Overview

Entities within Queensland's education sector help individuals transition through all stages of their schooling, giving them knowledge and skills they need for future education, training, or the workforce.

Tabled 10 June 2024.

Report on a page

This report summarises the results of our audits of the entities in Queensland’s education sector, including the Department of Education; the Department of Employment, Small Business and Training; TAFE Queensland; 7 universities; 8 grammar schools; and other statutory bodies.

Financial statements are reliable

All education entities’ financial statements are reliable and comply with relevant reporting requirements. The entities have efficient and effective financial statement processes, and they prepared good quality financial statements.

Entities still need to improve their systems and processes

We continue to identify weaknesses in entities’ internal controls (systems and processes), particularly regarding their information systems. While the entities are addressing deficiencies identified in prior years and improving the security of their information systems, the risk of cyber attacks continues to increase. The sensitive nature of information the entities hold about students and research makes them an attractive target. They must continuously review and strengthen all their information systems to respond to changes within their entity and to the evolving cyber security risk.

We also found issues with controls for payroll, and for recording building construction costs that have not yet been paid for.

Universities are facing financial challenges

Most universities continued to make a loss in 2023, despite recording higher investment revenue. Their costs are escalating due to rising inflation, increased wages, and expenses associated with the return of international students and the reopening of borders. In addition, domestic enrolments continue to decline, as students defer or reduce studies to work to manage their costs of living. Some universities are impacted by the need to fix wage underpayments.

Universities' higher investment revenue was due to a recovery in market conditions this year. This may not be guaranteed in the future. The reopening of borders in 2022 also saw an increase in revenue in 2023 from international student numbers nearing pre-pandemic levels. However, this growth may be affected by the Australian Government's proposed introduction of caps to international students announced alongside the May 2024 federal budget.

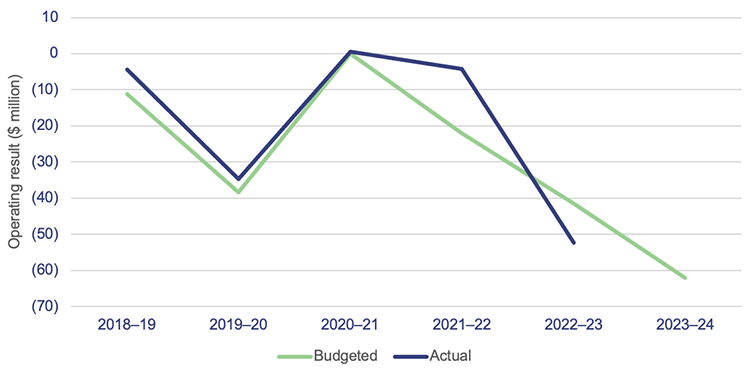

TAFE Queensland’s financial sustainability remains a risk

TAFE Queensland’s financial results have been deteriorating for several years, and based on current projections, this is expected to continue. It faces significant financial challenges in meeting government’s service expectations and will need to continue assessing its cost of service delivery. TAFE Queensland is also working with the Queensland Government on strategies to support its financial sustainability.

Departments have not met their budgeted capital spend

Both departments faced challenges in achieving their capital expenditure targets in 2022–23, with actual expenditure that was (averaged over both departments’ figures) 22.6 per cent less than planned. This was due to shortages in materials and labour, which impacted on the timing of work being performed, causing delays in some projects. Capital underspend can mean assets may not be replaced when required.

1. Recommendations

This year, we are making the following recommendations for all education entities.

| Strengthen information system controls (Chapter 3) |

1. With the evolving security threats, we recommend that all education entities:

|

| Improve processes to capture and record ongoing building project costs that have not been paid for by the year-end date (capital accruals) (Chapter 3) |

2. All education entities should:

|

| Assess employment agreements and historical pay practices to identify potential wage underpayments (Chapter 3) |

3. All education entities should:

|

Prior year recommendations require further action

Education entities need to take further action to address the recommendations made in our Education 2020 (Report 18: 2020–21), and Education 2021 (Report 19: 2021–22) reports. We continue to identify weaknesses in the security of their information systems.

The Department of Education; the Department of Employment, Small Business and Training; and TAFE Queensland still need to take further action on 2 other recommendations as listed in Appendix D.

We have included a full list of prior year recommendations and their status in Appendix D.

Reference to comments

In accordance with s.64 of the Auditor-General Act 2009, we provided a copy of this report to relevant entities. In reaching our conclusions, we considered their views and represented them to the extent we deemed relevant and warranted. Any formal responses from the entities are at Appendix A.

2. Entities in this report

This report summarises the financial audit results for education sector entities as at their year-end dates for preparing financial statements. For the Department of Education; the Department of Employment, Small Business and Training; TAFE Queensland; and some statutory bodies, this was 30 June 2023. For universities, grammar schools, and other statutory bodies, it was 31 December 2023.

