Overview

Our annual report summarises our performance, operations, and business highlights for 2023–24. It contains our financial statements, including the opinion of the independent external auditor. It complies with the Financial Accountability Act 2009, Financial and Performance Management Standard 2019, and the detailed requirements set out in the Annual report requirements for Queensland Government agencies. We also recognise our peoples' achievements, and thank our clients and stakeholders for their work with us this year.

Outgoing Auditor-General’s farewell

There are too many highlights from the past 7 years for me to include here. First and foremost, I appreciate this opportunity to publicly thank our people – our employees and contracted audit service providers, who have served Queensland tirelessly through what was a remarkable time of change. I thank the Queensland Parliament and the many clients and stakeholders I have had the privilege of providing our services for.

Effective oversight of public service delivery and the value for money that Queensland gains from our work was more important than ever over the past period. We faced COVID-19, much-needed scrutiny of audit quality, climate-related events, and skills shortages – to name a few. We also had 2 state and local government elections during my tenure, along with too many machinery of government changes.

Legislative change to the Auditor-General Act 2009 was a significant milestone. Decades of reviews stipulated the need for enhanced independence of the state’s audit office so we are free from potential influence from the executive government. To see that come into fruition was a high point, with the changes reflecting how fundamental independence is to our role. In March 2023, I was also honoured to be the first Auditor-General made an officer of the parliament in our 164-year history. There is more to be done to complete the recommended changes to our mandate that further enhance and protect the office’s independence.

I believe in our own continuous growth, and know we must remain relevant as the world changes around us. This annual report discusses the results of the 2023 strategic review of the Queensland Audit Office (QAO). I was pleased to see it concluded QAO’s functions are effective, efficient, economic, and valued. We immediately started, or continued, implementing the recommendations so we can improve. I am also proud of the work my office did to address the recommendations from the previous 2017 strategic review.

Involving our clients and stakeholders more meant they were more likely to hear what we were saying. From the onset, we continued QAO’s strategy of placing them at the centre of all that we do. I designed a new operating model that pivoted to who we serve (parliament and public sector entities) to provide more consistent and relationship-based services from across our business. I aimed to better understand the differing environments entities work in, and attended 803 engagements with clients across Queensland over the 7 years. This includes meeting with 76 of the 77 Queensland local governments.

We sought innovation through our business improvement initiatives. Our data analytics project, strengthening our quality assurance, modernising our methodologies and tools, refreshing our reports to make them easier to understand, and becoming more transparent including on the audit requests we receive from elected members come to mind. We elevated professional development opportunities for our people via secondments with the Office of the Auditor-General New Zealand and the Office of the Auditor General of British Columbia. There were other successful projects our staff worked hard on, for which I am grateful.

A key endeavour was sharing the deep insights from our work. I tabled new reports, such as an annual status of Auditor-General’s recommendations, which tells people if entities are acting on our recommendations. We launched new ways to deliver our advice beyond tabled reports, including data visualisations that translate performance information for everybody to understand. We produced tools to support entities’ application of our advice. For 3 years in a row, QAO was recognised by peer offices in the Australasian Council of Auditors-General (ACAG) Awards.

We sharpened our forward work planning to develop focus areas that umbrella our work and bring together strategic risks to entities. Entities are also facing new challenges, which we will need to provide assurance over, for example, on climate reporting by the public sector, and the deployment of artificial intelligence to government service delivery. QAO’s upcoming audit topics and reports reflect the interests of the Queensland community and address matters where our insights can best add value.

I wish the incoming Auditor-General the best for the years ahead with the 2023 strategic review confirming that QAO’s work to date serves as a valuable platform for influencing positive change in the way public services are delivered. It is indeed an incredibly worthwhile role and it has been a privilege to serve Queenslanders. Thank you.

Brendan Worrall

Auditor-General: 11 July 2017–10 July 2024.

A message from the Acting Auditor-General

On behalf of our people, I thank Brendan Worrall for his stewardship of the Queensland Audit Office and applaud his services as the 23rd Auditor-General. His focus on the value from our services and real outcomes from our work continued to reinforce the vital role our office has as part of the state’s integrity system.

In the past few years, we saw momentous legislative change. The Integrity and Other Legislation Amendment Act 2022 amended the Auditor-General Act 2009, aimed at strengthening our independence while providing enhanced accountability to parliament. The changes addressed recommendations made as far back as the 1991 Electoral and Administrative Review Commission, through to Professor Coaldrake’s 2022: Let the Sunshine in – Review of culture and accountability in the Queensland public sector.

In 2023, our mandate was also expanded to allow for performance audits of government owned corporations, shifted primary approval of our fee rates to the parliamentary Cost of Living and Economics Committee (COLEC), and, as Brendan mentions, recognised the Auditor-General as an officer of the parliament. We can now employ our people under the Auditor-General Act 2009, so we have more control over our resources and can remain responsive to external factors while pursuing innovation. The amendments also mean next year QAO’s annual report will be tabled by the chair of COLEC.

In the coming period, QAO will remain committed to delivering quality audits that meet our clients’ expectations and regulatory requirements. Our strategic plan guides us in meeting our clients’ and the Queensland community’s expectations of probity, accountability, and transparency. We will continue to foster our relationships and share our insights through genuine and timely engagement.

We will remain flexible to new opportunities and challenges. This includes implementing additional audit quality requirements following recent changes to Australian auditing and professional standards, auditing climate and sustainability disclosures, and auditing transactions associated with the 2032 Brisbane Olympic and Paralympic Games. Our fit-for-purpose business practices, such as how we develop our people, our data analytics, our information systems audit work, and a technology refresh, will augment our operations and enable us to continue to serve our clients efficiently.

There is a substantial body of work ahead of us in implementing the recommendations from the 2023 strategic review of QAO, and we look forward to the benefits we will gain. We will report to COLEC, QAO’s Executive Management Group, and our Audit and Risk Management Committee on our progress, and keep our clients and stakeholders informed.

Finally, I am delighted to take this opportunity to congratulate the incoming Auditor-General, Rachel Vagg. She will lead our office from 12 August 2024 in our support to parliament and in helping maintain the confidence Queenslanders have in the public services they receive.

