Overview

In providing community services, the government may use debt to fund initiatives, such as investment in clean energy infrastructure, and entities may hold investments to fund future programs or obligations. The government undertakes several activities to manage its debt and the state's credit rating, as well as the profile of investments it holds.

Tabled 6 March 2024.

Report on a page

This report examines how the Queensland Government is managing its debt and investments, and reports on some recent transactions relating to these. It also discusses risks associated with the debt and investments and how government entities respond to these risks.

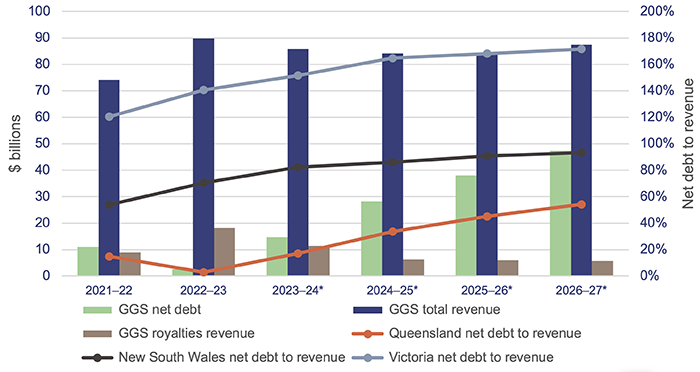

Net debt levels are expected to increase in future years

In 2022–23, net debt (financial liabilities minus financial assets) decreased, as it did last year. Favourable economic conditions, particularly higher revenue from the royalties that companies pay for mining coal, meant the government borrowed less than it budgeted for in 2022–23.

The government has budgeted $96 billion for capital expenditure over the next 4 years to deliver a variety of infrastructure in energy, transport, health, education, and water management. So, as revenue from royalties reduces and debt is used for significant government initiatives, net debt is expected to increase.

Investments have been volatile in recent years

The government invests mainly to help fund future financial obligations. In recent years, the economic impacts of COVID-19 and other events, such as the war in Ukraine, have caused additional volatility across investment portfolios. However, there has been a slight increase in the fair value of investments (the price at which they could be sold) in 2022–23 due to stronger investment returns (compared to 2021–22).

The value of the Debt Retirement Fund has increased

The government established the Queensland Future Fund – Debt Retirement Fund in 2020–21. It holds a diversified portfolio of investments. This includes a 22 per cent investment in the QIC Registry Trust, which is the holder of the investment in the Queensland Titles Registry (which trades under the name Titles Queensland).

In 2022–23, the fund received earnings from its investments. The value of the fund has increased from $7.718 billion as at 30 June 2022 to $8.336 billion as at 30 June 2023.

The Housing Investment Fund has been expanded

In October 2022, the government increased the investment in its Housing Investment Fund (the fund) to $2 billion. The investment returns will be used to support a revised target of 5,600 social and affordable homes commenced by 30 June 2027. The $2 billion investment is held in the Consolidated Fund (the government’s central bank account) and managed by QIC Limited. The Department of Housing, Local Government, Planning and Public Works (the department) will receive $130 million in appropriation funding per year to deliver the Housing Investment Fund’s planned targets.

The target to ‘commence homes’ means that not all of these homes will be available for occupation by 30 June 2027, with construction on some of the projects supported under the fund occurring beyond this date. The department is currently tracking the number of contracts signed for new homes as commencements, and the number of completed homes. It is also tracking potential developments and dwellings (both those the department will commence itself and those it will partner with external providers on). This is to understand progress towards its target over time, and when homes will be expected to be available.

1. Entities involved in managing debt and investments

This report examines how the Queensland Government manages its debt and investments, including the associated risks. The following entities are most directly involved:

- Queensland Treasury manages the state's finances. It collects most of the state's revenue, sets the fiscal principles the state applies, and manages the state's budget. (‘Fiscal’ refers to government spending, revenues, and/or debt.)

- Queensland Treasury Corporation (QTC) is the central financing authority for the Queensland Government. It provides financial services such as borrowings, cash investments, and foreign exchange.

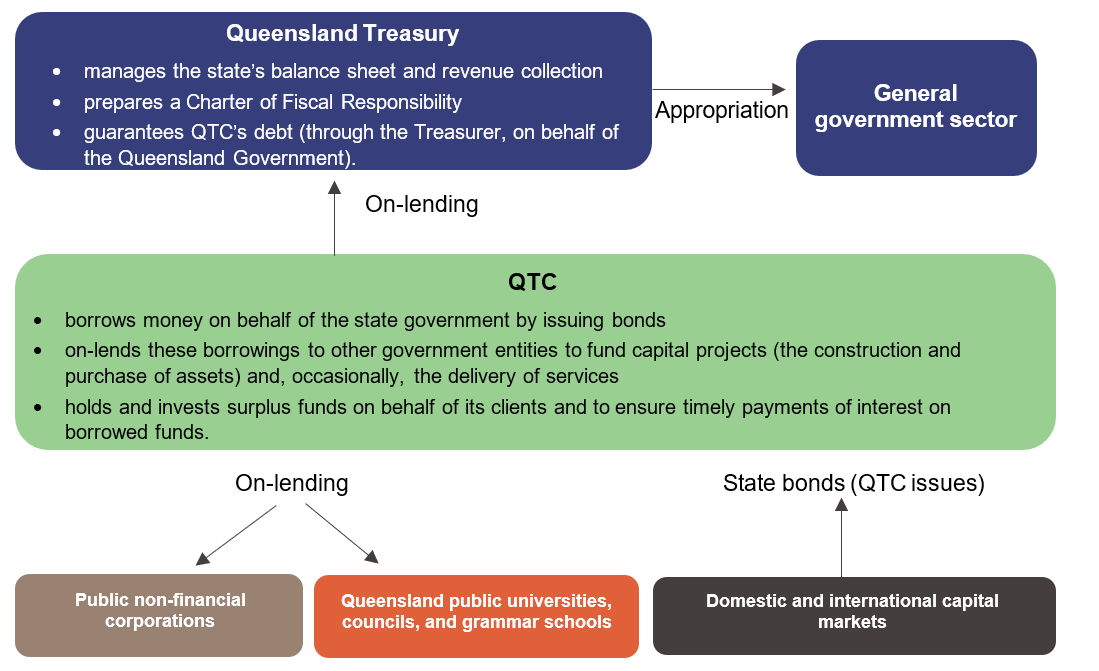

Queensland Treasury advises QTC how much borrowings the state requires and QTC identifies the most appropriate way to raise these funds in both domestic and international capital markets (buying and selling of financial securities like bonds). Once QTC has raised the necessary funds, QTC on‑lends this to public sector entities.