We provide 37 opinions for this sector. Our analysis in this report focuses on the 18 entities highlighted in Figure 2A (some appear twice), representing 99.2 per cent of the revenue within the education sector.

Notes: Yellow outer circles indicate the entities included in this report.

CQU – Central Queensland University; DoE – Department of Education; DESBT* – Department of Employment, Small Business and Training; GU – Griffith University; JCU – James Cook University; QUT – Queensland University of Technology; TAFEQ – TAFE Queensland; UQ – The University of Queensland; UniSQ – University of Southern Queensland; UniSC – University of the Sunshine Coast.

* The Administrative Arrangements Order (No. 1) 2023 on 18 May 2023 and the Administrative Arrangements Order (No. 2) 2023 on 15 December 2023, made by the Governor in Council, changed the department names and responsibilities. This report reflects the departments that existed during 2023. The Department of Employment, Small Business and Training (DESBT) was initially restructured to include the functions of Youth Justice to form the Department of Youth Justice, Employment, Small Business and Training (DYJESBT). This was the name of the department when we issued our audit opinion on the 2022–23 financial statements. In December 2023, DYJESBT was restructured again to form 2 departments – the Department of Youth Justice; and DESBT.

Queensland Audit Office.

3. Results of our audits

In this chapter, we provide an overview of our audit opinions for entities in the education sector. We also evaluate the effectiveness of the systems and processes (internal controls) the entities use to prepare financial statements.

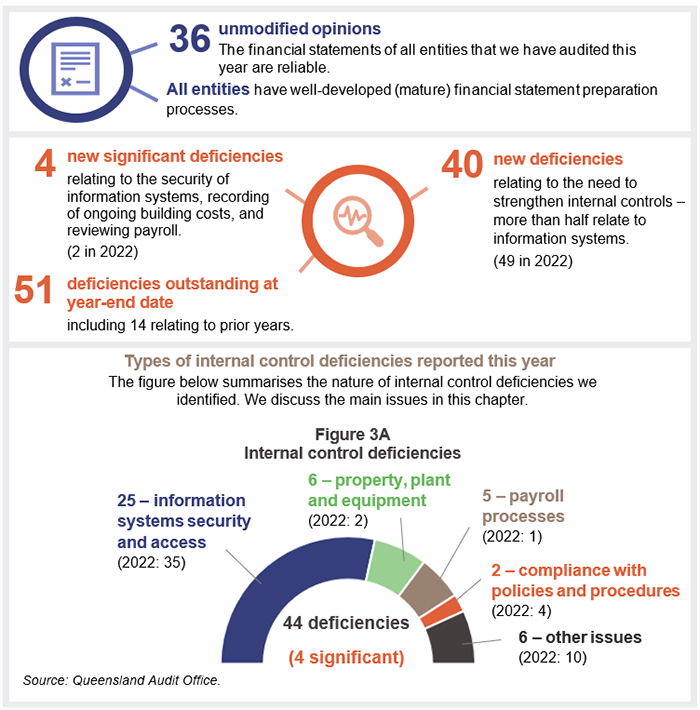

Chapter snapshot

A deficiency arises when internal controls are ineffective or missing, and are unable to prevent, or detect and correct, misstatements in the financial statements. A deficiency may also result in non-compliance with policies and applicable laws and regulations and/or inappropriate use of public resources.

A significant deficiency is a deficiency, or a combination of deficiencies, in internal controls that requires immediate remedial action.

Audit opinion results

We have issued unmodified opinions for all of the education entities in Queensland that we audited this year. This means users of the financial statements can rely on the results in them.

Four universities’ financial statement preparations were affected by an accounting issue that was not resolved by their legislative deadline and they received an extension from the minister. All other education entities met their legislative deadlines (except for 2 that were not finalised at the date of this report).

We express an unmodified opinion when financial statements are prepared in accordance with the relevant legislative requirements and Australian accounting standards.

We provide the details of our audit opinions in Appendix E.

Entities not preparing financial statements

Not all Queensland public sector education entities produce financial statements. Appendix F provides the full list of entities not preparing financial statements and the reasons.

Entities should further strengthen their internal controls

We assess whether the internal controls entities use to prepare financial statements are reliable, and we report any weaknesses in their design or operation to management for action. We rate these weaknesses as either significant deficiencies (higher risk that require immediate action by management) or deficiencies (lower risk that can be corrected over time).