Karen Johnson

Acting Auditor-General

QAO's values

|

|

|

|

Report on a page

Our workforce

| |

|

|

Our performance

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Our financial position

|

|

1. Our services for Queensland

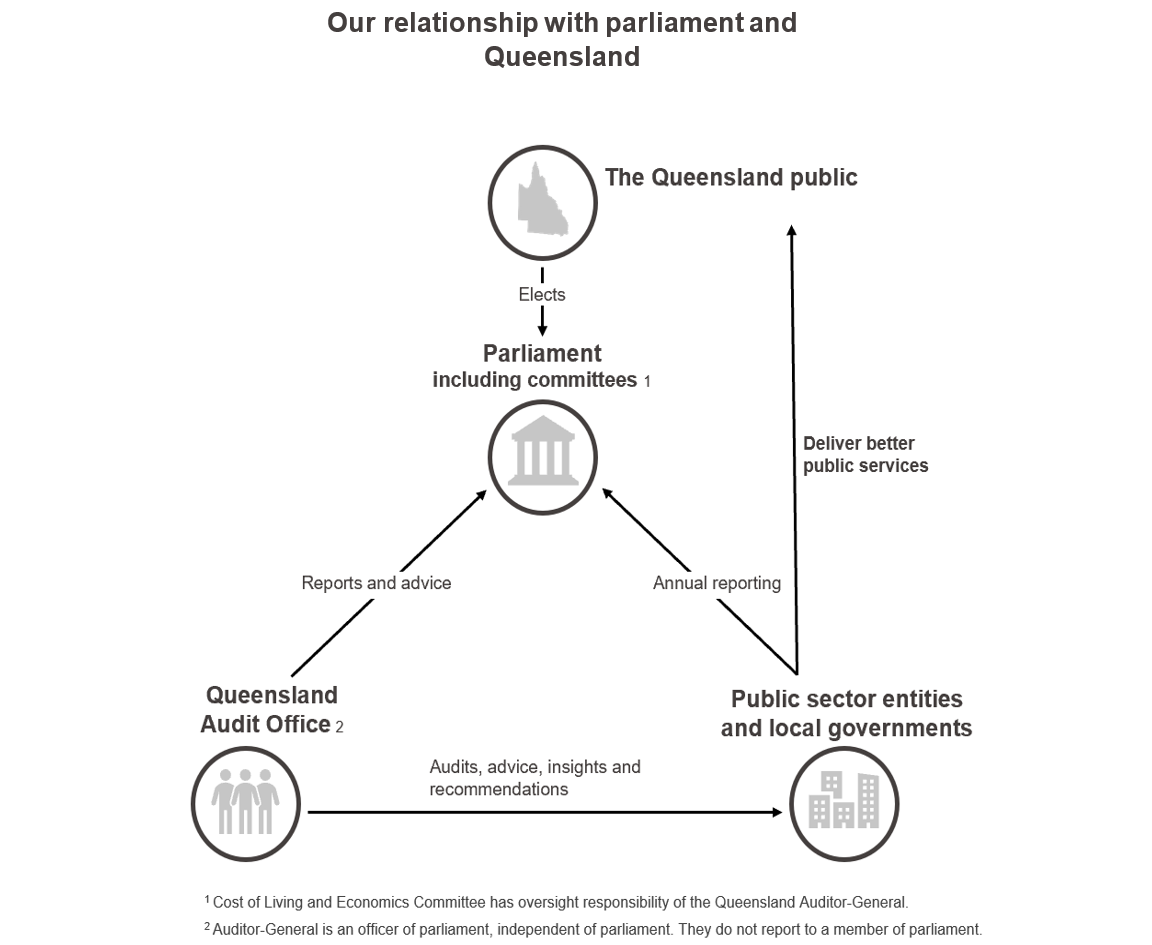

The Auditor-General, supported by the Queensland Audit Office (QAO), is parliament’s independent auditor of all of Queensland’s state and local government public sector entities. The Auditor-General Act 2009 (the Act) provides the legal basis for QAO’s access to information and the freedom to report the findings and insights from our audits. It promotes and protects our independence.

Our clients are all of Queensland’s state and local government entities, including departments, government owned corporations, statutory bodies, controlled entities, and the state’s 77 councils.

Queensland Parliament is our client, as we provide it with independent assurance over public sector and local government performance. It provides our office with appropriation to report to parliament on our work and to support it in its scrutiny and oversight. Parliamentarians provide input into our selection of audit topics, representing matters the public cares most about. We:

- provide professional audit services, which include our audit opinions on the accuracy and reliability of the financial statements of public sector entities, including local governments

- provide entities with insights on their financial performance, risk, and internal controls; and on the efficiency, effectiveness, and economy of public service delivery

- produce reports to parliament on the results of our audit work, insights, and recommendations

- support our reports with visualisations that connect our insights to regions and communities

- conduct investigations into claims of financial waste and mismanagement

- share learnings from our work with our clients, professional networks, industry, and peers.

The outcomes from our work

|

| The Queensland community is the reason for our work. From our selection of audit topics through to striving towards our vision for better public services, we aim to improve the lives of Queenslanders. |

Queensland becomes an independent colony.

First Auditor-General, Henry Buckley, is appointed.

First report to parliament is tabled – covering some of Queensland’s earliest projects such as the dredging of the Brisbane River.

The colony’s first audit act is passed, establishing the principles and responsibilities of public sector auditing.

The 1861 Act is replaced by the Audit Act 1874, better defining the Auditor-General’s role and function.

The 1874 Act is replaced by the Financial Administration and Audit Act 1977, combining responsibilities for financial administration and the Auditor-General.

The Audit Legislation Amendment Act 1993 is passed, changing the Auditor-General's Department to the Queensland Audit Office: launched 1 May.

Legislation is updated with the Auditor-General Act 2009 and Financial Accountability Act 2009. The Auditor-General’s independence is enhanced by separating audit provisions from financial accountability.

The Auditor-General Act 2009 is expanded to enable performance audits, in a first for the state.

The Auditor-General Act 2009 is amended to protect the Auditor-General’s and QAO’s independence. Staff are employed under the 2009 Act.

2. Report on our performance

Our strategic plan, revised annually, aligns our services with how we work together as one team towards our vision and purpose. The plan is informed by our operational and workforce planning, our forward work plan, and our service delivery statement (SDS) – which provides budgeted financial and non-financial performance information.

Strategic plan 2021–25

Vision: Better public services

Purpose: Independent, valued assurance and insights

Who we serve: Queenslanders, through parliament, public sector entities, and local governments

Approach:

| Objectives | Strategic risks | Strategies | Indicators of achievement |

|---|---|---|---|

| We support and inspire our people, which includes our audit service providers, to best serve parliament and our clients. | We do not attract and retain the right people who uphold our values, and our ethical and quality standards. | Attract and retain our people to meet parliament and our clients’ assurance expectations. | Our people are capable, uphold our standards, and feel respected and valued. |

| Those we serve trust and value our independent services and insights. | We do not maintain valued relationships nor adapt our services to meet changing needs. | Build trust in our relationships through listening and tailoring our response. | Our relationships and independence are valued. |

| We use contemporary auditing practices to deliver independent services that are used to improve accountability and performance. | We do not sufficiently use our technology to better understand our clients and deliver services that are valued. | Using data-driven solutions to enhance our assurance and insights to provide greater value. | Parliament and our clients benefit from our independent assurance services and the insights we provide. |

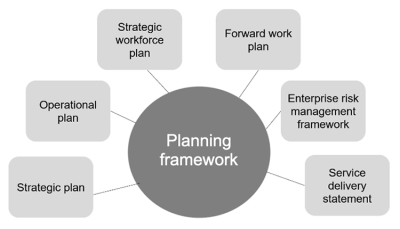

QAO’s strategic planning framework

Our strategic plan is based on a range of intelligence sources and information from across our business. Our strategic planning framework enables us to identify our aims, risks, and priorities.

Our executive leadership guides us in achieving our objectives, and every member of our workforce has a key role in our success.

Performance results for 2023–24

QAO assesses its performance against its strategic and operational objectives, using a range of measures developed through corporate planning and budgeting processes. Our performance targets are outlined in our SDS. We also compare our results to benchmarked averages of other Australian audit offices, where available, via the Australasian Council of Auditors-General (ACAG).

Our performance framework allows us to monitor and measure what we delivered – our outputs, how efficiently and effectively we operated, and the outcomes or impact from our services. Overall, these results inform our clients and stakeholders on how well we are achieving our mission and vision, including the value they receive from our services.

Performance results against annual measures

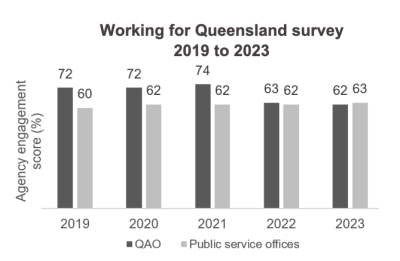

| Strategic plan objective: We support and inspire our people, which includes our contracted audit service providers, to best serve parliament and our clients |

| Target | Result |

| Improve our Working for Queensland survey score for overall employee engagement | 2023–24: 62 per cent 2022–23: 63 per cent |

| Improve feedback from our independent survey with our contracted audit service providers | 2023–24: 96 per cent said we work collaboratively 2022–23: 89 per cent said we work collaboratively |

| Increase on-the-job training and deliver the right number of training hours for our people | 2023–24: 129 training and professional development hours per auditor 2022–23: 89 training and professional development hours per auditor |

| Support our peoples’ achievement of professional audit qualifications | 2023–24: 3 employees received CA or CPA qualifications. CA ANZ recognised 2 of our people with Fellowship status 2022–23: 10 employees received CA or CPA qualifications |

| Manage the risk to our capacity due to a competitive labour market for audit professionals | Hired 9 graduates Our separation rate reduced by 10.5 per cent Transitioned our employees from the Public Sector Act 2022 to the Auditor-General Act 2009 |

| Strategic plan objective: Those we serve trust and value our independent services and insights |

| Effectiveness of our service delivery | |

| Target | Result |

| Deliver our audit opinions | 2023–24: 414 opinions 2022–23: 414 opinions |

| Improve audit clients’ overall satisfaction and meet SDS target of 80 index points (ip) | 2023–24: 82ip 2022–23: 83ip |

| Improve our financial audit clients’ overall satisfaction and meet our SDS target of 80ip | 2023–24: 82ip 2022–23: 84ip |

| Improve our performance audit clients’ overall satisfaction and meet our SDS target of 80ip | 2023–24: 82ip 2022–23: 74ip |