The State Investment Advisory Board (SIAB) is an advisory board of QTC, with independent representatives as well as Queensland Treasury representatives. It determines the investment objectives, strategies, and policies of the QIC funds relating to the state’s long-term assets (as explained in Chapter 3). - QIC Limited (QIC) is an investment manager and advisor for both public and private sector entities. Entities within the general government, public financial corporations, and public non-financial corporations sectors (see Figure 1A) invest with QIC.

Government entities provide a wide range of services to Queenslanders. In doing so, they may use debt to fund investment in physical assets (for example, the construction of infrastructure), and invest money to meet obligations (like those relating to superannuation and insurance). These entities fit within 3 sectors of the Queensland Government, as shown in Figure 1A.

Notes: The orange outlines denote the non-financial public sector, which is a combination of the general government sector and public non-financial corporations sector.

1 Capital investments: money spent to purchase or construct new assets or improve the performance of existing assets.

Compiled by the Queensland Audit Office.

2. The Queensland Government’s debt position

The Queensland Government borrows money, usually to fund capital investment into infrastructure. Effective management of debt is necessary to ensure continued access to capital markets and enable the funding of future investment decisions. This chapter analyses the Queensland Government’s net debt (financial liabilities minus financial assets) position, including who holds the borrowings, and how net debt is measured and managed.

As at 30 June 2023, the state’s total borrowings were $132.2 billion, and net debt was $24.3 billion.

Most borrowings are monies received from issuing bonds, with the agreement that the amounts borrowed will be repaid. QTC borrows money on behalf of Queensland public sector entities, so our analysis focuses on these borrowings. Other types of borrowings include leases over physical assets; and contracts to protect against movements in interest rates, electricity prices, and foreign currency exchange rates.

Net debt is calculated as financial liabilities (including deposits held, advances received, borrowings with QTC, leases and other loans, and securities) minus financial assets (including cash and deposits, advances paid, loans paid, and investments).

Why does the Queensland Government borrow money?

Queensland Treasury, as part of its fiscal management role within the state, identifies and manages how ongoing operating expenses, as well as capital expenditure (money spent to purchase or construct new assets or improve the performance of existing assets), should be funded. Entities in the public non‑financial corporations sector typically use borrowings to fund the construction of large infrastructure projects.

The state also looks to fund its operations and a significant portion of its capital expenditure from the revenue it earns. However, there may be periods when borrowings are required to fund its day-to-day activities.

Who holds debt within the Queensland Government?

Queensland Treasury identifies the borrowing requirements for the state through the budget process. QTC facilitates the raising of debt by issuing bonds (which deliver a loan for a specific period, with regular interest payments made over the period, and repayment in full at the end) to both domestic and international investors.

QTC then lends this (on-lends) to Queensland Treasury or other government entities. Queensland Treasury uses the amounts it borrows to fund government programs or projects through appropriations (money allocated by parliament) to entities in the general government sector.

QTC also provides these services to public sector entities that are not within the Queensland Government (such as universities and councils) and to entities within the public non-financial corporations sector (as explained in Figure 1A), who identify their own borrowing needs. The roles of Queensland Treasury and QTC are outlined in Figure 2A.

Compiled by the Queensland Audit Office.

What borrowings do entities hold with QTC?

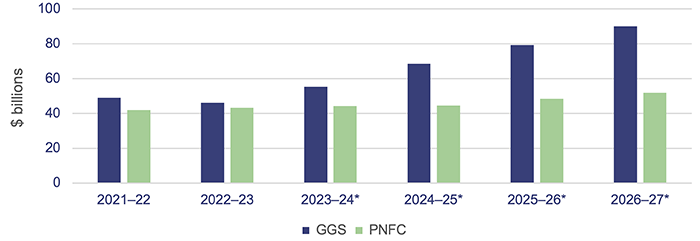

Figure 2B shows the amounts owed to QTC at 30 June each year by the general government sector and public non-financial corporations sector, along with projected borrowings up to 2026–27 for these 2 sectors.

As at 30 June 2023, these 2 sectors represent 90 per cent of QTC’s on-lendings. The remaining 10 per cent predominantly relates to borrowings held by public universities and local governments.

Notes: * Denotes projected 2023–24 budgeted amounts from the 2023–24 Queensland Budget Update. GGS – general government sector; PNFC – public non-financial corporations sector.

Compiled by the Queensland Audit Office.

Most general government sector entities (departments and statutory bodies) receive most of their revenue from appropriations and grants. Queensland Treasury borrows money from QTC on their behalf, to provide funding for programs or projects. As shown in Figure 2B, borrowings with QTC are forecast to increase over the forward estimates (the next 4 years) as the state invests in Queensland’s economic and social infrastructure. This is through the government’s 4-year capital program, focused on constructing hospitals, schools, transport infrastructure, social housing, and renewable energy transformation.

Public non-financial corporations sector borrowings are primarily held by entities with income-generating assets, such as Energy Queensland Limited. Total borrowings in this sector are forecast to increase over the forward estimates to fund projects under the Queensland Energy and Jobs Plan. This plan, released by the Queensland Government in September 2022, outlines the state’s pathway to delivering clean, reliable, and affordable power over the next 10 to 15 years. Key projects under the plan include the development of wind and solar farms near Dalby, pumped hydro, and transmission and distribution infrastructure.

The Queensland Government has approved $1.3 billion in initial investment in the CopperString 2032 project with $1 billion in equity funding in Powerlink Queensland (where shares are issued in exchange for a cash investment) approved in the 2023–24 budget. CopperString 2032 is the first renewable energy project by Powerlink Queensland to transmit renewable energy from the state’s north-west to the national electricity market. Borrowings will likely increase in the next 2 years as more funding is required, which has been factored into the 2023–24 budget.

What has caused movements in the net debt position in recent years?

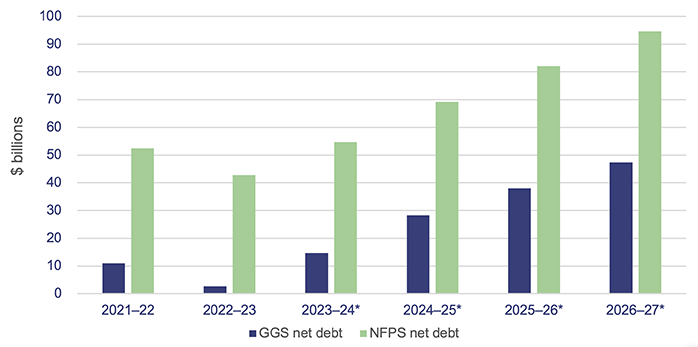

Figure 2C shows the net debt for the general government sector and the non-financial public sector since the 2021–22 financial year, alongside projected net debt.

Note: Years marked with an * are projected figures, from the 2023–24 Queensland Budget Update. GGS – general government sector; NFPS – non-financial public sector, which includes the general government sector and the public non-financial corporations sector.

Compiled by the Queensland Audit Office.