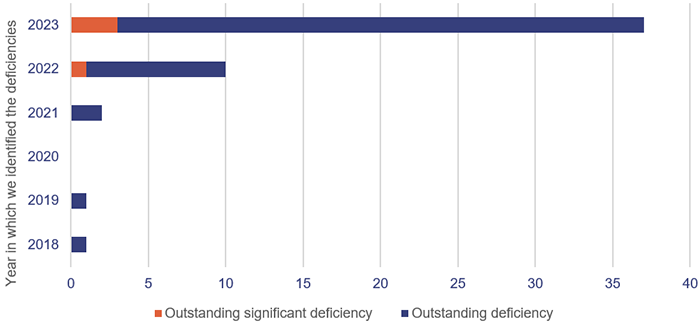

Overall, we found that the internal controls education sector entities have implemented to ensure reliable financial reporting are generally effective but can be improved. We were able to rely on the internal controls for the purposes of our audits, but identified 4 new significant deficiencies and 40 new deficiencies in the current financial year.

The significant deficiencies were for:

- not adequately monitoring the activities of internal and third-party users (for example, contractors) who had been given unrestricted (full-system) access to information systems. In addition, the security settings (for example, password settings) for third-party users were not in line with the entity’s internal policies

- not performing reviews of the access of users for some information systems applications

- not having appropriate processes to accurately capture and record ongoing costs for building projects at the year-end date

- not adequately reviewing payroll data integration and reports between 2 separate payroll systems.

As part of our audits, we monitor how entities resolve the weaknesses we have identified. Entities have strengthened their internal controls by resolving most long-outstanding issues. In 2023, they resolved 42 (86 per cent) of the issues outstanding from previous years (2018 to 2022).

Figure 3B shows the number of internal control deficiencies we have identified since 2018 that were unresolved as at the 2023 year-end date. All issues we raised before 2018 are resolved.

Notes: We identified 4 new significant deficiencies and 40 new deficiencies in the 2023 financial year. Education entities had addressed 7 of these issues at the 2023 year-end date, with 3 significant deficiencies and 34 deficiencies outstanding.

Queensland Audit Office.

Proactive and timely resolution of deficiencies indicates a strong foundation for the effective operation of internal controls. At present, 4 significant deficiencies (1 from last year) and 47 deficiencies (13 from prior years) remain outstanding. The open issues mainly relate to information systems (51 per cent), and entities expect to resolve these within the next 12 months.

Entities need to be proactive in identifying and addressing security weaknesses in their information systems

The Annual Cyber Threat Report 2023 from the Australian Cyber Security Centre again identified education as one of the 5 sectors most vulnerable to cyber security incidents. The threat to this sector is significant, as the entities hold attractive personal information on their students and employees, as well as intellectual property associated with research. They must continually assess cyber risk vulnerabilities and exposures. Those charged with governance need to oversee this and be kept well informed.

Most of the deficiencies we reported to entities in 2023 (60 per cent) related to internal control weaknesses regarding information systems. These included 2 significant deficiencies relating to how users access systems and how this is monitored (access management); and how security settings are implemented (security configuration). The most common weaknesses we identified related to entities:

- not securing high-risk accounts, such as those for people who have highly privileged/full-system access

- not adequately monitoring the activities of accounts for staff and third-party users (for example, contractors) who can access sensitive data and make changes within the system

- not restricting the access provided to staff and third-party users to only what they require to perform their jobs

- not updating security settings (for example, password settings) in line with each entity’s updated risk assessment, policies, and better practices.

Most education entities have taken steps in recent years to strengthen their information systems, but we continue to identify weaknesses as we look at more of their systems, databases, and networks. Some of the contributing factors include high staff turnover, lack of staff awareness of existing policies, and higher reliance on third-party providers. Our prior year recommendation – to strengthen the security of their information systems – remains relevant. Appendix D provides the full recommendation and its status.

The nature and the causes of the weaknesses we identified in information system controls highlight that education entities cannot ‘set and forget’ security controls. They should continuously review, improve, and strengthen controls to maintain their effectiveness. It is important that entities apply the appropriate security principles and recommendations to all systems they use to ensure all their information systems are properly secured.

As highlighted in our forward work plan for 2023–26, we plan to undertake an audit on managing third‑party cyber security risks. It will examine how effectively the Queensland Government identifies third parties with access to its data and networks, assesses related security vulnerabilities, establishes relevant controls, and minimises the impact of third-party security breaches.

Also, in State entities 2023 (Report 11: 2023–24), we have included a recommendation for all entities to manage the cyber security risks associated with services provided by third parties. We encourage education entities to consider this recommendation. Education entities should also action all relevant recommendations in Responding to and recovering from cyber attacks (Report 12: 2023–24).

Recommendation for all education entities Strengthen information system controls |

1. With the evolving security threats, we recommend that all education entities:

|

Entities need to accurately record ongoing costs for building projects

Education entities manage large building portfolios (worth $31.5 billion in 2023) that are fundamental to the delivery of education, with the 2 departments accounting for 79 per cent of the total value. All entities need to ensure they are accurately recording the cost to build and maintain these assets.