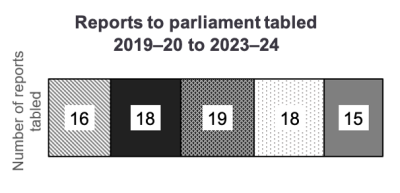

| Table our reports to parliament | 2023–24: 15 reports containing 70 recommendations 2022–23: 18 reports containing 82 recommendations |

| Provide support to the Queensland Parliament | 2023–24: 4 briefings on 5 reports to parliament 2022–23: 10 briefings on 14 reports to parliament |

| Efficiently and effectively manage the requests for audits we receive | 2023–24: Finalised 70 requests from this and previous years – sending detailed responses to 85 per cent within 30 days 2022–23: Finalised 83 requests from this and previous years – sending detailed responses to 81 per cent within 30 days |

| Produce resources for our clients, in addition to our reports to parliament | 2023–24: 33 blogs, fact sheets, better practice guides, and podcasts 2022–23: 30 blogs, fact sheets, and better practice guides |

| Efficiency of our service delivery | |

| Target | Result |

| Meet the SDS target of 6 months average time to produce reports on our financial audits | 2023–24: 6.4 months 2022–23: 8.4 months |

| Meet the SDS target of 9 months average time to produce reports for our performance audits | 2023–24: 13.8 months. ACAG average: 11.5 months 2022–23: 11.9 months. ACAG average: 11.4 months |

| Meet the SDS target of $140,000 average life cycle cost of reports on our financial audits | 2023–24: $175,000 2022–23: $151,000 |

| Meet the SDS target of $80,000–$90,000 average cost of financial audits for state entities | 2023–24: $97,000 2022–23: $93,000 |

| Meet SDS target $70,000–$75,000 average cost of financial audits for local government clients | 2023–24: $93,000 2022–23: $83,000 |

| Meet SDS target $395,000 average life cycle cost of reports on our performance audits | 2023–24: $492,000. ACAG average: $462,469 2022–23: $320,000. ACAG average: $425,345 |

| Manage the average cost per hour of work charged to our audits | 2023–24: $187.70. ACAG average: $206.67 2022–23: $170.60. ACAG average: $187.79 |

| Manage the percentage of our total paid hours charged to audit work | 2023–24: 54.2 per cent. ACAG average: 45.7 per cent 2022–23: 55.8 per cent. ACAG average: 45.6 per cent |

Note: ACAG averages for 2023–24 exclude data from one of 7 participating audit offices due to unavailability.

| Strategic plan objective: We use contemporary auditing practices to deliver independent services that are used to improve accountability and performance |

| Target | Result *Does not include our employees. |

| 100 per cent of our audits meet quality expectations and regulatory requirements | 93 per cent (28 of 30) of audit files reviewed had satisfactory quality assurance results |

| Deliver data analytics project milestones | Built 4 new tools to improve the efficiency of our audit work |

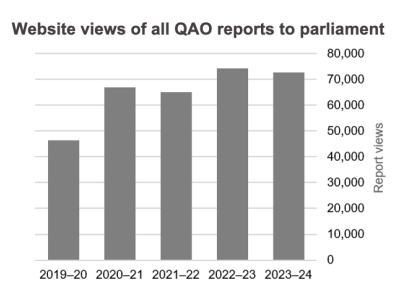

| Increase readership of reports to parliament | 2023–24: 72,767 users* 2022–23: 74,279 users* |

| Increase readership of better practice guides, blog, fact sheets, and podcasts | 2023–24: 31,315 users* 2022–23: 30,658 users* |

| Increase views of our interactive data dashboards | 2023–24: 9,516 users* 2022–23: 6,586 users* |

Detail on this year’s performance

Delivery of audit opinions

We continued to identify the risks that our audit clients were facing, design our audit work to respond to those risks, and report on matters of significance directly to our clients and to parliament.

We formed 414 audit opinions (2022–23: 414) about the reliability of state public sector and local government entities’ financial statements. We engage contracted audit service providers (ASPs) to support the delivery of our audit services each year and they are a critical part of our workforce. This year, our ASPs delivered 45 per cent of our audits, similar to 42 per cent in 2022–23.

Tabled reports to parliament

We tabled 15 reports to parliament on the results of our audits, our insights, key facts, and recommendations for performance improvement. This compares to 18 reports in 2022–23. We table our reports as soon as possible to ensure our assurance for parliament is timely and so entities can act immediately.

We tabled less reports due to the challenges QAO faced for qualified resources in a competitive professional labour market (Chapter 4), and due to the more complex or sensitive nature of some of our audit topics. Such topics require more engagement with the entities involved in the audit, and for some, with other stakeholders including the community.

Some of our clients also requested more time to respond to several of our reports – both on the early drafts we share with them and the following version we send for comment for 21 days per the Auditor‑General Act 2009. We also needed to extend or repeat the consultation period on some reports due to changes in entity leadership.

We have a range of strategies and actions in place relating to our resourcing, recruitment, and developing our people (Chapter 4). We continue to refine the scoping we do for our selected topics through our forward work planning process. This reduces the time we need in the audit planning stage. We will continue to engage closely with clients as we prepare our reports as a crucial part of our process.

Across this year’s reports, we made 70 recommendations (2022–23: 82) on how public sector entities and local governments can improve their performance and achieve the positive, intended outcomes we are seeking in public service delivery. This does not include the many recommendations we make to our clients directly during our financial audits throughout the year.

Readership of reports to parliament

We aim to increase views (readership) across all our reports over time, to grow exposure to our insights.

Within 2023–24, our reports were viewed 72,767 times. Our top 3 read reports of those tabled within this financial year were:

- Improving asset management in local government (Report 2: 2023–24) with 3,372 views

- Local government 2023 (Report 8: 2023–24) with 3,213 views

- Deploying police resources (Report 4: 2023–24) with 2,725 views.

We also track data on the readership of our supporting resources, including our blog, better practice guides, fact sheets, podcasts, and interactive data dashboards (Chapter 5).

Efficiency and effectiveness of our service delivery

We endeavour to use our resources as efficiently and effectively as possible, and ensure we allocate the right people to the right tasks to obtain the best possible value.

The cost and duration of each report to parliament is in QAO’s performance statement on pages 57–59.

We also compare our performance results to data from peer audit offices, where available, via the Australasian Council of Auditors-General (ACAG). For this year, the ACAG averages exclude data from one of 7 participating audit offices (Audit Office of South Australia), due to unavailability at the time of this report.

This year, we were the most productive audit office, charging a higher percentage of total (whole of office) paid hours to audit work than our ACAG peers (54.2 per cent compared to the ACAG average of 45.7 per cent). The average cost for each hour we charged to our audits was $187.70, compared to the ACAG average of $206.67. Over the past 5 years (2019–20 to 2023–24), QAO has had the second‑lowest cost per hour we charge for our audit work compared to the other offices.

Cost and timeliness of reports to parliament

We delivered our reports on the results of our financial audits at an average of $175,000 per report, which was $35,000 above our SDS target of $140,000, and $24,000 above last year’s average cost of $151,000.

The average cost of our performance audits, including the reports, was $492,000. This was $97,000 over our target of $395,000, and $172,000 above last year’s average cost of $320,000. Our cost for these reports was slightly higher than the ACAG average of $462,469.

We measure the timeliness of our financial audit reports from our clients’ year-end dates to the tabling date of the report in parliament. This year, the average time to deliver the reports was 6.4 months – slightly longer than our target of 6 months and below last year’s average of 8.4 months.

We measure the timeliness of the reports on our performance audits from the start of the audit to the tabling date. We delivered our performance audit reports on average in 13.8 months – longer than our target of 9 months and slightly up from last year’s result of 11.9 months. Our time was longer than the ACAG average time of 11.5 months.

Both cost and timeliness of our reports was affected by the complexity of some of the audit topics and the additional client engagement we undertook accordingly, for example, on our report on Reducing serious youth crime (Report 15: 2023–24). We also needed to extend our consultation times on draft reports when entity leadership changed.

The average cost of our financial audit reports also increased due to us needing to reflect machinery of government changes and insights in our report State entities 2023 (Report 11: 2023–24). This year, we tabled a new type of report to parliament, Queensland’s regions 2023 (Report 14: 2023–24), which required additional time for careful planning, review, and consultation.

Alongside some of our reports to parliament, we develop supporting guides or maturity models. These further share advice from our audits to support entities’ action on our recommendations, and we include the cost of development in the cost of our reports. We conducted additional work for our report Improving asset management in local government (Report 2: 2023–24), where we prepared individual advice on the maturity of each council’s asset management. This year, we also developed 2 guides for our report Responding to and recovering from cyber attacks (Report 12: 2023–24).