In 2022–23, favourable economic conditions (including higher revenue from the royalties that companies pay to mine coal) have assisted in managing the debt balance. The improved conditions have meant the government borrowed less than budgeted in 2022–23, and reduced its borrowings from 2021–22, as there were more operating cash flows (the money generated from normal business activities) to fund planned capital expenditure.

The capital program is projected to cost $96.2 billion between 2023–24 and 2026–27, a significant increase of $31.4 billion on the 4-year capital program outlined in the 2022–23 budget (which covered the period 2022–23 through 2025–26).

The Queensland Budget Update 2023–24 forecasts a continued increase in borrowings over the forward estimates to 2026–27 – although less of an increase than was forecast in the 2022–23 budget. The increase is based on the need to fund capital investments beyond maintenance and replacement. It also includes funding for programs within the general government sector focused on health (such as the expansion of capacity at 15 hospitals across Queensland), social and affordable housing (in addition to the Housing Investment Fund, which is discussed in Chapter 5 of this report), and the delivery of additional schools to support population growth.

The forecasted increase in borrowings is also expected to support delivery of the Queensland Energy and Jobs Plan. The government has committed an investment of $19 billion (increased from a budgeted $4 billion announced in the 2022–23 budget) over the next 4 years to support this plan.

How does the Queensland Government measure its performance in managing debt?

The state budget is focused on the general government sector. As part of the budget-setting process, the government outlines its fiscal objectives and the fiscal principles that support them. The state budget is developed in line with these principles each year.

The government assesses the sustainability of government debt by comparing the level of net debt (financial liabilities minus financial assets) to the revenue it earns each year. This is referred to as the ‘net debt to revenue ratio’, and it is expressed as a percentage. The budget includes a fiscal principle aimed at ensuring the general government sector net debt to revenue ratio is maintained at sustainable levels in the medium term (usually between 4 to 10 years) and reducing the net debt to revenue ratio in the long term.

Figure 2D shows the trend of the net debt to revenue ratio for the general government sector, and includes comparative ratios for the New South Wales and Victorian governments. Queensland’s net debt to revenue ratio is expected to increase over the next 4 years, while remaining below the levels in New South Wales and Victoria. This result is driven by the budgeted increase in borrowings under the capital program and a reduction in revenue in 2023–24 as coal prices normalise.

Total revenue is expected to decrease by $4 billion in 2023–24. The trend in total revenue over the forward estimates is in line with royalties revenue falling in 2023–24, then leveling out over the following years. This is because the exceptionally high coal and oil prices seen in 2022–23 are expected to fall as commodity prices return to normal. Total revenue is then expected to remain steady at $84 billion over the next 2 years, with a rise to $87 billion in 2026–27.

Notes: * Denotes budgeted amounts. GGS – general government sector.

Compiled by the Queensland Audit Office, from Queensland Treasury; NSW Treasury; and Department of Treasury and Finance, State of Victoria information.

If the government identifies that changes are needed to manage debt levels, it can take action that includes:

- managing its operating expenditure to ensure there are sufficient funds available to pay down existing debt and to reduce the need to fund new projects through borrowings. Given the increase in royalties revenue for 2022–23, there has not been a specific focus on this in the current period

- introducing initiatives to help provide funding for the debt or to provide more assets to back the debt held. This was done in 2020–21, when the government established the Queensland Future Fund, as explained in Establishing the Queensland Future Fund (Report 11: 2021–22). We have provided an update on the financial performance of the Debt Retirement Fund in Chapter 4 of this report

- increasing revenues (for example, by introducing new or changed levies and taxes) to reduce future borrowing requirements. In the current year, this was seen through the introduction of tiers for royalties revenue (as explained further in Chapter 5).

How is interest on the debt managed?

The majority of general government sector debt (borrowed by QTC and on-lent to Queensland Treasury) is held under fixed (rather than variable) interest rates. Due to this, the impact of interest rate variations in the short term is usually not significant. As new borrowing arrangements are entered into at current market rates, interest is paid at this rate on the additional borrowings. The Queensland Budget 2023–24 estimates interest expenses to be $1.9 billion in 2023–24, an expected increase of $290 million (17 per cent) from 2022–23. This increase in interest expense is due to an expected increase in borrowings and interest rates.

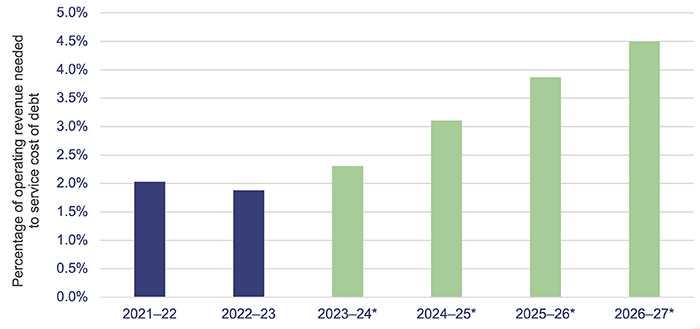

Comparing interest expenses to operating revenue provides information on the share of revenue that must be devoted to servicing the cost of debts. Figure 2E shows that this ratio is projected to increase over the forward estimates. In 2022–23, 1.9 per cent of the general government sector’s operating revenue was needed to service the cost of debt. This is estimated to increase to 4.5 per cent by 2026–27.

QTC and Queensland Treasury manage the risks around interest expense through several strategies. These include having a mixture of loan durations and types, as well as holding assets to back the debt (and manage credit risk). QTC also uses interest rate swaps, where appropriate, which allows a fixed interest rate to be swapped to a variable interest rate and vice versa.

Queensland Treasury also provides input into managing the risk of variation in interest rates:

- through the policies it sets

- by providing the framework for approval of borrowings by entities within the general government sector

- by providing interest rate forecasts to inform budgeting and planning outcomes, as well as the whole of government liquidity management.

How is credit risk managed?

QTC borrows money from domestic and international capital markets by issuing bonds. These bonds are purchased by investors, both within Australia and overseas.

While investors may take many different factors into account in their investment decisions, one key factor they typically consider is the credit rating of the bond issuer. Having a high rating can give the issuer access to capital at affordable interest rates and can give easy access to funds from the international bond market and secure foreign direct investment. This is particularly important in attracting international investors who may not be as familiar with Australian entities and the local economy, as this is a tool that is used internationally and issued by an independent third party – making it reliable and comparable for investors.

What is a credit rating?

A credit rating represents an opinion on the credit-worthiness of a bond in comparison to other bond issuers. The higher the credit rating, the less likely it is that the bond issuer will not meet its payments to the investor.

A bond issuer (such as QTC) borrows money by selling bonds to investors (known as bond holders). A bond represents a right to receive payments of interest throughout the term, and to be repaid the principal at maturity. Once a bond has been sold, the bond issuer can use the capital raised to invest in other assets. For a government bond issuer, this is usually for investment in infrastructure.

The bond holder can:

- hold the bond until maturity

- sell the bond to other investors, including the bond issuer.

