress

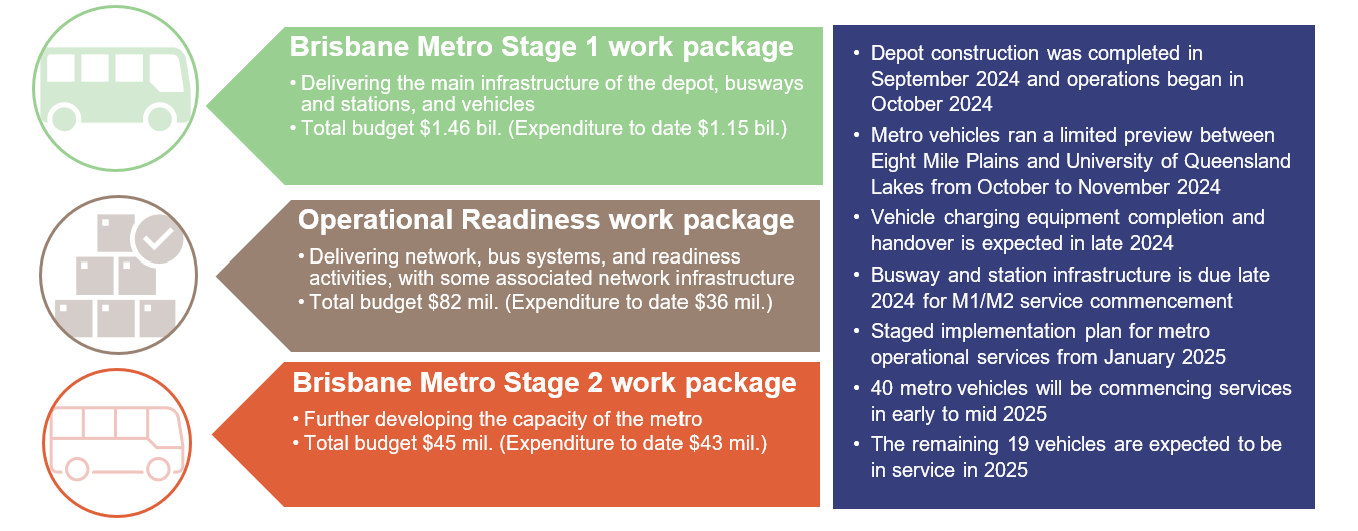

Figure 2H provides information on activities under each of the 3 work packages of the Brisbane Metro project, as well as the total budgeted and actual expenditure as of 30 June 2024.

Expenditure to date across the work packages increased from $790 million in 2022–23 to $1.233 billion in 2023–24. There has been a budget increase for the Stage 1 work package of approximately $18 million and budget decrease of $18 million for the Operational Readiness and Stage 2 work packages.

Brisbane City Council estimates that the remaining cost to complete all 3 work packages will be $353 million. This is expected to be spent in the 2024–25 and 2025–26 financial years.

This is in line with the progress of the project as outlined in Figure 2H, which shows when milestones are due to be reached. These include completion of the busway and station infrastructure, commissioning of the system, and start of busway testing and training.

Compiled by the Queensland Audit Office from the Brisbane City Council project budget.

Construction works for the project began in late 2021. The construction of the Brisbane Metro depot, originally planned for December 2023, was completed in September 2024. Operations of the depot commenced in October 2024. The depot has 65 chargers installed, including 5 fast chargers, more than 2,300 solar panels, and onsite maintenance and staff facilities.

In October 2024, Brisbane City Council commenced a ‘limited preview’ of passenger services for Brisbane Metro vehicles and infrastructure for the route between Eight Mile Plains and University of Queensland Lakes. These metro services were discontinued in November 2024, with the route services continuing using the existing bus network.

In December 2024, Brisbane City Council announced that metro operational services for the main routes of Metro 1 (M1) and Metro 2 (M2) are expected to commence in a staged implementation plan. M2 from University of Queensland Lakes to Royal Brisbane and Women's Hospital is expected to commence passenger services in January 2025, with M1 from Eight Mile Plains to Roma Street expected to commence in mid-2025. These routes primarily replace existing bus routes.