This year, QAO also experienced resource challenges for suitably experienced employees (Chapter 4).

Efficiency benefits from our analytics solutions

The data that QAO has access to, as enabled under our mandate, is key for the efficient and cost‑effective delivery of our audit services. It also gives us opportunities to develop innovative solutions that are integrated with our audit methodologies, and support deeper insights from our work. We design our tools to increase the efficiency of our audit work by focusing on what our people need so they can be as effective as possible – reducing the time they spend on manual data analysis.

This year, we launched 4 new audit-driven analytics solutions and provided data-driven services to replace or supplement those that each of our audit teams would normally undertake. We estimate to have significantly reduced the hours our people spend on manual audit calculations and analysis.

By continually innovating, we reflect our desire to foster unique, outcomes-oriented thinking amongst our people, where we encourage them to challenge the status quo and seek ways to better serve our clients. This aspect of our culture also helps us attract and retain a skilled and passionate workforce.

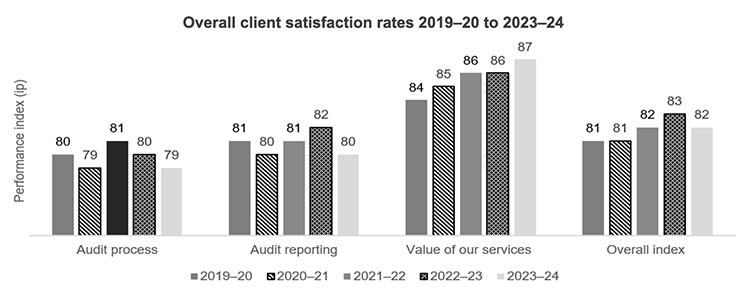

Audit clients’ satisfaction with our services

We engage an independent research provider (named ORIMA) to survey our audit clients every year. We use the results to immediately address any issues our clients may have and develop our strategy. We analyse the results over time to identify trends by client type, location, and the QAO team they work with.

In the survey, we ask departments, government owned corporations, statutory bodies, and local governments for feedback on our processes, our documents and reports, and value of our services. Index points (ip) is the average of the aggregate indices for each area of performance that the survey explores.

Over the past 5 years, our results have remained relatively steady.

This year, for our financial audits, our overall result of 82ip trended slightly lower than last year (2022–23: 84ip), but we exceeded our overall target of 80ip. We received 79ip for our audit process (2022–23: 81ip), 80ip for reporting (2022–23: 83ip), and 87ip for the value of our services (2022–23: 88ip).

One of our financial audit clients shared in the free text section of the survey:

‘I appreciate the insight that is able to be provided given the audit engagement across other organisations as it enables us to do things better at our organisation.’ – ORIMA survey, September 2023.

For our performance audits, the overall results were higher than last year at 82ip (2022–23: 74ip), and exceeds our performance target of 80ip. We received 80ip for our audit process (2022–23: 76ip), and 84ip for our reporting (2022–23: 77ip). We were particularly pleased to see our score for the value of our services went up to 83ip, from 68ip in 2022–23.

Regarding one of our performance audits and reports to parliament, an entity shared:

‘It was a pleasure working with the audit team. They were very knowledgeable and helped to work through our processes to ensure any potential gaps were explored fully before making any decisions. The audit report was communicated well with our organisation and opportunities were provided for additional input or corrections to be made.’ – ORIMA survey, October 2023.

We received significantly less responses to our surveys with performance audit clients – 52 per cent, down from 83 per cent last year. We are identifying ways to encourage better completion rates to yield more data.

We combine the results from our financial and performance audits to reflect our commitment to delivering consistent engagement and services from across our business. This approach provides one score for each client, giving us a more fulsome picture of their audit experience for the year. Our overall combined result this year was 82ip.

Overall, from the strengths identified in the surveys, our clients continue to recognise and appreciate the professionalism of our staff. They also all called out our collaborative approach to our work, meaning we aim to consult early and well on our audit planning, results, and reports to parliament.

We need to improve how long it takes for us to give clients feedback on their draft audit documents and ensure there are no large gaps in time between our audit teams contacting or engaging with clients.

We aim to complete audit work in-person to glean a better understanding of the context they operate in and to establish efficient communication and rapport. However, we can better plan the focus of our site visits to client locations before we arrive.

What we do with these results

Effective reporting to management and to our staff is a key part of us using these results and acting quickly on feedback or change opportunities. This year we improved our internal reporting to the Executive Management Group. This includes comparing results for QAO-led and audit service provider work, identifying clients with large variances to previous years, understanding who is or is not responding to the survey, and comparing results between reports to parliament.

We also improved our Power BI report for our people, which shows them their clients’ scores over time, so they can set their performance goals for their teams and track real-time data on survey completion.

Every 2 years we survey our clients’ audit committees, and members of parliament, with the next surveys to occur in 2024–25. The most recent survey results with these groups can be read in our 2022–23 annual report: www.qao.qld.gov.au/reports-resources/reports-parliament/annual-report-2022-23.

Supporting our parliamentary clients and stakeholders

We continually aim to help parliament understand entities’ performance and financial management, so it can hold them to account for the delivery of public services.

Briefings on our reports

Our reports to parliament are each referred to the respective parliamentary committee that will be responsible for reviewing it. The committee may elect to hold a briefing on the report from QAO, and from the entities involved in the audit. We also ensure we notify other committees if our audit includes an entity it has oversight of, or if the topic may be of interest. We inform the Cost of Living and Economics Committee of all our reports.

This year, we gave 4 briefings to 4 parliamentary committees covering the findings and recommendations in 5 of our reports to parliament, compared to 10 briefings on 14 reports in 2022–23. We anticipate briefings on the remainder of the reports we tabled this year later in 2024.

Overall, 16 of our reports from this year and previous years were referred to committees, and 5 committees finalised their inquiries into 6 reports from previous years.

In June 2024, in its report on Improving asset management in local government (Report 2: 2023–24), the Housing, Big Build and Manufacturing Committee commented:

‘The committee acknowledges the importance of asset management maturity and practices for sustainability and the support of growing and thriving communities. The recommendations provided by the QAO will assist councils to improve planning and management of the assets they administer.’ – Report No. 16, 57th Parliament, Housing, Big Build and Manufacturing Committee. Page 5.

In August 2023, we attended the then Economics and Governance Committee’s (now the Cost of Living and Economics Committee) public hearing on the Integrity and Other Legislation Amendment Bill 2023 on the changes pertaining to QAO and Queensland’s integrity bodies. We also made a formal submission to the committee on this Bill.

In November 2023, the Auditor-General presented to the Economics and Governance Committee on our performance and in April 2024, we attended a public hearing for the Cost of Living and Economics Committee’s Inquiry into the Report on the Strategic Review of the Queensland Audit Office.

Engagement on our services and insights

In February 2024, the structure and membership of Queensland’s parliamentary committees changed. We wrote to each newly established committee on 1 March 2024 about our services and to provide an overview of our recent and upcoming work as related to the entities they oversee.

We remained responsive to parliamentarians’ requests for audits by carefully and objectively examining the information that they sent to us, per our mandate. We publish all requests from elected members on our website to ensure transparency: www.qao.qld.gov.au/audit-program/requests-audits.

We continued to engage directly with ministers about our recent and upcoming audits. We consistently offer to meet with the ministers whose entities are involved in the respective audit to ensure they understand our aims, to secure feedback, and, overall, to increase attention to our recommendations.

We consulted early on our new forward work plan with parliamentary committees and ministers (regarding the audit topics impacting them), receiving some feedback on the timing and scope of our planned audits.

Each year, we host a forum for parliamentary committee chairs, deputy chairs, and secretariat staff. This year, we discussed our forward work plan, the status of Auditor-General’s recommendations report, themes emerging from QAO’s work, and the results of our prior-year survey with members of parliament. We also presented on how to understand the state budget and how we use it in our work.

We invest in our relationships with the secretariat staff of the committees to better understand their needs from our reports, and for their advice on how and when it is best to engage with members. We also share how we do some of our own work, for example, on how we use plain language writing in our reports.

Developing our program of upcoming audits and reports

Per the Auditor-General Act 2009, each year we publish a 3-year plan to ensure we are auditing and reporting on the right matters at the right time.