The credit rating is usually expressed using letters, for example, AAA or BBB, and may include other numbers or symbols to provide further detail on the rating. For example, AA+ or Aa1 is a higher rating than AA- or Aa3. Rating agencies (explained below) typically each have a different way of expressing the rating, resulting in the different number, letter, and symbol combinations.

Credit ratings of BBB and higher are considered ‘investment grade’, and lower ratings are ‘speculative’. Investment grade bonds are seen as higher quality investments, and therefore lower interest rates are offered for them. Higher interest rates for speculative grade investments represent the risk taken by investors, who take a higher payment to compensate them for taking on this risk.

Who determines the credit rating, and how is it used by investors?

Credit ratings are determined by rating agencies, including Standard & Poor’s (S&P Global), Moody’s Investor Service, and Fitch Ratings. These agencies are accredited to issue their ratings and must follow a code of conduct (for example, not having a conflict of interest in holding bonds with the issuers they are rating). Each rating agency uses its own methodology to determine a credit rating. These models use measurable (quantitative) and subjective (qualitative) information in their assessments.

A higher credit rating is preferred by borrowers. A higher credit rating means there is less risk that a borrower will not meet its payments to the investor. The investor is therefore more likely to accept a lower interest rate that reflects the lower risk.

Queensland’s credit rating

Queensland has a strong investment-grade credit rating. The rating agencies issued the following ratings across August and September 2023, based on the previous financial year’s results:

- S&P Global: AA+ (outlook stable)

- Moody’s Investor Service: Aa1 (outlook stable)

- Fitch: AA+ (outlook stable).

The rating agencies assess these credit ratings annually, usually publishing credit ratings in the September quarter. In the months before the agencies issue the credit ratings, Queensland Treasury and QTC representatives engage with them to:

- provide an overview of Queensland’s annual budget following tabling in parliament

- compile the data requested by the agencies for use in their models

- attend annual management meetings with the agencies

- perform fact-checking of the draft credit rating publications to identify possible factual errors.

Queensland Treasury and QTC also engage with the rating agencies throughout the year following publication of certain reports (for the most recent ratings round, this included the 2022–23 Budget Update, 2022–23 Report on State Finances, and the 2022 Queensland Sustainability Report).

3. The Queensland Government’s investments

The Queensland Government holds investments to help fund long-term obligations and to support future expenditure. This chapter analyses the Queensland Government’s investments, including how they are managed, the entities involved with the investments, and how these investments performed.

How are government investments managed?

The Queensland Government holds investments across several entities as shown in Figure 3C. It does this to:

- fund long-term obligations

- manage risk associated with future expected payments (for example, insurance claims)

- manage the state’s finances.

Many of these investments are held through managed funds. The distinction between managed funds and other funds announced by the government is explained in Figure 3A.

|

What is a fund? |

|

The government will often refer to the creation of a fund, or the contribution of money to a fund, when making announcements about various initiatives. These are usually allocations of resources or monies within budgets, and they are different to managed funds. DEFINITION Managed funds are pools of investments held for one or more investor. For example, Queensland’s Long Term Asset (LTA) portfolio is part of a managed fund held by Queensland Treasury Corporation (QTC) and invested by QIC Limited (QIC). |

Compiled by the Queensland Audit Office.

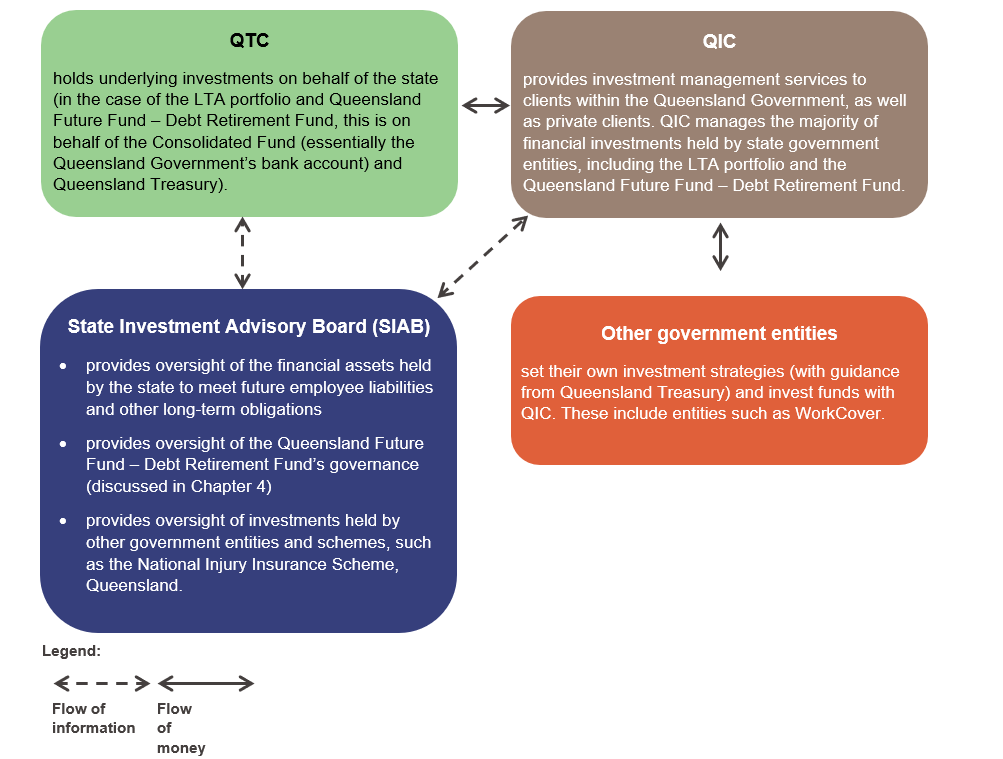

The state’s portfolio of investments is held by various government entities.

QIC is the investment manager of the state’s long-term investments (and therefore undertakes the day‑to‑day management of investments), while the State Investment Advisory Board (SIAB) provides oversight for many of the investment strategies for the government’s managed funds.

SIAB is an advisory board set up under QTC, with independent representatives as well as Queensland Treasury representatives. It determines the investment objectives, strategies, and policies of QIC funds relating to significant state investments.

Figure 3B outlines the roles and responsibilities of key parties involved in managing the state’s investments.

Compiled by the Queensland Audit Office.

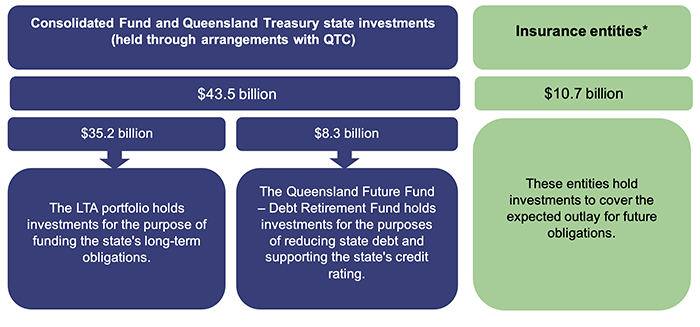

Which government entities hold investments?