In 2023, we identified a significant deficiency at one entity relating to the way it recorded its capital accruals at the year-end date. It recorded the total costs remaining on these building projects (based on their budgets) rather than the actual work completed by the year-end date. This misrepresented the actual progress of building works, and resulted in its assets and liabilities both being overstated by $266 million (with no net effect on balance sheet). This was reported as an error in the prior-year balances (30 June 2022), which the entity corrected in its current year financial statements.

Capital accruals refer to costs recorded at the year-end date, indicating the progress made on long-term projects (for example, constructing a building), even though payment for these costs has not been made yet.

We also identified weaknesses in the way some entities are managing these, and the type of information entities use to record these accruals at the year-end date. These include:

- lack of appropriate supporting evidence for recording the capital accruals

- the absence of a formal methodology to calculate capital accruals

- lack of training on managing projects that require budgeting, analysing costs, and monitoring of progress and costs.

Recommendation for all education entities Improve processes to capture and record ongoing building project costs that have not been paid for by the year-end date (capital accruals) |

2. All education entities should:

|

Entities need to comply with enterprise agreements

Some Queensland public universities have underpaid certain staff mainly due to incorrect interpretation of complex enterprise agreements. Over the last 3 years, they have either repaid staff or recorded a liability for staff they have identified as being underpaid – at a combined total of $29.9 million.

All 7 universities have started reviews of their compliance with enterprise agreements. Some have substantially completed these reviews – in some cases going as far back as 2015 – while others are still in the process of assessing the extent of any historical underpayments of staff wages and entitlements.

From the reviews they have conducted, some universities have improved their systems and processes to reduce the risk of future staff underpayments.

In 2023, one university identified a significant shortfall relating to historical payment of staff wages and entitlements. This led to an error in the prior year’s balances and operating result, which the university corrected in its current year financial statements.

The underpayment was due to several factors, including:

- not having systems to identify compliance with enterprise agreements

- poor record keeping

- inadequate payroll systems

- misclassification of the duties or roles of casual academics

- low awareness among senior staff of new or changed obligations in enterprise agreements.

Entities must prioritise compliance, or risk facing reputational damage, disputes, or legal action.

Recommendation for all education entities Assess employment agreements and historical pay practices to identify potential wage underpayments |

3. All education entities should:

|

4. Financial performance of education sector entities

In this chapter, we analyse the financial performance and position of education entities. We also discuss financial sustainability, and emerging issues relevant to the sector.

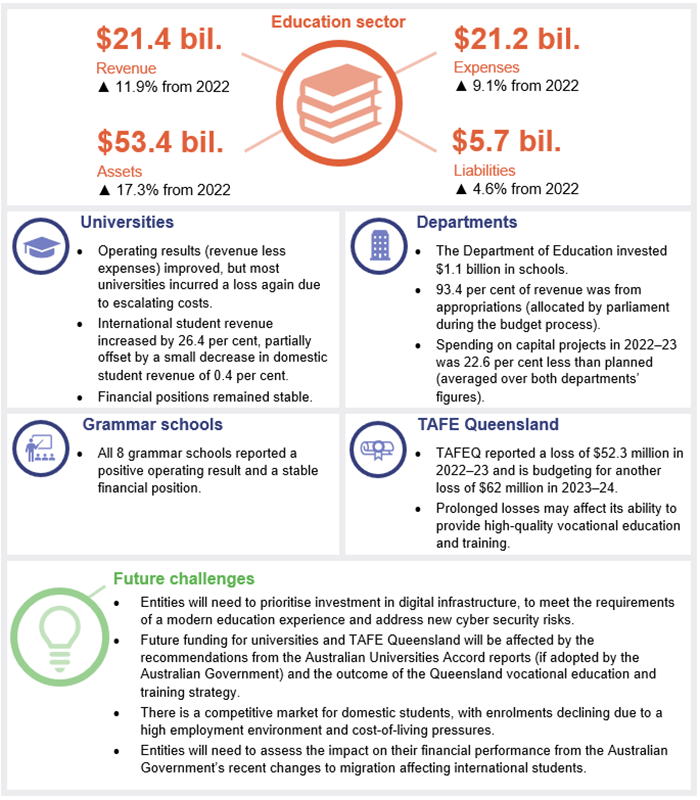

Chapter snapshot

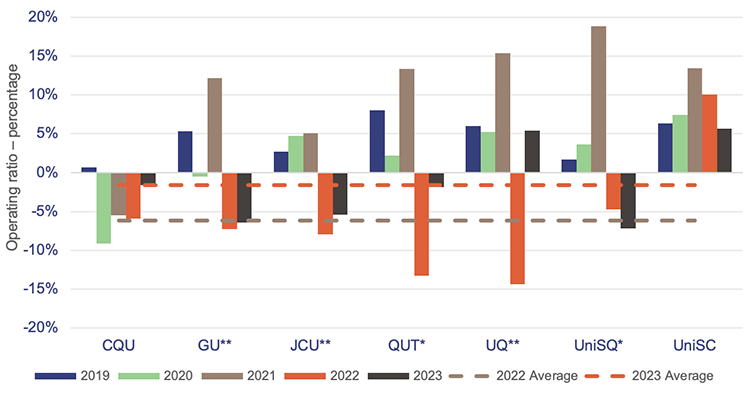

Most universities are facing financial challenges

In 2023, most Queensland universities continued to make a loss, despite improving their operating results by $554.5 million (99 per cent) compared to last year.