Our plan provides transparency to parliament, our clients, and the Queensland community on the audits we intend to perform and reports we intend to table, and why we consider these important. Our forward‑looking plan also gives our clients advance notice, so they have as much time as possible to prepare for our audits.

This year, we published our Forward work plan 2024–27 on 24 June 2024. A summary is available at Appendix B.

In developing the plan, we considered the range of strategic risks facing public sector entities and local governments. We have a robust methodology for prioritising potential topics based on their impact and importance, and the influence we can have over improvements to entity performance. As we have a limited number of audits and reports to parliament we can produce each year, we are careful and systematic in our selection.

A critical part of developing our plan each year is regular engagement with key stakeholders. We proactively sought input or feedback from parliamentary committees, entity leadership, stakeholders such as peak bodies, and other integrity bodies.

The culmination of our efforts from this plan is our delivery of insightful and timely reports to parliament. Over the next 3 years, QAO will supplement its plan with new or updated audits that respond to risks, and any changes to government priorities and strategies.

Managing the requests for audits we receive

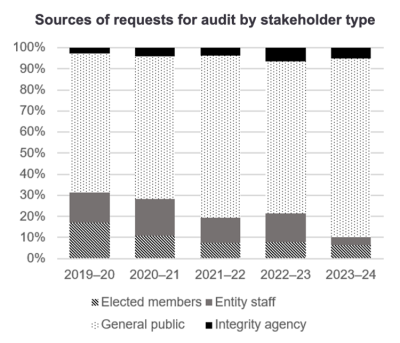

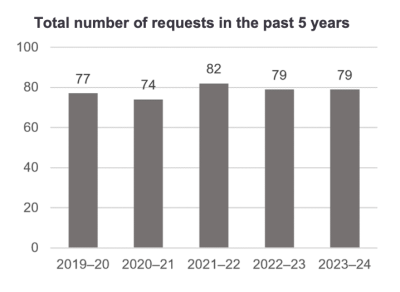

QAO welcomes information on public sector performance and requests for audits from members of the public, elected representatives, public sector and local government employees, and other integrity bodies.

To be transparent, we publish requests from members of state parliament and councillors on our website: www.qao.qld.gov.au/audit-program/requests-audits.

This year, we received 79 requests, assessing 7 as high priority – meaning the topic may have significant impact or reflects a widespread issue across public sector service delivery or financial waste and mismanagement.

We finalised 70 requests we received in this or previous years, which included completing 14 investigations. We reported 16 findings or issues directly to entity management in relation to 7 of our completed investigations, and closely engaged with them to expedite or resolve matters.

Thirteen requests contributed to our current or planned performance audits, and we added another 4 to our list of potential topics for our forward work plan. We did not take further or detailed action on 39 of the requests we received, generally because the topics were not within QAO’s mandate, we had previously investigated them, or the request did not provide sufficient information for us to progress.

The most common topics or themes in the requests we received related to the governance of information or projects, systems implementation, and procurement. We received a similar ratio of requests by stakeholder type last year.

Some of our reports to parliament incorporate matters raised in requests for audits. This year, we covered ex‑gratia payments (voluntary payments an entity is not legally required to make under contract) in our report State entities 2023 (Report: 11: 2023–24).

How efficiently we processed requests

This year, we increased how quickly we responded to requests. We sent detailed responses to 85 per cent of those submissions within 30 days of receipt, which is up from 81 per cent in 2022–23.

The average duration of requests we had in progress this year was 10.4 months, slightly slower than 9.2 months in 2022–23. On average, we had 25 active requests at the end of each month, the same as 2022–23.

The cost of managing requests for audits comes from the investigative work and liaison we do to determine what actions we will take. This year, the average cost of the high-priority investigations we finalised was $5,736 per request, down from $9,755 in 2022–23. We achieved this by streamlining how we analyse requests, liaise with our client-facing staff, and report on the requests. This efficiency also reflects less complexity in the requested audits.

3. Overview of our financial position

We aim to lead by example in holding ourselves to the high standards we expect from the public sector entities and local governments we audit, and ensuring long‑term financial sustainability. We ensure we provide cost-effective and valued audit and assurance services to parliament and our fee‑paying clients.

This year’s results reflect our ongoing focus on driving efficiency and improving how we manage our operations, while managing employee resource fluctuations and market demand for qualified audit professionals.

We remain financially sustainable in terms of our revenue, staff costs, and net surplus, with a current ratio of assets to liabilities of 7.7 as at 30 June 2024 (current ratio measures whether an organisation is sustainably balancing its assets, financing, and liabilities and is a general metric of financial health). This indicates an excellent ability to pay our debts as they become due.

We delivered our services with little impact on our overall financial position, with our revenue and operational expenses tracking well against our budget for 2023–24.

Our funding from parliament for 2023–24, received under the Appropriation Act 2023 and the Appropriation Bill 2024, was $8.13 million. This appropriation is allocated to reporting and advice or assistance to parliament, delivering performance audit and assurance activities, preparing our forward work plan, investigating requests for audits, and remunerating the Auditor‑General.

Our overall income from our continuing operations was $54.1 million, slightly over our budget of $51.5 million.

QAO recognises the revenue from the audit fees we need to charge our clients for our financial audit services on a full cost recovery basis. High-quality, outcomes-focused and timely audits are a time and labour-intensive process. The fees we charge to deliver our audit services need to recover both direct and indirect costs. Approximately 84.5 per cent of our revenue comes from our client fees and the revenue from fees this year was $45.7 million, slightly over our budget of $43.6 million. This is due to additional work arising from machinery of government changes, in addition to early 2024 year-end audit testing.

QAO’s total expenses from our continuing operations was $53.9 million, marginally over our original budget of $51.7 million. Over half of our expenses were employee costs at $29.5 million, which was above our budgeted $28.6 million, due to our need to recruit additional, suitably qualified people from a competitive labour market. This work included (and will include into next financial year):

- the increase in staff salaries per wage increases from state government certified agreements – QAO must self-fund ongoing wage increases

- addressing 2023 strategic review recommendations regarding our ability to resource all our audit and assurance services

- upskilling our capability with specialised training and development, particularly following significant changes to the audit landscape such as that on climate-related reporting and assurance

- improving how we use audited entities’ information and data to derive further efficiencies in our services for them. We must continue to improve the security and handling of the data we source and house to manage the evolving and increasing cyber security risks all organisations face.

Our supplies and services were $23.8 million, $1.3 million over our budget of $22.6 million, primarily due to increased costs related to our information technology (IT) needs, and our need to engage audit service providers to help us execute our mandate in delivering our audit work.

Our other expenses were conservative, primarily covering rent and office services, minor office equipment, and staff development.

QAO’s financial statements and independent auditor’s report are from page 34 of this annual report.

4. Leadership, governance, and risk

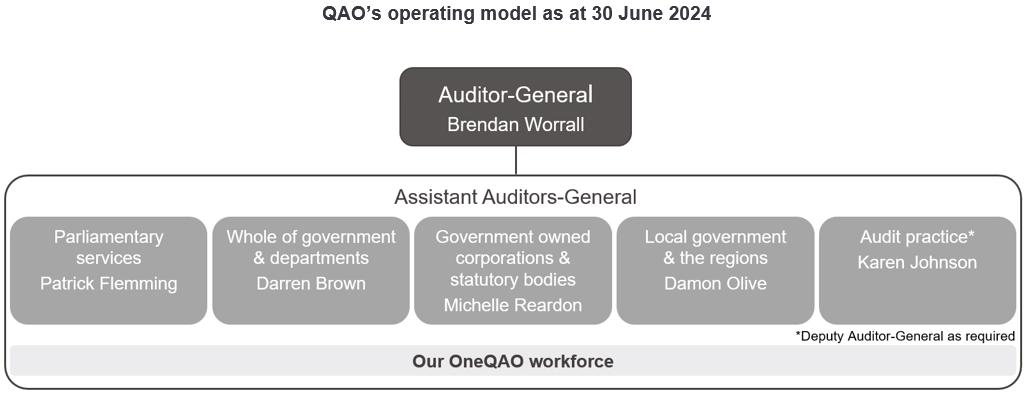

Our OneQAO organisational structure ensures all aspects of our service delivery are cohesive, so our clients experience more consistent services.

The Executive Management Group (EMG) supports the Auditor-General in meeting QAO’s responsibilities under the Auditor-General Act 2009, governs QAO’s strategic direction, and leads us to achieve our vision and purpose.