Figure 3C shows the significant holders of government investments (where the investments are held in QIC funds), as at 30 June 2023.

Note: Insurance entities* include the Motor Accident Insurance Commission; Nominal Defendant; Queensland Building and Construction Commission; The National Injury Insurance Agency, Queensland; and WorkCover Queensland.

Compiled by the Queensland Audit Office.

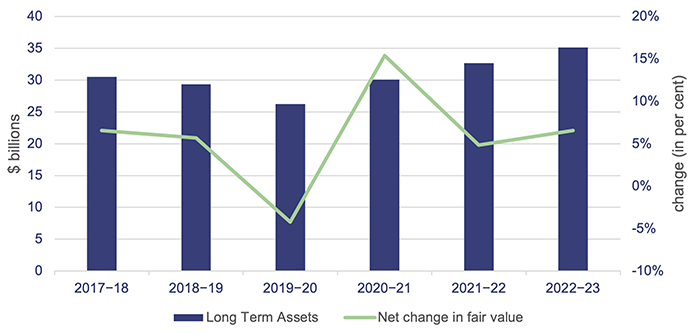

How have the investments performed?

The entities in Figure 3C each have different asset allocations (the mix of different types of investments in a portfolio), aligned to their risks and objectives.

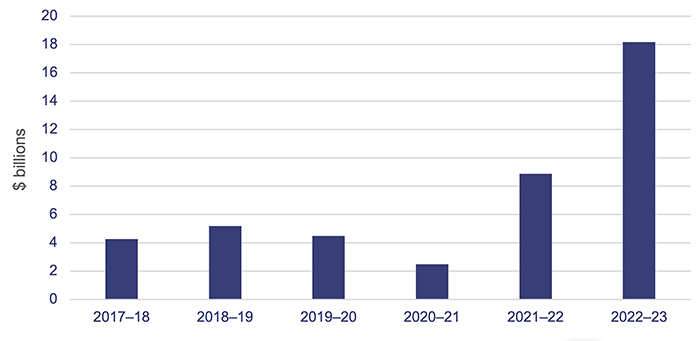

The Long Term Asset (LTA) portfolio is the largest single asset pool held within the state, and it has a diversified asset mix. Figure 3D shows its total long-term assets in recent years, compared to the net change in fair value of these assets. (Fair value is the price at which the investments could be bought or sold.)

Note: Net change in fair value represents only the change in the fair value of financial assets, which in this case are the investments. It does not include deposits or withdrawals made during the year.

Compiled by the Queensland Audit Office.

Figure 3D shows that there have been significant fluctuations in the change in fair value of investments over the past 6 years. In 2021–22, there were lower returns compared to 2020–21. These were due to the ongoing macroeconomic impacts of COVID-19 and other geopolitical factors, such as the war in Ukraine.

There has been a slight increase in the change in fair value of investments in 2022–23 compared to 2021–22, related to strong returns in certain sectors such as technology and resources. The value of the LTA portfolio has steadily increased from 2020–21 to 2022–23. This is attributable to positive returns and deposits into the portfolio.

Defined benefit superannuation scheme

As stated earlier, the LTA portfolio is held for the purpose of funding long-term obligations of the state. The largest liability the LTA portfolio backs is the defined benefit superannuation scheme. The Queensland Government holds the superannuation defined benefit obligation for the State Public Sector Superannuation Scheme and Judges’ Scheme. These schemes provide for post-retirement benefits to certain public service employees and have been closed to new members since November 2008. Various factors, such as salary growth and employee turnover/retirement, are considered when valuing the future obligations of the scheme.

The scheme is recorded in the whole-of-government financial statements, in accordance with the Australian Accounting Standards Board’s (AASB) accounting standard AASB 119 Employee Benefits. This calculation is complex; is performed by the State Actuary; and uses assumptions about future salary growth, interest rates, and inflation when estimating the value to be paid in future.

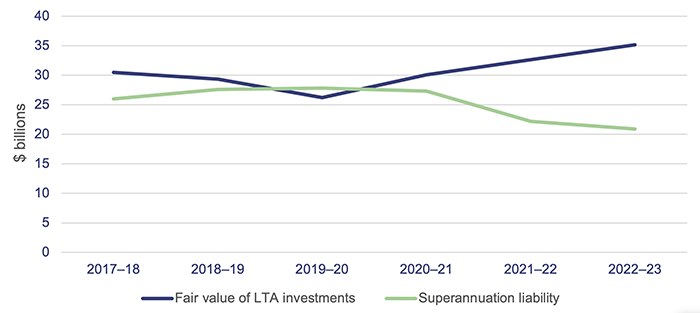

Figure 3E shows the value of the LTA portfolio and defined benefit liabilities, as reported in the whole‑of‑government financial statements as at 30 June each year.

Note: The Fair value of LTA investments line above includes the entire LTA portfolio. As at 30 June 2023, $25.5 billion of these assets support the superannuation liability.

Compiled by the Queensland Audit Office.

The improvement in the position, as shown in Figure 3E, reflects:

- stronger investment returns, which increased the value of the investments

- contributions made by the government to the LTA portfolio for other government initiatives such as Path to Treaty Fund, Housing Investment Fund, the Queensland Government Insurance Fund, and $2.5 billion invested from royalty windfalls (see Chapter 5)

- higher interest rates (based on Australian Government bonds). These rates are used to discount future payments of superannuation benefits, so they are expressed in today's dollars. The higher rates represent higher returns on investments backing the debt, therefore needing less investments to cover the liability. Therefore, the increase in interest rates has decreased the value of the liability.

The government has a fiscal principle for the defined benefit obligation to be fully backed by investments, in line with advice from the State Actuary. When the State Actuary assesses if the liability is fully funded under actuarial standards, it uses different criteria to calculate the liability to those required by the applicable accounting standards.

For example, while AASB 119 requires the liability to be calculated using discount rates (the rates used to measure future values in today’s dollars) based on Australian Government bonds, the State Actuary is required to apply rates based on expected investment returns. This can result in a significant difference in the surplus/deficit calculated under accounting and actuarial standards. The most recent actuarial review was completed for the year ended 30 June 2021. The actuary concluded that the LTA assets exceed accrued liabilities by $6.649 billion.

The Superannuation (State Public Sector) Act 1990 was amended in 2020 to include a requirement consistent with this fiscal principle, which has been achieved consistently since then.

4. The Queensland Future Fund

The Queensland Future Fund was established under legislation to support Queensland’s credit rating and reduce debt. The Queensland Future Fund is a framework under which funds may be created. This chapter provides information on the first fund created under this framework, the Debt Retirement Fund, including its current structure, some of its key investments, and its performance for the year ended 30 June 2023. We also explain the current structure of Titles Queensland, which was one of the key investments of the Debt Retirement Fund when it was established.