Higher investment returns played the most significant role in the universities’ improved performance this year. Five universities incurred losses, largely because of continued cost escalations and challenging domestic conditions. These were offset to some extent by a recovery in revenue from international students.

To assess the long-term financial sustainability of universities, we calculate their operating ratios (revenue less expenses, expressed as a percentage of total revenue) as an average over time. As Figure 4A shows, the operating ratios for most universities have improved since last year. But the challenging conditions are expected to continue in the short term, with most of the universities budgeting for a loss again in 2024.

This highlights the importance of universities continuing to carefully manage their financial performance and prioritise investment in areas that are critical to achieving their strategic objectives – such as students and research activities.

Universities received higher returns on investments this year. This is not guaranteed in future

In 2022, universities’ investments in managed funds (where monies are pooled together with that of other investors) performed poorly. However, because of a strong recovery in the domestic and global financial markets, investment income in 2023 significantly increased – by $677 million (225 per cent). This can fluctuate from year to year, depending on market conditions that are outside of a fund manager’s control.

Figure 4B shows the significant impact that investment market volatility can have on the universities’ operating results. The negative investment returns of $300 million in 2022 were a key reason for the sector’s net loss position, while the positive investment returns of $377 million this year have led to an improved position.

Movements in investment income will not translate into actual cash until the universities receive payments (for example, dividends) from their investments or sell them.

Universities’ costs continue to rise

In 2023, total expenses recorded by the university sector increased by $616 million (10.2 per cent) (2022: $429 million – 7.6 per cent). This was mainly because of higher employee expenses, which continue to be their biggest cost – 55.4 per cent of total expenses. They increased by $282 million (8.2 per cent) (2022: $107 million – 3.2 per cent), primarily due to salary increases under enterprise bargaining agreements, and growth in the number of employees. Some universities also incurred costs relating to addressing historical wage underpayments during the year.

The university sector also had higher expenses associated with the return of international students, including paying commissions to agents as international student enrolments grew. Other increased expenses included scholarships to attract and retain students, and higher travel and conference expenses once travel restrictions lifted. Rising inflation has also led to cost escalations across the university sector.

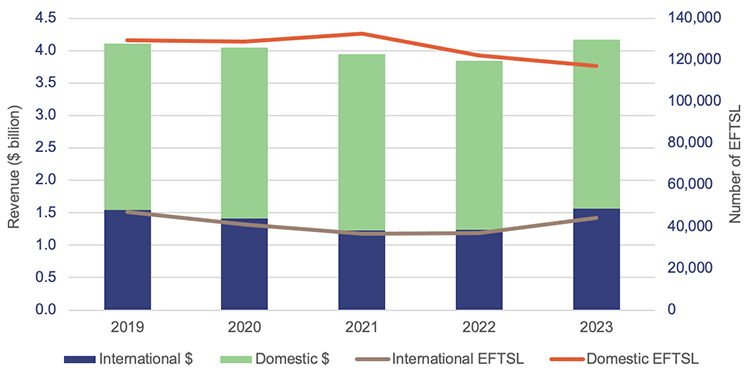

International student numbers are returning to pre-pandemic levels, but revenue from domestic students continues to decline

In 2023, total revenue recorded by the university sector from international students significantly increased by $326 million (26.4 per cent) (2022: $10.3 million – 0.8 per cent), due to the reopening of international borders in 2022. The certainty regarding border settings enabled international students to make longer‑term decisions about their studies and resulted in a strong increase in enrolments, which neared pre-pandemic levels.

The Australian Government made recent changes to migration that may impact future international student numbers. They include updates to the visa application criteria (for example, new tests to ensure students are coming primarily to study) and the proposed introduction of caps to international students announced alongside the May 2024 federal budget. Other risks (such as delays in visa processing times, geopolitical tensions, and wars) could also affect future enrolments.

Figure 4C shows the breakdown between international and domestic revenue and the equivalent full-time student load (EFTSL) over the last 5 years.

Notes: Not all students study full time for a whole year. Equivalent full-time student load (EFTSL) is a way of representing the various study loads as a proportion of the study load the students would have if they were studying full time for one year. ‘Number of EFTSL’ adds them all together.