Our EMG and leaders drive successful business improvement and transformation opportunities, model our core values, and influence our positive culture. Our Assistant Auditors-General oversee our client services, quality, and people.

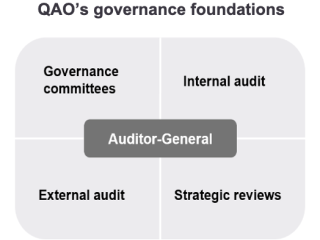

Governance framework

Our governance arrangements promote effective and accountable risk management. Our governance committees and groups challenge and monitor our risks, and our proactive or responsive actions.

Executive Management Group (EMG)

QAO’s EMG determines QAO’s strategy and budget; leads us in achieving our objectives; and helps us optimise, monitor, and report on our performance and risks. The 6‑member group convenes monthly.

The Audit and Risk Management Committee

The Audit and Risk Management Committee (ARMC) is an advisory committee to the Auditor-General. It is comprised of 3 independent members who bring in expertise from other industry environments.

The ARMC provides oversight of QAO’s risk, control, and fiscal responsibilities underpinning our corporate governance. It met 4 times in 2023–24. Details of committee membership are included in Appendix C.

Section 30(3) of the Financial and Performance Management Standard 2019 states that in establishing an audit committee, an accountable officer must have regard to the audit committee guidelines Queensland Treasury provides. In October 2023, Queensland Treasury updated the guidelines, and QAO ensured it applies its requirements. This includes ensuring our committee’s 3 members are all external and independent to QAO. Our charter details the committee’s responsibilities and appropriateness of the members’ skills, and includes that the committee must assess and report to the Auditor-General on its performance.

The Audit Quality Sub-Committee

The Audit Quality Sub-Committee is a sub-committee of the ARMC. It is responsible for advising the ARMC on quality assurance activities across QAO’s audit services. It monitors QAO’s audit quality activities and advises the ARMC of any unmanaged quality risks. All 3 committee members are independent. The committee met once in 2023–24.

Projects board

QAO’s Projects board monitors and oversees QAO’s initiatives, which we set up in response to risks and opportunities the business faces, including data analytics, learning and development, and the efficiency of our audit document filing processes. The board is accountable to the EMG and provides recommendations on project direction.

The board is comprised of 4 members, including one external, independent member, and is chaired by a member of the EMG. The Auditor-General has a standing invitation to attend meetings as an observer. The board met 9 times in 2023–24.

Sub-committees of the EMG

Our governance structure includes sub-committees to the EMG, which monitor and make recommendations regarding the primary risks QAO faces.

People Committee

QAO’s People Committee guides how we manage our strategic risk of recruiting and retaining the right people to uphold our values and ethical and quality standards. This includes QAO’s recruitment and retention decisions that require Auditor-General approval.

The committee is comprised of 3 Assistant Auditors-General. QAO’s Director – Human Resources is also invited to attend meetings. It met 12 times in 2023–24.

Quality Management Group (QMG)

This group supports the Auditor-General in complying with professional and ethical requirements and provides leadership to QAO in achieving quality audit and assurance outcomes. The QMG members monitor all aspects of QAO’s quality assurance framework.

The group is comprised of 3 Assistant Auditors-General. The chair may invite the Senior Director – Audit Practice, and other specialists. The group met 3 times in 2023–24.

Information and Cyber Governance Committee

This committee guides governance of matters relating to information, data, and cyber security. It focuses on compliance with legislation and government policy, and on increasing data governance awareness and capability within our organisation. This includes compliance per section 53 of the Act and to the Information Privacy Act 2009, Public Records Act 2002, and the information security policy (IS18:2018).

The committee is comprised of 3 members, chaired by a member of the EMG. It met 3 times in 2023–24.

Finance Management Group

This group supports the Auditor-General in complying with the Financial Accountability Act 2009 and the Financial and Performance Management Standard 2019. It reviews QAO budgets, service delivery statement measures and reporting, budget updates, and annual financial statements.

The committee is comprised of 3 members, chaired by a member of the EMG. It met twice in 2023–24.

Project Independence group

This group provided oversight and guidance on implementing amendments to the Auditor-General Act 2009 on transitioning the employment of QAO staff from the Public Sector Act 2022, which occurred on 13 December 2023.

The group was comprised of 6 members who represented subject matter experts from across QAO, on matters such as human resources and QAO’s legislation. It was chaired by a member of the EMG and met fortnightly or as needed.

Major legislative change for QAO

In 2022, Queensland Parliament first passed the Integrity and Other Legislation Amendment Act 2022, amending the Auditor-General Act 2009 (the Act). Some amendments took effect in March 2023, and the remaining in December 2023.

The primary amendments covered formal recognition of the Auditor-General as an officer of the parliament, employing our people under the Auditor-General Act 2009, enabling us to conduct performance audits of government owned corporations, and increasing oversight by the Cost of Living and Economics Committee.

In February 2024, parliament passed the Integrity and Other Legislation Amendment Act 2024, which further amends the Auditor-General Act 2009. The 2024 amendments that apply to QAO will include parliamentary oversight of the appointment of the Auditor-General, QAO’s funding proposals, and the annual report. The new requirements will commence during 2024–25.

Implementing the changes to our legislation was a significant body of work for our office, in particular for our specialists in our parliamentary services and human resources areas. It entailed deep understanding of various legislation, external engagement with stakeholders, and ongoing consultation with our workforce on the changes.

2023 strategic review of our office

Approximately every 5 years, a strategic review of QAO is conducted by an independent reviewer, appointed by the Governor-in-Council. The reviewers engage with us and our clients to understand how well we are operating and fulfilling our mandate. We welcome these reviews as an important opportunity for us to improve our services and operations.

In May 2023, Her Excellency the Governor of Queensland appointed the 2023 strategic reviewers, and the final report was tabled in parliament on 15 February 2024. The Cost of Living and Economics Committee (COLEC) held a public briefing with the reviewers on 15 April 2024, and a public hearing with the Auditor-General on 29 April 2024. COLEC’s report is due in September 2024.

The 2023 review terms of reference covered the functioning and operation of QAO, including how QAO discharges its responsibilities.

The 2023 reviewers also looked at the recommendations in the 2017 strategic review of QAO, and those in the 2022 Coaldrake Review: Let the Sunshine in – Review of culture and accountability in the Queensland public sector.

Summary of the review conclusions

The 2023 strategic review report and QAO’s response is available on our website: www.qao.qld.gov.au/about-us/external-reviews. Overall, it noted:

- The preceding 5 years have been a tumultuous period, domestically and internationally, and that QAO has navigated these challenges and served the state well.

- Queensland gets good value from its investment in QAO.

- QAO’s functions are performed economically, effectively, and efficiently.

QAO accepted the 58 recommendations the reviewers made:

- Forty-seven of the recommendations are directed to QAO (including 9 made to the incoming Auditor‑General about our organisational structure, planning, governance, and internal workforce challenges).

- Nine recommendations are directed to external parties, including to COLEC and the executive government, as stakeholders required for legislative change, and public sector entities regarding their completion of our client satisfaction surveys.

- Two recommendations closed out the recommendations from previous strategic reviews of our office, which the 2023 reviewers decided should no longer be followed up due to changed external circumstances or QAO’s actions in response.

We were pleased to hear that the review found QAO’s professionalism, expertise, the approach of its staff, and the assurance it provides were highly regarded.

It found that our financial audits complied with QAO’s methodology and auditing standards and provided useful and relevant feedback to stakeholders. However, it noted some areas for improvement regarding our processes for how we manage our documentation. The review also found areas for improvement regarding our performance audits, stating:

‘QAO’s performance audits are sound and robust. However, we also identified areas where there are room for improvements.’ – 2023 Strategic Review of the Queensland Audit Office. Page 11.

Our progress in implementing the 2023 recommendations

We have prioritised the timing and order for our completion of each recommendation based on a combination of risk, complexity, progress of existing initiatives, and corporate capacity to implement changes. We started work in December 2023 when the reviewers provided the final report to the Premier for tabling in parliament. Some of the recommendations were already underway, as they covered improvement opportunities we were already aware of and addressing.

Some recommendations will require a longer-term focus to be of full benefit. They require a staged approach over several years before they can be considered as fully addressed, and some recommendations entail multiple steps or actions, which we will steadily and progressively undertake.