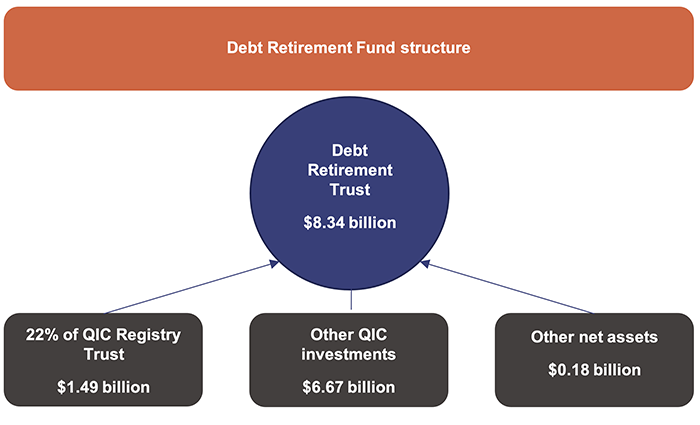

The structure of the Debt Retirement Fund

When established in 2021, the Debt Retirement Fund was funded through 3 initial asset investments. As we outlined in Establishing the Queensland Future Fund (Report 11: 2021–22), a diversification program was undertaken soon after these assets were contributed. This was to minimise the risk to the fund through concentration (that is, holding most of its funds in a small number of assets) and to provide liquidity (the ability to easily convert assets into cash to fund short-term obligations).

The Debt Retirement Fund investments are held through an investment trust managed by QIC Limited (QIC), known as the Debt Retirement Trust. The structure of the fund, as at 30 June 2023, is shown in Figure 4A.

Compiled by the Queensland Audit Office.

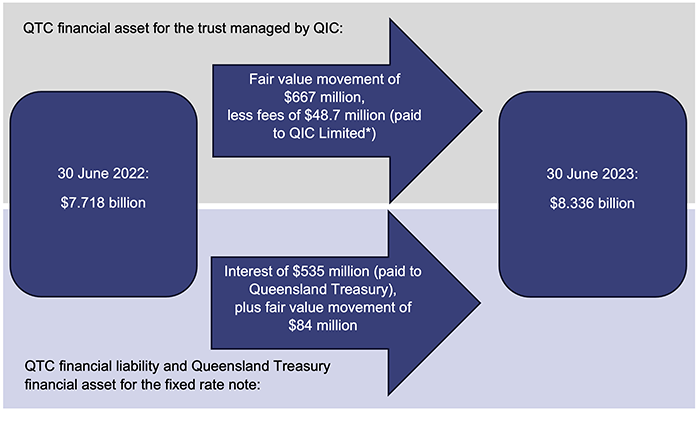

Financial performance of the Debt Retirement Fund

2022–23 was the second full financial year of operations for the Debt Retirement Fund. Queensland Treasury Corporation (QTC) and Queensland Treasury report on the results of the fund in their annual reports. QTC reports on the financial assets in the Debt Retirement Fund held with QIC, and the financial liability for the fixed rate note held between QTC and Queensland Treasury. Queensland Treasury discloses a financial asset in its financial statements for the fixed rate note.

A fixed rate note is a debt instrument that pays a fixed amount of interest per annum. It is used to recognise the benefit of an investment for one party, even though the investments themselves are held by another party.

In the case of the Debt Retirement Fund, Queensland Treasury recognises the benefit of the fund, while QTC holds the underlying trust investment. QIC manages the trust, which now has a diverse investment mix. A similar arrangement is used to account for the state’s Long Term Asset (LTA) portfolio (see Chapter 3), except the benefit of the portfolio is held by the Consolidated Fund (which is essentially the Queensland Government’s bank account).

Under the requirements of the Debt Retirement Fund trust deed, QIC prepares separate financial statements for the Debt Retirement Trust; however, these are not publicly available, as there is no requirement for them to be published.

Figure 4B provides a summary of the Debt Retirement Fund’s financial performance.

Notes: Fair value is the price at which the investments could be bought or sold. The movement reflects the change in fair value over the financial year.

*QIC returns a portion of the fees it receives to Queensland Treasury as part of the Competitive Neutrality Fee Regime. Competitive neutrality fees are a requirement for public sector entities to pay taxes to remove the benefits (and costs) that result from their public ownership when competing with the private sector.

Compiled by the Queensland Audit Office.

Parts of the Debt Retirement Fund are reported on in multiple sets of financial statements. These include:

- the Debt Retirement Trust, which is managed by QIC. These are special purpose financial statements and are not available publicly. The trust had a return of 8 per cent for 2022–23

- the investment in the trust, which is held by QTC. This is reported as a financial asset by QTC and reflects the return of 8 per cent, excluding fees paid

- a fixed rate note between QTC and Queensland Treasury, which reflects the value of the trust at the start and end of each year.

The fixed rate note was established in 2021 with an interest rate of 6.5 per cent per annum. This rate is meant to reflect the Debt Retirement Fund’s investment return objective of consumer price index (CPI) plus 4.5 per cent (before fees) over a rolling 10-year horizon. The rolling 10-year horizon is used to reduce the impact of temporary increase or decrease in the CPI benchmark. This reflects the fact that these assets are usually held for many years, and it is appropriate to measure the long-term investment performance using a long-term benchmark.

The fixed rate note is recorded as a financial asset by Queensland Treasury and as a financial liability by QTC. QTC recognises an interest expense for the fixed rate note, and Queensland Treasury recognises the same amount as interest income. The value reported for the fixed rate note is adjusted to equal the market value of the Debt Retirement Fund each year at 30 June, and is reported as the same value by both Queensland Treasury and QTC.