Queensland Audit Office.

The decline in domestic student enrolments continues to be challenging, with total revenue recorded by the university sector from domestic students decreasing by $9.3 million (0.4 per cent) (2022: $106 million – 3.9 per cent). The low unemployment rate is reducing demand for university places, as more students defer study or take smaller study loads so they can enter the workforce and cope with increasing cost-of-living pressures.

The weak domestic demand is expected to continue in the short to medium term, and universities will need to effectively manage their strategies to attract and retain domestic students.

Universities are disputing their franking credit claims with the Australian Taxation Office

The 7 Queensland universities, along with 31 other Australian universities, owned shares in Education Australia Limited (a private company). In 2021, it went through a major restructure, and paid a cash dividend, transferred a portion of its shares in IDP Education Limited (a listed company), and distributed the associated franking credits (see below) to each university.

In Education 2022 (Report 16: 2022–23), we reported that the Australian Taxation Office (ATO) was reviewing the eligibility of franking credit claims for the 38 Australian universities. The claim for each university was $22.8 million. For Queensland public universities, this totalled $159.6 million.

Franking credits represent the tax a business pays on its profits. This saves its investors from having to pay tax on their share of the profits, which are known as dividends. Universities seek a refund from the Australian Taxation Office for the franking credits on their investments.

In 2023, the ATO issued a notice stating the universities were not eligible to receive a refund of their claims. All 38 Australian universities have lodged a formal objection with the ATO, disagreeing with its decision. They are awaiting a further response. If the ATO stands by its decision, the universities will assess their options, including the possibility of taking the matter to court for a decision.

Due to uncertainty regarding this issue, 3 of the 7 Queensland universities recorded an impairment expense for the full amount in 2023. In this case, the impairment expense represents a reduction in the value of their franking credit claims while waiting for the matter to be resolved. Other Queensland universities continued to record it as an amount owing from the ATO.

We also sought additional audit evidence from our own independent tax expert. Assessing the technical position taken by both the ATO and the different positions taken by universities on this matter required significant judgement, due to a lack of legal precedent (previous similar cases). As a result, we concluded we had sufficient and appropriate audit evidence to support each university’s financial reporting treatment.

In our audit report for the universities who continued to record the franking credit claims as being owed from the ATO, we included a key audit matter. We did this to highlight the additional procedures we conducted to audit this balance and to emphasise the uncertainty surrounding the ATO refund.

Major reforms are proposed for the higher education sector

In Education 2022 (Report 16: 2022–23), we highlighted that the Australian Government had established an Australian Universities Accord, to consult on a range of issues and provide recommendations to build a long-term reform plan for Australia’s higher education system. On 19 July 2023, the Australian Universities Accord panel released its interim report, outlining 5 recommendations for immediate action by the Australian Government. These were supported by the government, and one recommendation led to a 2-year extension of an Australian Government grant that provides funding guarantees to universities (regardless of domestic student enrolments). It had been due to end in 2023.

The Australian Universities Accord Final Report, released on 25 February 2024, made 47 further recommendations for the Australian Government to consider. These will have significant and wide‑ranging impacts across the higher education sector.

They include replacing the funding model under the existing Job-ready Graduates Package. Universities will need to continue working constructively and collaboratively with the Australian Government on what comes next, and consider the impact of all recommendations adopted by government on their longer-term strategy.

TAFE Queensland’s financial sustainability remains at risk

In Education 2021 (Report 19: 2021–22) and Education 2022 (Report 16: 2022–23), we reported on the significant financial challenges TAFE Queensland (TAFEQ) faces. We recommended that it continue to clarify how much it costs to provide each of its services, so it could make informed decisions about future services and efficiencies in operations.

It continues to work alongside Queensland Treasury and the Department of Employment, Small Business and Training to develop a Queensland vocational education and training (QVET) strategy that will assist with improving its sustainability through the formal recognition of its community service obligations. This will likely include a new funding model for TAFEQ that considers its training commitments and service expectations as a public provider. For example, it is required to run some programs that cannot make a profit. Its private sector competitors are not. The Queensland Government is expected to formally announce the QVET strategy in 2024.