Following a successful pilot metro (battery-electric vehicle) test in 2022, Brisbane City Council placed an order for an initial 59-vehicle fleet. As of October 2024, 21 vehicles have been accepted and are owned by council, 9 vehicles are undergoing final fit-out or pre-acceptance testing, 5 vehicles are in transit, 7 vehicles are being manufactured in Europe, and the manufacturing of 17 vehicles has yet to start.

Brisbane Metro – Woolloongabba Station funding commitment

In March 2022, as part of the South East Queensland City Deal, the Australian Government, Queensland Government, and Brisbane City Council announced a funding commitment of $450 million for a new Brisbane Metro – Woolloongabba Station. The Department of Transport and Main Roads is working with project partners to complete planning for the Brisbane Metro – Woolloongabba Station. This includes defining the project scope and investigating engineering options, project costs, risks, benefits, and procurement strategies to determine a preferred option for delivery.

Planning completed to date has informed decisions regarding the project. The detailed business case will be submitted to the Australian Government, Queensland Government, and Brisbane City Council for consideration and to inform next steps.

Lessons learnt from other major infrastructure projects

Several significant projects are underway across Queensland to support economic growth, the transition to renewable energy, and Queensland’s growing population.

Given the scale and importance of these projects, it is crucial for agencies to learn from the experiences of past projects. This can provide valuable guidance for the planning and execution of current and future capital projects.

Insights from major infrastructure projects, locally and internationally, highlight the importance of strong governance, cost monitoring, and adherence to project timelines. Below are key learnings for agencies, some of which were previously shared in the report Transport: 2018–19 results of financial audits (Report 5: 2019–20).

The importance of strong governance arrangements

Effective oversight and governance are crucial in managing capital projects to ensure resources are allocated efficiently and align with community needs. Public trust can be eroded if agencies do not effectively monitor and evaluate their activities, or if they lack effective risk management strategies.

Queensland is currently delivering one of the largest capital programs in the country, with many individual projects significantly larger and more complex than those undertaken in the past. Figure G1 in Appendix G for key considerations for agencies in developing robust governance arrangements.

Agencies need to manage their costs effectively

Unexpected cost increases are continuing to pose a significant challenge to delivering capital projects across Australia. Since 2022–23, the estimated actual expenditures on capital projects in Queensland have been, on average, 15 per cent higher than the budgeted expenditures.

Cost pressures place significant demands on agencies and their project contingencies (the funds set aside to cover unexpected costs). This often requires them to make difficult decisions about the quality and scope of the infrastructure they ultimately deliver.

Effective management of project budgets, timelines, and their contingencies is essential to navigating these challenges and ensuring that vital projects meet both budgetary constraints and community expectations. Figure G2 in Appendix G highlights key considerations for agencies in effectively managing their project costs.

Effective project management can help deliver infrastructure on time

Effectively managing project timelines is crucial for long-term infrastructure projects. These projects often face fixed completion dates and evolving challenges such as technological developments, regulatory changes, and shifting stakeholder expectations.

Effective timeline management not only optimises the use of resources but also helps mitigate cost overruns and scope changes. Conversely, inadequate project management can lead to compressed timelines. This can mean higher costs, rushed decision-making, and infrastructure that falls short of its potential. Figure G3 in Appendix G highlights key considerations for agencies in effectively managing their projects.

3. Ensuring accountability for Queensland’s major projects

Public sector entities are responsible for exercising diligence and care in their decision-making to uphold accountability and transparency. Clear guidelines and strong business processes help agencies meet these standards, ensuring decisions are defensible and financial statements are accurate.

This chapter outlines ongoing issues in procurement decisions and challenges in accounting for asset transfers within public sector agencies, and the need for more comprehensive and consistent information on capital projects.

Public sector entities need to strictly manage conflicts of interest when making procurement decisions

Given the significant amount of money involved in delivering infrastructure projects, it is critical that public sector entities strictly comply with the principles of the Queensland Procurement Policy 2023. This is particularly the case when managing conflicts of interest. If entities do not comply with the policy, their procurement decisions may not withstand scrutiny and may not be in the best interests of the entity or the public.

We continue to recommend agencies strengthen their practices, including improving how they manage conflicts of interest and conduct value-for-money assessments.

Agencies need better coordination for asset transfers

Assets owned by one government agency may be transferred to another. This generally happens:

- through a machinery of government change (when the government decides to change how agencies are structured)

- where the asset is constructed by one agency and transferred to the agency who is responsible for its ongoing operation and maintenance.