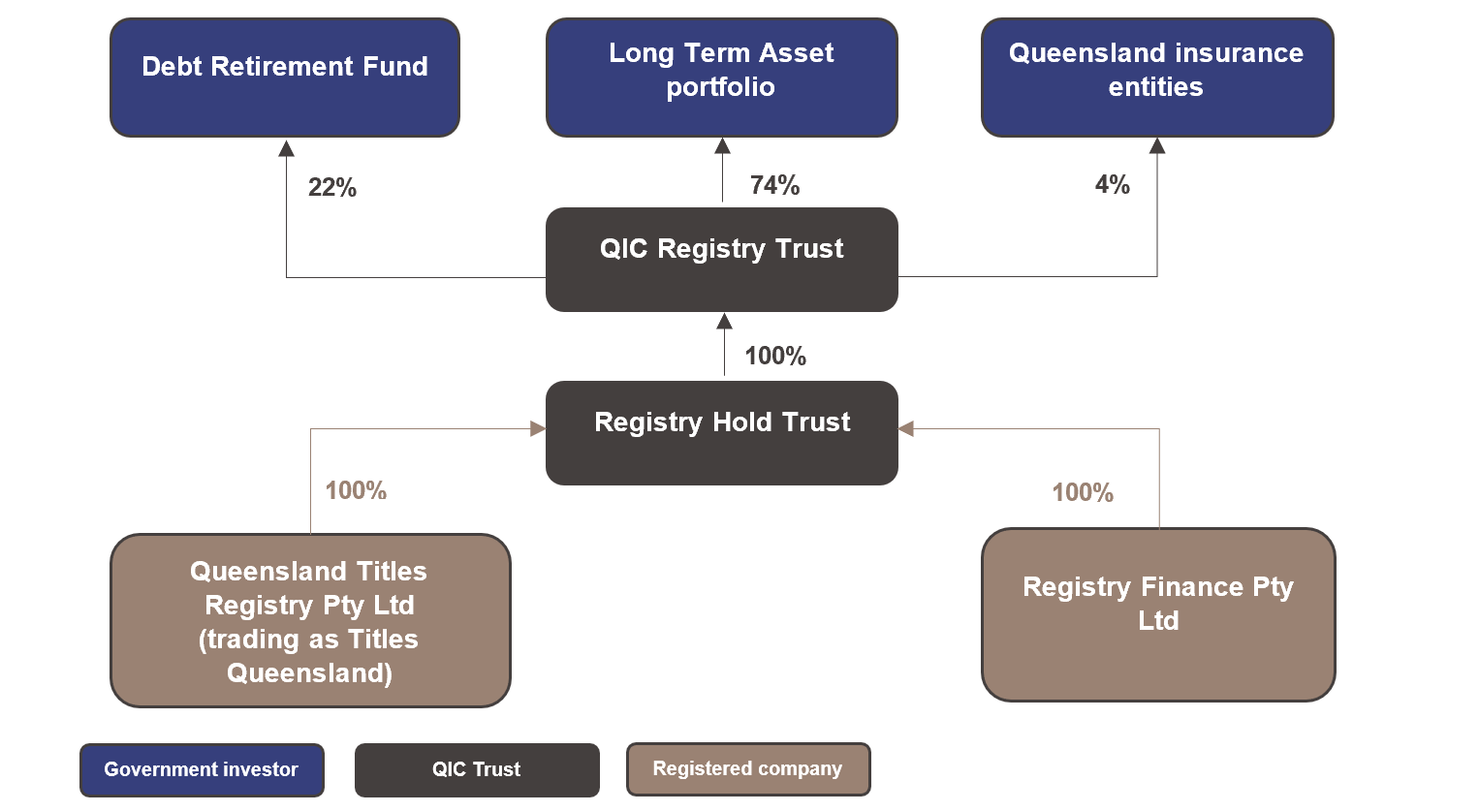

Investment structure of Queensland Titles Registry

The Queensland Government established a separate business to manage the Queensland Titles Registry operations in 2021 as part of establishing the Debt Retirement Fund. The Queensland Titles Registry manages and maintains the titles for land and water in the state. This business trades under the name Titles Queensland. Figure 4C outlines the investment structure of the Queensland Titles Registry as at 30 June 2023.

Compiled by the Queensland Audit Office.

Queensland Titles Registry Pty Ltd and Registry Finance Pty Ltd are registered companies whose shares are held by Registry Hold Trust, which is a unit trust established to manage the Queensland Titles Registry investment. This trust is managed as part of the Titles Queensland business. The units in Registry Hold Trust are held by the QIC Registry Trust, a QIC-managed fund. Government entities invest in this fund through existing QIC investment structures.

A unit trust is a trust in which investors pool their investments into a single fund, such as the Debt Retirement Trust. The investments are divided into a number of defined shares (called units). The units are held by unitholders (investors) and represent the right to share in the returns of the investment fund, which usually take the form of cash distributions.

During 2022–23, Queensland Titles Registry Pty Ltd paid dividends of $579 million to Registry Hold Trust. Registry Hold Trust paid distributions of $501 million to the QIC Registry Trust, which was then paid to its unitholders. This does not mean that the ultimate government investors actually received this amount, as many of these returns were reinvested into QIC funds. The Debt Retirement Fund is one of the unitholders of QIC Registry Trust which received distributions (refer to Figure 4B for the performance of the fund).

Supporting Queensland’s credit rating

Payments from the Debt Retirement Fund can only be used to either pay down the state’s debt or reinvest in the fund (and pay for the costs of managing the investments).

For the year ended 30 June 2023, the Debt Retirement Fund reinvested its returns in other investment funds – this increased the value of the fund and reduced Queensland’s net debt.

As mentioned at the beginning of this chapter, one of the reasons the Queensland Future Fund was established was to support Queensland’s credit rating. When assessing the state’s credit rating, the rating agencies (see Chapter 3) have considered both the total value of the fund and the liquidity of the fund. Higher quality and more liquid investments are viewed more favourably, as they are more easily sold at the value they are held at, if a quick sale is needed.

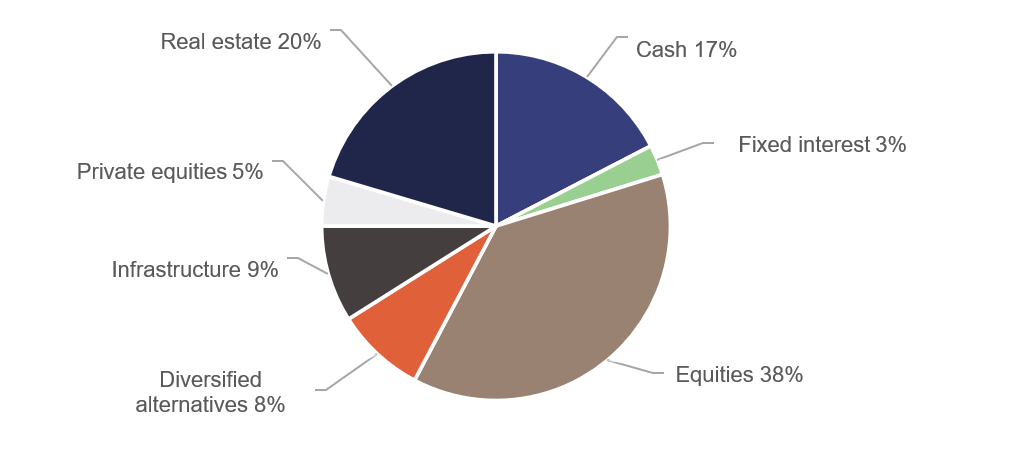

The Debt Retirement Fund has a mix of investments with different liquidity characteristics. Figure 4D shows the underlying mix of the Debt Retirement Fund’s investment allocation.

Notes: Equities – investments in Australian and overseas shares.

Diversified alternatives – investment in varied pools of investments across alternative asset classes, such as private equities, infrastructure, and properties.