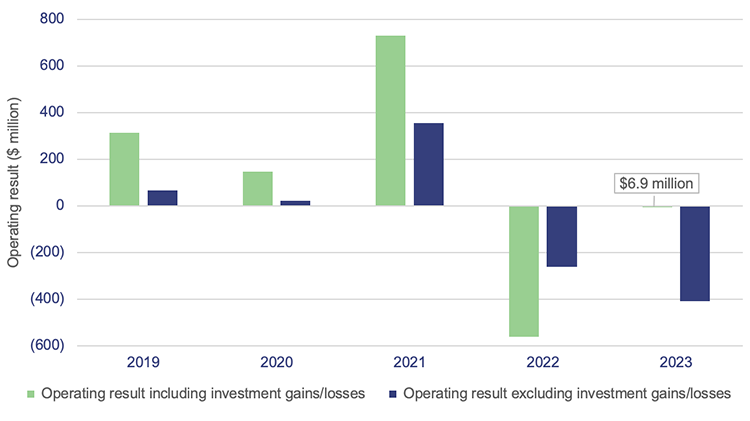

Figure 4D shows the declining operating results TAFEQ has experienced in recent years. In 2020–21 and 2021–22, the Queensland Government provided significant additional funding to support its operations. Without this, its operating results would have been worse.

TAFEQ recorded an operating loss of $52.3 million in 2022–23 as its expenses continue to increase at a higher rate than its revenue. It is budgeting for another operating loss of $62 million in 2023–24. The losses are expected to continue in the future because of:

- cost increases from growing employee expenses under enterprise bargaining agreements

- TAFEQ continuing to provide training in many regional and remote campuses where the training demand is low, resulting in a high average cost per student

- ongoing low unemployment levels, which reduce overall training demand in the community. Many people do not actively seek vocational training if they already have a job.

TAFEQ continues to implement strategies to improve its operating efficiency. This includes developing an organisation-wide education planning tool, and undertaking a medium-term project to increase the conversion rate of student enquiries to enrolments.

Asset management at education entities

Property, plant and equipment (land and buildings) continues to be the most significant item on the balance sheet for education entities, accounting for 85 per cent ($45 billion) of their total assets.

The increasing value of assets in the education sector, and their importance in the delivery of education services, means entities need to carefully plan for their maintenance, upgrade, or replacement. Well‑developed asset management plans, linked to entities’ overall strategies, can help with investment decisions. They can also ensure assets continue to be fit for purpose and can respond to changing learning styles.

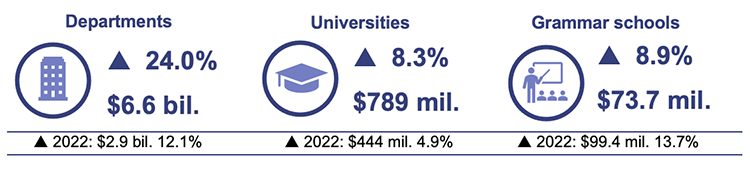

Asset values increased across the education sector

Measuring the value of some asset categories (such as land, buildings, and infrastructure) for education entities can be complex. It requires judgements and assumptions, and includes updating the fair value of their buildings (to represent how much it would cost to replace them at today’s prices). Various factors affect these updates, including construction costs and labour supply.

Queensland Audit Office.

Consistent with last year, all entities across the sector saw increases in the value of their assets. There has been a 22.7 per cent increase in buildings across the education sector – by $6.1 billion – following on from an increase of $2.9 billion (12.3 per cent) in the previous year.

The current market conditions continue to escalate construction costs, resulting in significantly higher costs to upgrade or replace buildings than in the past.

Departments have challenges in spending their budgeted capital expenditure

The Department of Education has heavily invested in its property, plant and equipment (its capital assets – mostly schools and buildings) in the last 5 years ($5.6 billion), to be prepared for the future and for growing student numbers. It plans to spend $1.5 billion in 2023–24 on large expansion programs for both new and existing schools.

In 2022–23, the Department of Education faced challenges in achieving the desired outcomes from its capital investment programs, resulting in an underspend of $448 million (28.8 per cent). The Department of Employment, Small Business and Training also underspent by $14 million (16.5 per cent) compared to its planned capital program (this amount excludes the Youth Justice function that was briefly transferred into the department). Shortages in materials and labour have caused delays in some projects and affected their timings. When the departments can complete this work, they will likely face an environment where the construction costs are significantly higher than what they initially budgeted for.

If the capital underspending continues, there is a risk that assets will not be maintained, upgraded, or replaced when required. While the expansion of education infrastructure is ongoing, existing infrastructure is continuing to age.

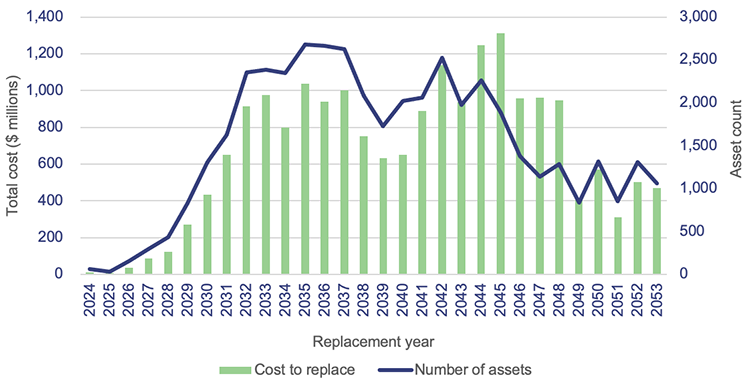

Figure 4F shows the number of buildings the Department of Education owns, and the cost to replace them over the next 30 years. Approximately 14 per cent of buildings (equal to $4 billion) will need to be replaced in the next decade due to their age.