We are reporting our implementation progress to QAO’s EMG and ARMC, and COLEC. We are also keeping our people informed of our actions, and updating our clients and stakeholders at our events and meetings, as relevant or of interest to them.

We will only ‘close’ a recommendation once we have sufficient evidence demonstrating that all aspects have been effectively addressed, as validated by QAO’s internal auditors. The next strategic review of QAO is due 5 years after the Queensland Government responds to the parliamentary committee’s (COLEC’s) report.

Overview of QAO’s implementation of 2023 strategic review recommendations

| Recommendation type | In progress | Not | Closed | Total |

|---|---|---|---|---|

| 2023 – made to QAO | 35 | - | 3 | 38 |

| 2023 – made to the incoming Auditor-General | - | 9 | - | 9 |

| 2023 – made to external parties | - | 8 | 1 | 9 |

| 2023 – no further follow up required | - | - | 2 | 2 |

| Sub-total | 35 | 17 | 6 | 58 |

Sharing what we learned from the review process

QAO’s preparation for, and work on, the strategic review was sizable. Before the review commenced, we identified and collected the information the reviewers may need, who in our office was responsible for collating it, and how they could do so as part of their day-to-day job. We set up a secure system and central repository to efficiently house data and documents, and regularly reported on our preparation progress to the EMG.

Following the tabling of the strategic review report, we published a blog on our website on What we learned from an external review of our office. While an audit and an external review differ in their approaches and levels of assurance, we shared parallels between the 2 on how best to prepare to ensure maximum value. In our blog, we outline how we prepared and what we learned, and include a list of tips for others.

QAO’s internal audit function

Internal audit conducts independent and risk-based assurance activities, aiming to improve QAO’s operations. It works in accordance with an annual plan, and its charter aligns with the International Standards for the Professional Practice of Internal Auditing. QAO engaged Bellchambers Barrett to deliver its internal audit program this year, which included assessing:

- the adequacy and effectiveness of QAO’s accounts payable processes and controls

- the design and operating effectiveness of QAO’s process for translating directives of the Public Sector Act 2022 following our transition to employing our people under the Auditor-General Act 2009

- phase 2 of the effectiveness of QAO’s process for calculating fee-for-service (end-to-end) revenue based on our timesheeting and rates we charge our clients

- the completeness and accuracy of data migration for the transition of our payroll system

- the maturity of QAO’s information security management system (ISMS) against ISO 27001.

The results of the internal audits and QAO’s subsequent actions are reported to the Auditor-General, the EMG, and ARMC.

External audit of QAO

Sections 71 and 72 of our legislation, the Auditor-General Act 2009, detail the requirements for an independent audit of QAO. An auditor is selected through a procurement process undertaken by the Department of the Premier and Cabinet and then appointed by the Governor-in-Council.

Similar to what QAO’s audits do for public sector and local government entities, our external auditors provide assurance that the information in our financial statements can be relied upon, and that the statements are free from material misstatement and comply with relevant legislation.

Our risks and responses

Integrated risk leadership

QAO’s risk management approach encompasses our culture, processes, and structures for identifying, responding to, and controlling existing and emerging risks. We use our assessments as input into our strategic and business planning, and we apply them to our operations, projects, and business decisions.

QAO records the key risks it identifies in risk registers, which we report on quarterly to the EMG and our governance committees.

Some of the 2023 strategic review recommendations related to our risks, which we are either already addressing or have since commenced action on.

Managing the capacity and capability of our workforce

Industry-wide recruitment and retention challenges continue, with high market demand and a reduced pool of suitable candidates for professional audit positions. Our profession is also seeing less people undertake relevant university qualifications. This means we face risks to how we can resource our audits in-line with client expectations, without compromising the wellbeing of our people.

Further, the 2023 strategic review of QAO highlighted the results in the 2022 and 2023 annual Working for Queensland survey that our staff are feeling increased workload pressure, and their workload is having a negative effect on their health.

In response to the above factors, we have progressed our strategic workforce planning to identify and bridge any gaps between our current and future workforce needs including the number of, and skills‑types, of our employees. Our actions to help us attract and retain the right people this year included:

- increasing our staffing at each level so we can meet the scope of our work, and support non-billable activities (such as training to meet changes in the auditing landscape)

- ensuring our learning and development curriculum (Chapter 6) targets, and invests in, the capabilities we need now and for the future

- continuing to mature the service delivery that our ASPs provide with what our clients expect and value, including increasing training, feedback, and performance management for ASPs

- revising our performance management system so our employees have clear, measurable goals to work towards, and we quarantine time for coaching and development on the job

- streamlining how quickly we can promote and recruit for available positions, and improving how we onboard new starters so they are well-positioned to immediately add value

- prioritising our graduate and undergraduate development program to attract, retain, and upskill our future workforce

- continuing to implement QAO’s wellbeing framework, which is grounded in 8 dimensions of: occupational, social, physical, financial, spiritual, emotional, environmental, and intellectual

- continuing to meet our workplace health and safety requirements

- examining how we source shorter-term contractors and specialist capability so we can efficiently support higher-tempo periods during the year.

Improving how we resource our audit work

A major activity this year was refining how we resource our audits so our clients receive consistent services over time, we remain responsive to unexpected work, and we align the knowledge our people have with our clients’ needs. All while giving our employees rich experiences and greater team stability.

Our resourcing approach means we organise our people under ‘communities’, which are like large portfolios, servicing clients by industry or industries.

In October 2023, we launched our communities and, throughout this year, continued to smooth task allocations and identify efficiency opportunities. We also set up support tools to ensure consistent ways of working across our business, complemented by our employee engagement activities (Chapter 6).

Recruitment and staffing

The number of employees QAO needs has increased. In addition to meeting workload demands, we must upskill our people with specialised training. We also need to deploy staff to projects that meet or enhance our service requirements.

Some examples of this include:

- implementing additional audit quality requirements following recent changes to Australian auditing standards and professional requirements

- auditing of climate and sustainability disclosures, which are required under Commonwealth legislation for 8 large Queensland Government-owned companies from 1 July 2025

- addressing the recommendations from the 2023 strategic review of QAO

- auditing of new entities and their transactions, such as those associated with the delivery of the 2032 Brisbane Olympic and Paralympic Games

- maturing how we use audited entities’ data to derive further efficiencies in our services for them. And continuing to improve the security of the data we house per evolving cyber security risks.

In response, we look to attract the right candidates by advertising our unique employee value proposition, and using both traditional and emerging recruitment methods. We also connect with professional bodies, universities, and student societies to promote our organisation and career opportunities.

To source the skills we need for the large and rapidly evolving area of climate-related reporting, we are engaging with our peers via the Australasian Council of Auditors-General (ACAG), and collaborating with industry specialists. We have also established a working group comprising EMG members and senior staff who audit the entities the reporting will first affect.

Changes to how we employ our people

Following the major changes to our legislation this financial year, and in what was a special milestone event for our office, on 13 December 2023 our employees transferred employment from under the Public Sector Act 2022 to the Auditor-General Act 2009.

Employment conditions largely remained the same for most of our people. However, this change will give us more flexibility and predictability for our strategic workforce planning and will allow us to be more responsive to market standards for audit professionals.

Ahead of, and during, the employment changes, we engaged closely with our people via a change management initiative and provided a wide range of supporting materials.

Providing valued client engagement

Our clients are required to undergo our audit services, rather than choose us as a provider. As such, we must be aware of the authority our role and work carries, and what this means for our relationships.

We receive feedback on our services via our independent client surveys (Chapter 2), via external mechanisms including the strategic review of QAO, and directly from clients when we meet with them or visit their work sites. Through this, we act on opportunities for improvement.

To mitigate risk, we centre our relationships at the core of our strategic plan (Chapter 2), and consider them in all our operations, across all facets of our business. We:

- analyse our large and varied client base to identify those whom we need to engage with more, and better. This also means we can focus on those entities that are responsible for delivering a significant volume of public services and/or have influence over other entities

- analyse our client surveys to identity any trends, by service area, client type, location, and audit teams

- consult early on our planned audit program, upcoming audit work, and draft reports to parliament

- produce additional resources, on top of our mandated services, to support and help our clients – such as our blogs, fact sheets, better practice guides, and events

- seek to better understand our clients and the unique environments they operate in by speaking and/or meeting with them more frequently, including at their work locations across Queensland

- mature the service delivery of our audit service providers so it is in line with ours and our clients’ standards and expectations

- ensure transparency around our work, and how and why we do it via our annual report, transparency report, correspondence with clients and stakeholders, and via our external communication channels

- educate and coach our people so they understand how and why to build long-term productive relationships, and set performance goals on effective client engagement and communication

- grow our relationships with our peers at other audit offices, integrity bodies, and professional bodies to expand our knowledge.