Typically, asset transfers between 2 state government agencies are made by ‘adjusting their equity’, which results in an increase of assets for the receiving entity and a decrease for the transferring entity.

Under asset transfers by equity, the transfers represent only a change of ownership, meaning there are no revenues or expenses for either party and no impact on their financial results.

For the transfer to be adjusted through equity, agencies need to meet specific requirements set out in the Queensland Financial Reporting Requirement (FRR) 4F Equity, Contributions by Owners and Distributions to Owners. This includes obtaining government approval (generally from the relevant ministers) through a formal equity designation, or under supporting legislation (the Public Sector Act 2022 in the case of a machinery of government change). The designation should indicate that the transfer is through equity and ensure approval is obtained at or before the transfer takes place.

If these requirements are not met, agencies cannot treat the transaction as equity. Instead, the receiving agency will record revenue, and the transferring agency will record an expense on transfer. Given the often significant value of assets being transferred, this could distort the operating results of the respective agencies.

Machinery of government change: The formal transfer of functions from one agency (usually a department) to another. This is done through departmental arrangements notices, which are published in the Government Gazette.

Equity: Represents the net worth of an entity (remaining value of assets of an entity after paying off its debts). This includes funds or assets that the owners (government) have contributed to or invested in the entity.

Financial reporting requirements: These are minimum reporting requirements issued by Queensland Treasury that departments and statutory bodies need to follow in preparing annual financial statements.

Formal equity designation: A document that confirms the transfer of assets/liabilities between agencies showing contributions made by the owners. The responsibility for the designation lies with the agency transferring the assets, not the agency receiving them.

Enduring equity designation: A formal designation that identifies future asset transfers between agencies are to be adjusted through equity. This applies to a series of expected transfers over a longer period of time.

Operational control: The authority and responsibility to manage and use an asset, including decisions about its operations and maintenance. It is usually held by the agency using or managing the asset.

Control of an asset: The right to benefit from an asset and decide how it is used. It follows accounting rules to decide when an asset should be recorded in financial statements.

The Cross River Rail Delivery Authority (the Delivery Authority) leads the planning, construction, and transfer of complex infrastructure assets for the Cross River Rail (CRR) project. This includes designing, constructing, and delivering critical assets such as rail stations, tunnels, and other infrastructure. Over the life of projects like CRR, operational management and control of assets periodically pass from one entity to another.

During the year, there was a difference of opinion between the Delivery Authority (the delivering agency) and Queensland Rail (the receiving agency) regarding when control of certain assets were transferred.

The Delivery Authority viewed control as transferring once construction was complete and the assets were operationally ready, referred to as ‘operational control’, considering the physical handover as the point at which Queensland Rail assumes responsibility and risk.

In contrast, Queensland Rail believed control should only be recognised after final inspections, verification of operational readiness, and formal acceptance of the assets, with an emphasis on aligning accounting control with operational responsibility to avoid early recognition in their financial statements.

To ensure asset transfers are timely and there is alignment between the operational transfer of the assets and the intended financial reporting impact, agencies should collaborate early on the transfer process, determine when control of an asset is expected to transfer, obtain the appropriate approvals, and establish clear governance structures to oversee the whole process.

This is especially important as large-scale projects are expected to drive an increase in asset transfers through major projects, highlighting the need for proactive planning and alignment across agencies to manage the complexity and volume of transfers efficiently.

The Queensland FRRs prescribe the rules for how agencies account for asset transfers through equity. Where future asset transfers are anticipated, the FRRs allow for an enduring equity designation to be granted. This provides the authority for agencies to recognise future asset transfers via equity for accounting purposes.

Agencies may benefit from Queensland Treasury considering whether additional guidance can be provided to emphasise the importance of operational, legal, and financial teams working together early to ensure all important milestones are accurately recorded to appropriately account for asset transfers.

| Relevant agencies should work together better to ensure all legal, accounting, and operational aspects of asset transfers are considered early and agreed prior to the transfer |

1. We recommend that agencies involved with future asset transfers implement appropriate governance arrangements to ensure that:

2. We recommend that Queensland Treasury consider whether additional guidance can be provided to better assist agencies in understanding their responsibilities for asset transfers and the issues they may need to consider in discharging their responsibilities. |

The government needs to provide more information on capital projects

The capital statement presents an overview of proposed capital outlays by each agency, as well as a summary of the government’s approach to providing infrastructure. In Major projects 2023 (Report 7: 2023–24), we highlighted the need for the government to provide more information on capital projects within the capital statement.

We identified a lack of consistency in the naming of projects and programs between budget years, and in the presentation of projects or programs. This may make them difficult to compare. We also noted that the capital statement does not indicate the estimated project completion dates or categorise whether projects are new, ongoing, or completed.

In reviewing the 2024–25 capital statement, we identified similar inconsistencies in the naming of projects. We also made findings relating to disclosures of the total estimated costs of projects. Agencies have taken some corrective action on our recommendations from last year. Appendix F provides the full recommendation and status as of 30 June 2024.

Naming of projects and programs

Preparing capital statements is common practice in all Australian states and territories. In Queensland, the requirements for what needs to be included in the capital statement is detailed in Queensland Treasury’s guidelines, Capital Statement – Guidelines for Agencies, as well as the Capital Program Portal – BP3 Module user guide.

These guidelines require agencies to name projects and programs in a self-explanatory manner, provide an appropriate level of context for the reader, and strive for consistency with other publications.

We have, however, found instances of projects significantly changing in scope, but retaining the same project name in current and prior capital statements. This makes it difficult for readers to identify and monitor projects across years.

Presenting projects and programs

The capital statement guidelines require agencies to disclose the total estimated cost for each project or program of works. This amount represents the total expenditure to 30 June, the allocated expenditure budget for the current year, and the remaining budgeted expenditure.

If a project or program of works is an ongoing expenditure for the agency, the agency does not present a total estimated cost; it only discloses the total expenditure for the budget year.

If the project has a defined budget that spans multiple financial years, it is expected that the total estimated cost will reflect the approved budget. We have identified inconsistencies between prior and current year capital statements for disclosures of total estimated costs for projects.

This lack of consistency makes it difficult for readers to understand the total cost of a project. For example:

In 2023–24, Central Queensland renewable projects was presented in the capital statement with a total estimated cost of $500 million. Of this, $229 million was expected to be spent by 30 June 2024, and the remaining amount was to be spent after the 2023–24 financial year. In the 2024–25 capital statement, the total estimated cost of the project was removed and the project was changed to being presented as an ongoing program of work. This means the estimated cost of $500 million was no longer presented. No further commentary was included in the capital statement to note the adjustment in the presentation of this amount, reducing transparency regarding the total cost of the project. |

The absence of clear guidelines for agencies on how to report changes to the total estimated cost can lead to inconsistencies. It also makes agencies’ total capital expenditure unclear.

4. Progress of the Cross River Rail project

The Cross River Rail (CRR) project is being delivered by the Cross River Rail Delivery Authority (the Delivery Authority).

The project will deliver a 10.2-kilometre rail line that includes 5.9 kilometres of twin tunnels running under the Brisbane River and central business district. It also includes 4 new underground stations, one new station, and 7 rebuilt aboveground stations.

In March 2023, the capital budget for the CRR project increased by $960 million to $7.848 billion due to supply chain issues and rising material and labour costs. This budget includes funding for the Tunnel, Stations and Development (TSD), and Rail, Integration and Systems (RIS) work packages; and for other works such as station upgrades and land acquisitions.

As a result of these supply chain and market challenges, major construction works were extended from 2024 to 2025, and the formal opening date delayed. The Delivery Authority has not yet announced the revised expected opening date or provided a revised budget due to ongoing delivery challenges.

Cross River Rail faces ongoing delays and cost increases

During 2023–24, the CRR project experienced challenges due to ongoing market pressures, including rising material and labour costs, a tight labour market for skilled workers, supply chain uncertainties, and lower productivity due to industrial actions. These challenges have significantly impacted the project’s progress and are expected to continue to do so. Efforts are underway to address these issues, but the full extent of their impact on the project timeline and budget is still being assessed, with further delays or cost increases likely.

As of 30 June 2024, $6.8 billion has been spent on the project, which is $237 million over the original budget. The 2023–24 budget did not include payments negotiated for TSD (after the budget was submitted), which were included in the $960 million increase approved for the CRR project.