Queensland Audit Office and Department of Education asset registers 2023.

In our forward work plan for 2023–26, we have identified infrastructure investment as one of the focus areas for our future performance audits. Effective asset management and investment are critical to long‑term financial sustainability. We encourage education sector entities with large infrastructure assets to also consider any recommendations contained in our related reports, such as our report on Improving asset management in local government (Report 2: 2023–24).

Maintaining departmental assets

Education entities’ building assets must be maintained to a minimum level, so they continue to support delivery of services to the broader community.

The Department of Education spent $445 million on maintenance in 2022–23, while the Department of Employment, Small Business and Training spent $43 million (this amount excludes the Youth Justice function that was briefly transferred into the department). Together, the departments increased their expenditure on repairs and maintenance in 2022–23 by $84 million (21 per cent).

Over the last 5 years, both departments have adhered to Queensland Government policy by meeting their annual minimum maintenance requirements, being one per cent of the replacement cost of their building portfolios. However, despite spending the required amounts, rising costs mean the departments may not have completed all the expected maintenance that was needed.

The Queensland Government Building Policy Framework states that departments must develop and maintain a strategic maintenance plan. This plan should consider factors such as the age, functionality, maintenance requirements (both planned and unplanned), and condition of their buildings.

In Education 2021 (Report 19: 2021–22) and Education 2022 (Report 16: 2022–23) we reported that the Department of Education and the Department of Employment, Small Business and Training were in the process of assessing the condition of their assets (condition assessments) to support their future maintenance plans. We recommended that both departments complete regular and timely condition assessments. In the following sections, we provide an update on the progress each department has made.

Department of Education

The Department of Education has completed its condition assessment program, consisting of 1,268 education sites (schools and education centres) and 173 early childhood centres. It did not cover education sites that opened after 2018 (for example, new schools). This involved fully inspecting and assessing all buildings and infrastructure at each site and identifying all required maintenance works.

By April 2024, the Department of Education had evaluated and integrated more than 60 per cent of the data from the condition assessments into its finance system. The remaining condition data is expected to be integrated by 30 June 2024. This data will form the basis of each school’s multi-year maintenance plan.

At present, these plans only cover key preventative maintenance requirements. In future, condition data will be used in the department’s asset management plans to support its future maintenance programs.

Department of Employment, Small Business and Training

The Department of Employment, Small Business and Training is using a risk-based approach to assess the condition of its buildings and infrastructure assets (TAFE campuses). This initially involved reviewing the extent of inspections performed in previous years, identifying 30 building components and categories (for example, electrical switchboards) and allocating risk ratings to each.

The department’s previous program (from 2018 to 2022) inspected and assessed 9 of these categories. Its current program, for 2022 to 2025, plans to inspect and assess another 4 asset categories, 3 of which have now been inspected.

The department’s approach does not assess an entire building at the same time. Instead, it assesses similar components across the whole building portfolio together.

The documentation of the results of the inspections meets some, but not all, of the minimum requirements of a condition assessment report under the Queensland Government Building Policy Guideline. The department needs to do more work to appropriately capture, manage, and report on the asset condition data the assessments have collated. It is currently developing a way to centralise the recording of this data, in line with the minimum requirements, to inform the timing and cost of future maintenance.

Enabling digital learning in state schools

In Enabling digital learning (Report 1: 2021–22), we shared information about how well the Department of Education is connecting the students and staff of state schools to digital resources and online content. Having faster internet speed means schools will have reliable access to digital technologies regardless of geographic location.

In Education 2022 (Report 16: 2022–23) we reported on the progress made by the Department of Education in increasing internet speed in schools. The department signed a 5-year agreement with a supplier to upgrade internet speeds across state schools in December 2021.

The department has increased average internet speeds to 1,000 kilobytes per second (kbps) or more per student for almost all (98 per cent) school sites, as shown in Figure 4G. It is a significant improvement since March 2021, when we first reported this, but further increases will be necessary to effectively support the growing demands of modern educational technology effectively.

Note: kbps – kilobytes per second (measure of how fast data is moving).

Queensland Audit Office from Department of Education data on internet speeds in schools.

The department has begun phase 2 of this project, which is expected to increase internet speeds to an average of 5,000 kbps for each student by 2026.

2023 education dashboard

Our interactive map of Queensland allows you to explore information on education entities and compare to other regions, including data on revenue, expenses, assets, liabilities and other measures like student and staff numbers.