Private equities – investments in private companies (those that are not listed on a stock exchange).

Compiled by the Queensland Audit Office.

5. The Queensland Government’s significant transactions in 2022–23

In managing its debt and its investment strategy, the Queensland Government has, at times, taken significant measures. In 2022–23, these related to investing Queensland’s royalty windfall (unexpected gain in royalty income) and starting activities in the Housing Investment Fund (new model of social and affordable housing investment partnerships for Queensland).

Investing Queensland’s royalty windfall

The increase in coal prices in recent years has seen the value of Queensland’s coal exports increase significantly. This increased related revenues and profits made by the coal mining companies operating in Queensland. The 2022–23 budget introduced 3 new coal royalty tiers from 1 July 2022. The tiers are structured to increase royalty income with increases in the average sale price of coal.

The increase in coal prices and the new coal royalty tiers have led to a temporary surge in the royalty revenue collected by the state in 2022–23.

Compiled by the Queensland Audit Office.

In the 2022–23 Budget Update, the state government outlined that $4 billion of the additional royalty revenue will be used to fund a range of investments across regional Queensland. This included an investment of $3 billion by the Consolidated Fund for the purpose of funding future infrastructure in regional Queensland.

In the Queensland Budget 2023–24, the state government announced another $6 billion in funding, bringing the total commitment from the additional royalty revenue to $10 billion for regional infrastructure projects. The funding is expected to include:

- $7 billion towards state-owned pumped hydro projects (which use 2 water reservoirs at different heights to generate and store energy).

- $1.1 billion to support the construction of a transmission line from Townsville to Mount Isa ($594 million of which is expected to be spent in 2023–24), being CopperString 2032.

The Queensland Budget 2023–24 also announced commitments for other regional projects due to the royalty windfalls, including:

- $3.6 billion to build new or expanded hospitals in Moranbah, Mackay, Cairns, Townsville, Bundaberg, Fraser Coast, and Toowoomba.

- $0.9 billion for new 10-year agreements with the Royal Flying Doctor Service and LifeFlight Australia.

- $0.5 billion for payroll tax relief for regional businesses by extending the one per cent regional discount on payroll tax to June 2030.

The 2023–24 Queensland Budget Update predicts that the increased coal prices of the past 2 years will normalise in the near-term. This will result in a substantial decline in royalties over the next 4 years, including a 37 per cent decline in 2023–24 and a further 45 per cent decline in 2024–25.

Housing Investment Fund

The Housing Investment Fund is one of 3 programs established under the state government’s Queensland Housing Investment Growth Initiative (announced in 2021).

The Housing Investment Fund was originally led by Queensland Treasury, in consultation with the then Department of Communities, Housing and Digital Economy (renamed Department of Housing as part of machinery of government changes announced on 17 May 2023). The function was transferred to the Department of Housing from Queensland Treasury as part of these changes. It is now led by the Department of Housing, Local Government, Planning and Public Works (renamed as part of the machinery of government changes announced on 18 December 2023) and supported by Queensland Treasury.

The Housing Investment Fund was initially established with $1 billion from the transfer of the Queensland Titles Registry. This investment was created to provide a steady income stream to support housing programs. At the Queensland Housing Summit in October 2022, the Queensland Government announced an additional $1 billion investment in the Housing Investment Fund to support a revised target of 5,600 social and affordable homes commenced by 30 June 2027. Commencement (typically when contracts are signed for new or existing dwellings) is earlier than completion (when houses are available for occupation by individuals).

The Housing Investment Fund provides subsidies, one-off capital grants, and other support to developers, builders, community housing providers, tenancy managers, institutional investors (who invest money on behalf of others in securities, property, and so on), and superannuation funds. This funding is to encourage these parties to partner to develop, finance, and operate social and/or affordable housing in Queensland. The Housing Investment Fund is the Department of Housing, Local Government, Planning and Public Works's only program looking at affordable housing together with social housing.

Social housing is rental housing that is funded or partly funded by the government. It is available to Queenslanders who meet the eligibility requirements and cannot access or sustain a tenancy in the private rental market. Social housing includes public housing, Aboriginal and Torres Strait Islander housing, and housing owned or managed by community housing providers in partnership with the Queensland Government (community housing).

Affordable housing is typically defined differently across states and the federal government in Australia. It focuses on providing housing to those who have some capacity to pay for their housing but need a level of support (typically reduced rent) to fully meet the cost.

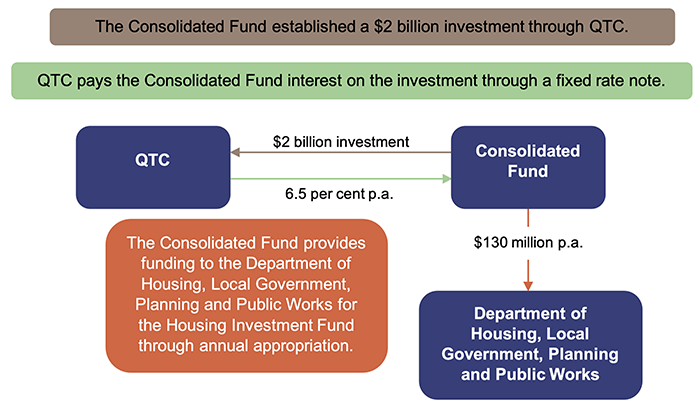

The $2 billion investment is held by the Consolidated Fund through a fixed rate note with the Queensland Treasury Corporation (QTC – as explained in Chapter 4). The State Investment Advisory Board is responsible for the investments.

Funding of $130 million per annum has been allocated for the delivery of the program, which is provided to the Department of Housing, Local Government, Planning and Public Works through annual appropriation. This is supported by the interest received on the fixed rate note between the Consolidated Fund and QTC.

Note: p.a. – per annum.

Compiled by the Queensland Audit Office.

The National Rental Affordability Scheme is an Australian Government initiative, which provides affordable housing to eligible households. The scheme is scheduled to end in 2026.

The Housing Investment Fund is supporting 2 community housing providers to progressively purchase up to 456 properties participating in the federal scheme, where the owners have indicated their intention to sell when the scheme ends. This investment will help to maintain the stock of social and affordable housing in Queensland.

As of 30 June 2023, 57 of these properties had been purchased and 37 contracted to be purchased across Townsville and South East Queensland. The other properties identified by the community housing providers are located across Townsville, South East Queensland, the Sunshine Coast, Moreton Bay, and Gympie.

The Department of Housing, Local Government, Planning and Public Works currently tracks the contracts signed for new and existing dwellings, as well as the status of each dwelling through to completion. It is also recording and tracking the status of proposed developments and opportunities with external partners for new dwellings. This tracking includes the likelihood of external proposals being converted to dwellings in order to project the expected progress of the fund.

We will monitor the progress of the Housing Investment Fund and report on this in our State entities 2024 report to parliament.