In response to some of these challenges, the Delivery Authority and Pulse (the delivery partner for TSD) amended the TSD construction contract to revise project milestones and payment schedules, allowing the contractor to meet its obligations within a revised timeline, while negotiations continue for further changes.

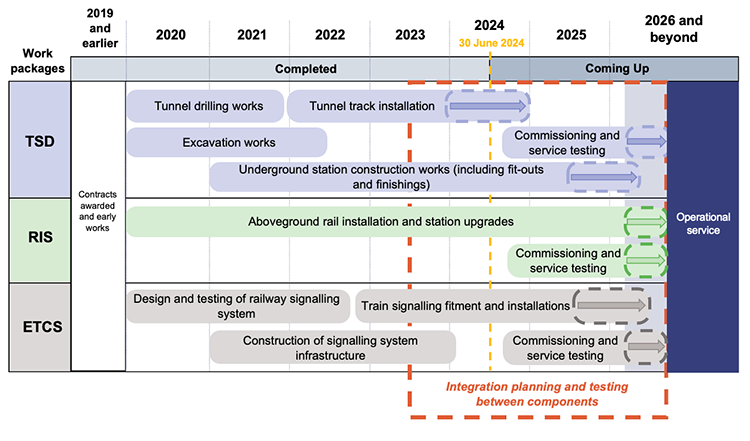

Figure 4A outlines the progress of the CRR project as of 30 June 2024, and the revised project timelines based on the integrated delivery program implemented in 2023.

Notes: TSD – Tunnel, Stations and Development; RIS – Rail, Integration and Systems; ETCS – European Train Control System. Refer to Figure D1 in Appendix D for the project details.

Compiled by the Queensland Audit Office from Cross River Rail Delivery Authority management reports.

Project milestones achieved during the year

While Figure 4A indicates that timelines for each package have shifted, the Delivery Authority made progress on all major work packages in 2023–24.

Below ground, it installed mechanical and electrical systems, communications equipment, escalators, elevators, and platform screen doors. The first train, initially set to run through the tunnel to Roma Street station in May 2024, completed testing in September 2024.

Above ground, it handed over the Fairfield and Yeronga train stations to Queensland Rail. It also handed over Rocklea station in July 2024. The Delivery Authority also continued rebuilding Yeerongpilly and Dutton Park stations and constructing Exhibition station.

For the ETCS package, progress was made in testing and fitting signalling systems onto trains during the year.

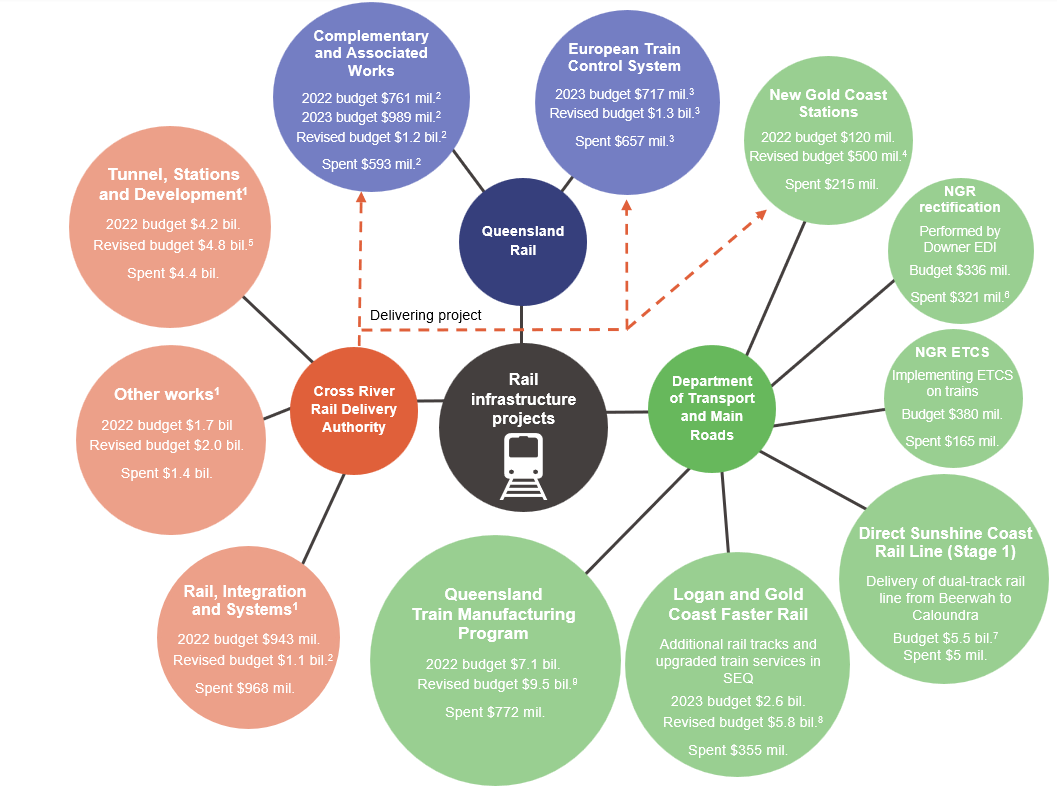

Additional funding for Cross River Rail-associated projects

The Delivery Authority is also delivering several related projects for the Department of Transport and Main Roads and Queensland Rail. These include upgrading train stabling yards, bridges, and stations (funded by Queensland Rail as part of the Complementary and Associated Works package); implementing the rail signalling system (the European Train Control System project, also funded by Queensland Rail); and constructing the Pimpama, Hope Island, and Merrimac stations on the Gold Coast (the New Gold Coast Stations project).

In June 2024, the Queensland Government announced additional funding of $554 million for the European Train Control System project. The funding will be used to cover cost increases from ongoing market pressures and to support an expanded scope of works.

The extra scope includes installing equipment further south to Moorooka, enhancing cyber security and readiness for operations, supporting integration with the Cross River Rail project, replacing ageing rail assets, and exploring the use of the same signalling system in other projects outside of the CRR.

As part of the broader SEQ Rail Connect (which is a strategy to deliver an integrated transport network in the South East Queensland (SEQ) region), other rail infrastructure projects are being planned to complement and support the CRR.

These include building new generation trains, a train manufacturing facility in Torbanlea, a rail facility in Ormeau, and new tracks and rail systems in South East Queensland, and deploying new signalling systems on more trains.

Figure 4B outlines all projects, their funding sources, budget increases, and expenditure to date.

Notes:

- The Cross River Rail Delivery Authority capital budget for the Cross River Rail project (including private finance) is $7.848 billion.

- The total budget for the Rail, Integration and Systems work package is $2.3 billion, with Queensland Rail funding $1.2 billion and the Delivery Authority funding $1.1 billion. The revised budget relates to additional works for Clapham Yard Phase 3. These balances have been sourced from Cross River Rail Delivery Authority reports, and there may be minor differences in spend due to accounting treatment.

- In 2024, the Queensland Government announced additional funding of $554 million for the European Train Control System work package, bringing the total budget to $1.3 billion funded by Queensland Rail. This amount includes $47 million previously allocated to the Delivery Authority, but unspent. These balances have been sourced from Cross River Rail Delivery Authority reports, and there may be minor differences in spend due to accounting treatment.

- The total budget for New Gold Coast Stations is $500 million, with the Department of Transport and Main Roads funding $427 million, and Queensland Rail funding $73 million.

- In 2023, the state committed additional funding of $530 million for the Tunnel, Stations and Development work package.

- In 2024, the New Generation Rollingstock (NGR) rectification program was completed, with all 75 NGR trains modified with accessibility upgrades.

- The Direct Sunshine Coast Rail Line (Stage 1) will deliver a 19-kilometre dual-track rail line, including one upgraded station and 2 new stations, from Beerwah to Caloundra. The first stage is expected between $5.5 billion and $7 billion.

- In 2024, the total budget for the Logan and Gold Coast Faster Rail was increased from $2.6 billion to $5.75 billion, funded equally by the Australian and Queensland governments.

- This represents the revised budget for the Queensland Train Manufacturing Program, following the completion of a tender process in 2023. The 2024–25 capital statement includes a component of this overall budget, being $4.9 billion for the manufacturing phase.

All budgets for major projects include a contingency to allow for any construction risks to be addressed as they arise. For the CRR project, this is included in the Other works revised budget of $2 billion. As of 30 June 2024, the contingency for the CRR project remained within budget.

Compiled by the Queensland Audit Office.