QAO’s organisational structure and operating model is geared to enable close oversight of our client engagement. This includes having Assistant Auditors-General – Client Services oversee client engagement and audit quality, meet with clients throughout the year, and develop our people.

How we manage complaints

This year, QAO received 7 complaints, mostly related to our processes for delivering financial audit services. We take any complaints seriously and manage them in accordance with policy. Our process for addressing complaints aligns with best practice, including the Queensland Ombudsman’s complaints management guidance.

This year, we strengthened our process by implementing new action plans for our people and our audit service providers to help monitor our client relationships. We use these plans if we receive a complaint, but also if client dissatisfaction becomes apparent through our independent client surveys or via client engagement.

Assuring quality audit services

The overarching aims of audit quality can be summed up as the degree of excellence with which we consistently perform our audits. We aim to deliver quality audits with insightful impacts that meet the expectations and regulatory requirements of our clients. This includes assuring that our work is supported by sufficient and appropriate audit evidence, and that we conduct effective client engagement.

We have controls in place to ensure we meet these responsibilities. This year, we continued to deliver:

- risk-based audit methodologies

- an annual quality assurance plan targeting riskier audit jobs

- reviews by engagement quality officers of our audit work and our reports to parliament

- reviews of our audit service providers’ performance and their systems of quality control

- effective resource allocation, ensuring the right mix and skills of people for our clients’ needs

- an integrated learning and development program to grow our capability and share learnings.

The Auditor-General Act 2009 requires us to table in parliament the standards by which we perform our audits – the Auditor-General Auditing Standards. Under these standards, we adopt the standards issued by the Auditing and Assurance Standards Board (AuASB) where relevant.

Transparency report

To demonstrate our commitment to audit quality, we voluntarily publish on our website a transparency report each year. It explains our quality program and results, how we seek to improve our audit practices, and describes our systems of quality management. We published our Transparency report 2022–23 in October 2023: www.qao.qld.gov.au/reports-resources/reports-parliament/transparency-report-2022-23.

Acting on the evolving risk of cyber security

Cyber security is a primary risk for all organisations globally, and at QAO we continued our journey to improve and address any emerging risks and threats. Our controls help us monitor and act on risks before they become an issue, and to ensure we can respond to and recover from an incident.

Our robust policies, standards, procedures, and planned activities help ensure the security of our information and protect the integrity, confidentiality, and availability of our information assets.

This year, we continued to update and improve our information security management system in accordance with ISO 27001 – the leading international standard for information security. We continued to implement the Australian Cyber Security Centre’s ‘essential eight’ maturity model for mitigating cyber risk, including the centre’s updates in November 2023. QAO diligently ensured our organisation strives for the highest possible level of maturity.

We continued our education campaigns across our workforce to ensure our people know about their obligations under the Auditor-General Act2009. This includes ensuring protected information is not divulged or made public, adhering to correct record keeping protocols, and reporting any breaches. Importantly, we continued our focused engagement with our contracted audit service providers to ensure they understand these critical requirements.

5. The impact from our services

We intend for our work to have an impact where we foster change by supporting and motivating entities to improve their service delivery, as well as holding them to account for how they use taxpayers’ dollars. To do this, we follow up on entities’ progress on acting on our recommendations, and we optimise and share the deep and broad insights from across our work via a range of methods.

Monitoring implementation of our recommendations

While our mandate does not extend to forcing entities to act on our recommendations, each year we ask them to self-assess their implementation progress. We then report to parliament on the results.

This approach gives entities and audit committees clarity over the current status of QAO recommendations. It also gives them a record of all performance audit recommendations we make to them, including those re‑directed from machinery of government changes.

Our resultant report to parliament includes insights on the most common types of recommendations we make – indicating shared challenges and opportunities across entities. It shows the recommendations that entities are least likely, or slower, to implement.

We tabled our report 2023 status of Auditor-General’s recommendations (Report 3: 2023–24) in parliament in November 2023. For it, we asked 98 entities to self-assess their progress in implementing the recommendations we made to them across the 18 performance audit reports we tabled in 2020–21 and 2021–22. We also requested updates on outstanding recommendations from our 2022 report.

Twenty of the 98 entities reported fully implementing our recommendations. Fourteen of the reports we tabled in 2020–21 and 2021–22 have outstanding recommendations, and entities reported implementing 41 per cent of the 146 outstanding recommendations in our 2022 report.

In its response to our report 2023 status of Auditor-General’s recommendations, Queensland Health said ‘I would like to acknowledge the valuable insights, important work undertaken and the continued assistance provided by your team to the Hospital and Health Service and Department of Health personnel regarding this process.’

Each year, as set out in our forward work plan (Chapter 2), QAO conducts a detailed ‘follow-up’ audit with a resulting report to parliament. We use the responses from the status of recommendations project above to help inform what this follow-up audit will be, along with our other intelligence sources and analysis.

Sharing our insights

We can achieve more positive outcomes from our work when we share the insights from our reports beyond the tabling period, and beyond the entities we make recommendations to. Many of the learnings in our reports are pertinent or of interest to other entities. Further, with entities and their people frequently changing, we continuously share and re-promote the enduring insights from our reports and guidance.

Our resources are guided by a strategy, with each reflecting an area of audit focus per our forward work plan (Chapter 2). We ensure we publish our resources at the right time, so they benefit entities.

Maturity models and other self-assessment tools

For some of our reports, we develop maturity models, guides, or tools, for example, our models on asset management, fraud assessments, and financial statement preparation. In 2023–24, we produced 6 new better practice guides covering procure-to-pay functions, fraud and corruption, financial statement preparation, and cyber security.

Our most viewed guide for this year of those we produced in any year was the Risk management maturity model, at 901 views, which was followed by the Fraud and corruption self-assessment tool at 528 views.

Blog on topical matters

QAO’s blog continues to be one of our most popular channels, allowing us to synthesise insights from our work into small articles and share advice quickly.

In 2023–24, we published 25 blogs. Our blog channel was viewed a total of 24,981 times this year. Our 3 most read blogs were: Effective asset management plans and their long-term benefits at 542 views, Ex‑gratia payments – what those charged with governance need to consider at 528 views, and Can confidential information be disclosed in financial statements? at 491 views.

Some of our blogs form part of an ongoing series, which reflect systemic issues that have a lot of subject matter to cover. This year, these included the challenge of performance monitoring and reporting, asset management, and risk management.

Interactive data dashboards

Alongside some of our reports to parliament, we illustrate our insights via interactive data dashboards: www.qao.qld.gov.au/reports-resources/interactive-dashboards.

We refresh our dashboards for our results of financial audit reports each year, sharing easy‑to‑understand financial performance results for entities and interesting demographic information.

One of our most popular dashboards accompanies our yearly status of Auditor-General’s recommendations report, allowing our readers to search based on their interests or role. This year, it was viewed 1,366 times: www.qao.qld.gov.au/status-auditor-generals-recommendations-dashboard.

Another key dashboard for us is our QAO Queensland dashboard, where we highlight key insights and data from across all our dashboards: www.qao.qld.gov.au/reports-resources/qao-queensland-dashboard. This dashboard has been viewed 2,272 times this year.

Our dashboard Understanding grants: www.qao.qld.gov.au/understanding-grants, brings together data from the Queensland Government Open Data Portal, and additional information relevant to understanding the local context for grants. This year, this dashboard was mentioned on the www.ourcommunity.com.au online newsletter, an organisation that delivers grant making, grant seeking, and grant management technology for the community across Australia.

Overall, this year, all our dashboards were viewed 9,516 times in total.

QAO’s first podcast

We aim to keep pace with the communication channels our audiences are using and how they prefer to receive information. We seek out innovative methods for sharing the insights we gather from across our years of work, and from across multiple entities.

In late 2023–24, QAO launched its first podcast, covering our reports related to cyber security. Launched on 4 June 2024, the podcast had been listened to by 208 people as at 30 June 2024.

Following our tabling of Responding to and recovering from cyber attacks (Report 12: 2023–24) and its supporting resources for entities, we received significant interest and positive feedback from clients and others who work in the cyber or governance areas.

One stakeholder wrote to the Auditor-General shortly after, reflecting on our report findings and recommendations: